As the year comes to a close, economists are looking ahead to next week's December jobs report--the final update on the labor market for 2015. With few year-end economic surprises and the recent Fed interest rate hike behind us, most analysts are expecting steady job growth and a moderate pick up in wages. Here's what we'll be watching for on Friday:

- Non-farm payrolls up 190,000 jobs.

- Unemployment rate steady at 5.0 percent.

- Labor force participation rate down to 62.3 percent.

- Average hourly wages up 2.5 percent from one year ago.

America's Big Benefits Shift

Beyond the top-line numbers, one issue we've watched this year is whether America's slow wage growth is partly explained by a shift from wages to benefits. This month, we took a closer look at the official data, which comes from the BLS "Employer Costs for Employee Compensation Survey." Let's look at a few interesting trends we uncovered.

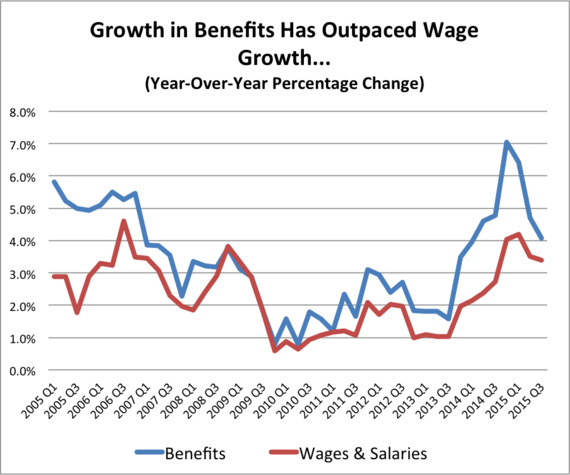

Trend #1: Benefits are growing faster than wages--and have been for a decade.

During the past decade, benefits--what economists call "non-wage compensation"--have dramatically outpaced wage growth. This includes monetarily measurable benefits like health insurance, paid vacation, free meals and more. In the 43 quarters since 2005, average U.S. benefits grew faster than wages in all but three quarters, all of which occurred during the tumultuous times of late 2008 and 2009. This trend is illustrated in the top figure below. Whatever is behind America's big shift from wages to benefits, it's been around for more than a decade.

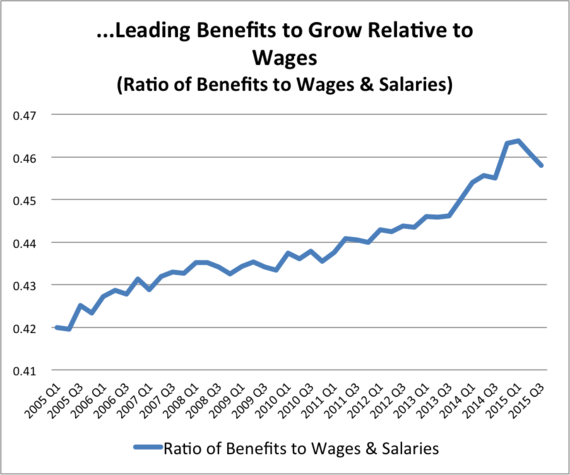

As benefits have outpaced wages, the fraction of workers' pay in the form of benefits rather than wages has been growing over time. This is illustrated in the bottom figure below. It shows the dramatic rise in the ratio of benefits to wages for U.S. workers since 2005. As is clear from the chart, while this trend has accelerated since the end of the Great Recession in 2010, it reflects a longer-term structural shift rather than an ephemeral quirk of the latest business cycle.

Source: BLS "Employer Costs for Employee Compensation Survey".

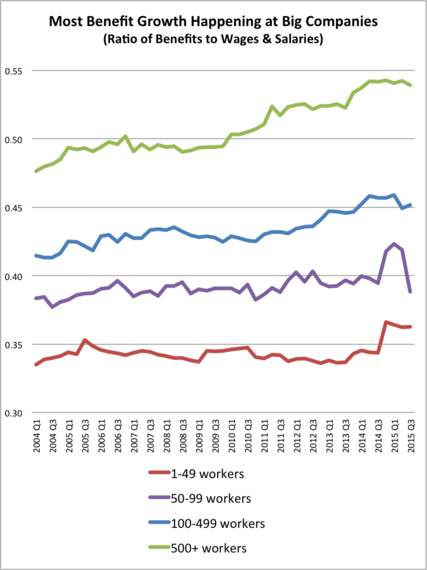

Trend #2: Most of the shift toward benefits is at America's big companies.

