Ok I admit it. I was a Regulation A+ skeptic. When the JOBS Act first came out in 2012, predictions that the JOBS Act makeover of Regulation A would be a game changer seemed wishful thinking. While the JOBS Act increased tenfold the annual dollar amount that can be raised under Regulation A, Congress delegated to the Securities and Exchange Commission (SEC) the authority to shape the contours of Regulation A through SEC regulation, leaving at the time many open questions.

Fast forward almost four years since the enactment of the JOBS Act and one year since the publication of the SEC's final rules on Regulation A+, there's much cause for optimism about the prospects of Regulation A+ opening up new opportunities for companies seeking to raise capital outside of the traditional means of funding. Against the backdrop of a sluggish IPO market, here are five reasons why Regulation A+ has the potential to become one of the leading means of raising capital in the United States.

1.Regulation A+ as a "Mini IPO" Investment Vehicle: the case study of Elio Motors

Last month, Elio Motors, an innovative start-up manufacturer of a $6,800 three-wheel car, announced that it raised nearly $17 million in a Regulation A+ offering and listed its shares for trading on the OTCQX. This was quite a feat. Elio Motors, a company with no revenue, no production line, no traditional underwriter, and limited resources nevertheless managed to "go public". So how did it do it?

Regulation A+ allows a company to raise up to $50 million annually from the general public. Unlike the Rule 506 exemption (which accounted for over $1 trillion raised in 2014) where offerings are by and large limited to high net worth individuals and institutions known as "accredited investors", there are no limitations as to the type of investor that may invest in a Regulation A+ offering. As such, the new rules open up the possibility for a significantly larger pool of investors to participate in a Regulation A+ mini-IPO and by extension for such offerings to be conducted online. Indeed this is just what Elio took advantage of. Utilizing the crowdfunding platform StartEngine, Elio reportedly raised money from a total 6,600 unaccredited investors, the very same investors who would unlikely participate in a traditional IPO or qualify to invest in a Rule 506 offering.

2.Regulation A+ allows Testing the Waters

Though Regulation A+ offerings are more streamlined than traditional IPOs, the offering documents are still required to undergo SEC review, and in certain cases, state regulatory review. The cost of undergoing this process is not insignificant. As such, Regulation A+ permits a company to gauge potential interest or "test the waters" by soliciting indications of interest from prospective investors both before and after filing with the SEC, subject to certain requirements. This was a feature that Elio also took advantage of, reporting that during a 6-month period more than 11,000 people expressed interest in investing in Elio.

3. Tier 2 Regulation A+ Offerings Preempt State Securities Registration Laws

When the SEC published its final rules, it categorized Regulation A+ offerings into two tiers, Tier 1 and Tier 2. In a Tier 1 offering, a company can raise up to $20 million annually and is subject to lower qualification standards (e.g. financial statements filed with the SEC do not need to be audited) while in a Tier 2 offering, a company can raise up to $50 million but is subject to higher qualification standards (e.g. ongoing current and periodic reporting with the SEC upon completion of the offering). In view of the elevated standards for Tier 2 offerings, the SEC provided for preemption of state law qualification of Tier 2 offerings. So why was this significant?

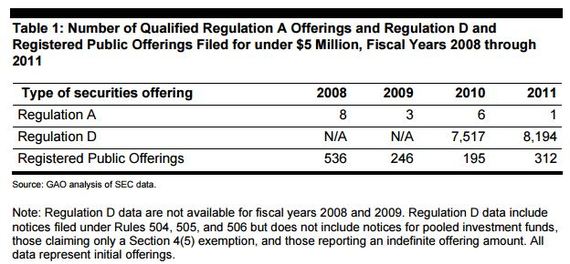

Prior to the rule changes to Regulation A, between 1998 and 2011, the number of qualified Regulation A offerings decreased from 57 to 1. Among the predominant reasons cited for the decrease, was the requirement to qualify the offering in every state where an investor may be resident (in addition to qualifying with the SEC).

In practice, this dual system of review lengthened and complicated the qualification process while substantially increasing costs to the point that it became prohibitive.Therefore, recognizing the inefficiencies of state registration, Tier 2 offerings need only qualify with the SEC while making a simple notice filing and paying a filing fee in certain states.

4.Shares Sold in Tier 2 Regulation A+ Offerings May Qualify to Trade on the OTC and NASDAQ

Ordinarily, there are no transfer restrictions for shares sold to a non-affiliate in a Regulation A+ offering (unlike in a Rule 506 offering). This means that a secondary market can develop for shares sold in a Regulation A+ offering increasing the marketability of Regulation A+ offerings. The OTC Markets Group which operates the OTCQB and OTCQX marketplaces specifically allows Tier 2 Regulation A+ companies to trade their shares