Not all U.S. workers are experiencing the shift toward benefits illustrated above. The largest U.S. companies (more than 500 employees) are driving nearly the entire trend. By contrast, benefits have shifted little at the nation's smaller companies with fewer than 100 workers.

The figure below shows the ratio of benefits to wages over time by size of employer, ranging from small businesses with 1 to 49 workers to large corporations with 500 or more employees. The data suggests that big companies drive the trend from wages to benefits. At firms with 500 or more workers, there is a pronounced upward trend in the ratio of benefits to wages since 2004. By contrast, the ratio of benefits to wages has been essentially flat for small and medium-sized employers with less than 100 workers.

The data shows that America's big shift toward benefits is primarily happening within the nation's largest employers.

Source: BLS "Employer Costs for Employee Compensation Survey".

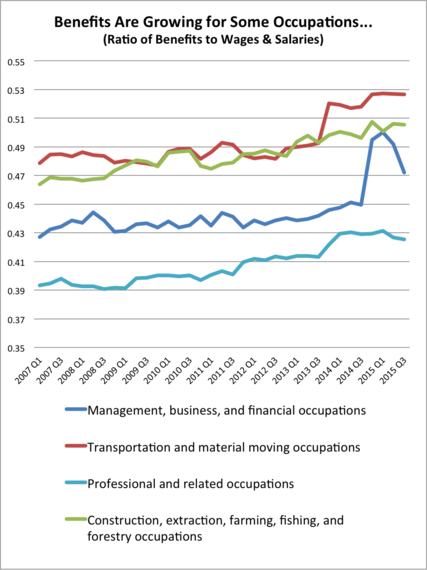

Trend #3: High-skilled, white collar and union jobs are driving the shift toward benefits.

Not all jobs are experiencing this overall shift from wages to benefits. It is sharply divided by occupation. Most growth in benefits today is occurring among high-skilled workers in either white collar jobs or in fields with large numbers of union-represented workers such as construction and skilled trades.

The figure below shows occupations with some of the largest and smallest shifts toward benefits in recent years. On the left, are jobs with steady growth in benefits versus wages. This list is dominated by highly skilled professional workers, which include workers in tech jobs, management and finance, as well as heavily unionized jobs in construction and transportation.

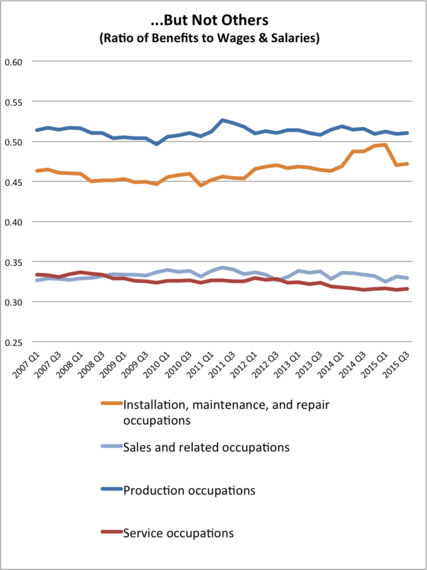

In the bottom figure are jobs where the ratio of benefits to wages has been flat or declining. This list is dominated by lower-skilled jobs in service, production, sales, and installation, maintenance and repair where unions are far less prevalent. Although not shown here, unionized workers overall have experienced a much more dramatic shift toward benefits than non-union workers over the past decade, regardless of occupation.

The shift toward benefits is clustered among American workers with the strongest bargaining power in the economy: high-skilled workers and those with organized union representation.

Source: BLS "Employer Costs for Employee Compensation Survey".

Trend #4: Not all industries are shifting toward benefits from wages.

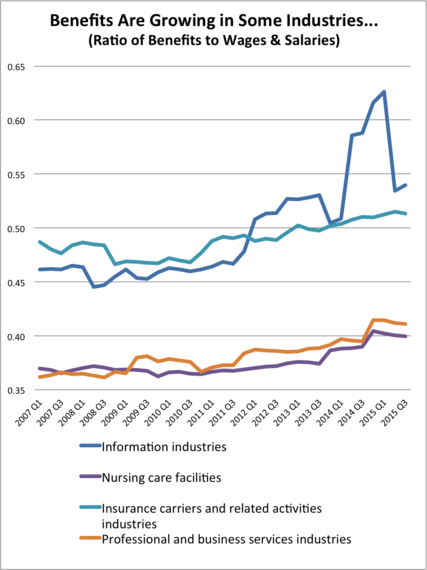

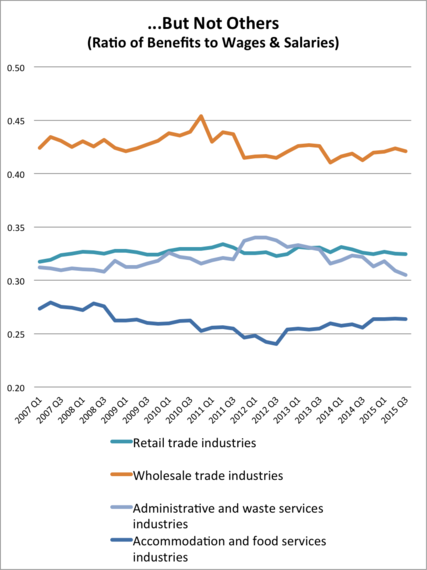

While the overall trend toward benefits is up, it is being driven by a handful of industries. The figure below shows U.S. industries with the fastest and slowest growth in the ratio of benefits to wages in recent years.

Overall, the pattern is similar to the view by occupations above. In the top figure are industries with large numbers of skilled, white-collar workers experiencing a greater shift toward benefits. This list includes professional services, insurance, information, and nursing care facilities industries.

By contrast, in the bottom figure are industries relying more heavily on low-skilled jobs that have experienced less of a shift toward benefits in the past decade. This includes the retail, wholesale, accommodation and food services, and administrative and waste services industries, all of which have experienced a flat or declining ratio of benefits to wages in recent years.

Lessons for Workers

Why are U.S. employers shifting from wages to benefits? There are many plausible theories: tax savings, rising health care costs, competition for key employees, quirks of the business cycle, and more. The goal of our analysis was to look deeper into the data to see if any of these explanations can be ruled out.

Based on the patterns above, it seems unlikely that taxes are driving the shift--there just haven't been large enough tax changes since 2004 to explain the pattern. Similarly, we can safely rule out the theory that this is a cyclical quirk in the data, as the trend began long before the last recession. Similarly, if rising health care costs were the main driver we'd expect the shift to be more widespread among industries.

The most likely explanation may be one of the oldest ideas in economic theory: a concept known as "diminishing marginal utility of income." Workers with low wages care mostly about taking raises in the form of cash. But beyond a certain income level, there's strong evidence from research that workers start caring about other things beyond salary. The "utility" or happiness workers get from an extra dollar of pay falls as incomes rise--and at some point benefits start to look more attractive than a cash raise.

One clear example of this is paid parental leave. This is a benefit that is hard for workers of any income to purchase. Without company-sponsored parental leave, some workers are fearful that time off for family may hurt career prospects. And a higher paycheck won't solve this problem--it's a dilemma faced by both low- and high-income workers alike. But once a specific salary level is reached, it's easy to imagine workers preferring a company-sanctioned parental leave plan to a cash pay raise because it protects their career path while they take time off.

The growing preference workers have to benefits over wages is economic behavior that is likely a major force driving today's shift toward benefits. And it explains why the shift is happening more often clustered among America's most highly sought-after (or well organized) workers. As pay reaches beyond the level needed for the basics, more workers may find themselves earning enough to put pay raises aside and instead negotiate for employer-provided benefits that are hard to buy in the marketplace, but that make huge improvements in the quality of life in the workplace.

To speak with Dr. Andrew Chamberlain about this month's jobs report or labor market trends, contact pr [at] glassdoor [dot] com. For the latest economics and labor market updates, subscribe to email alerts here and follow @adchamberlain.

This article originally published on Glassdoor Economic Research.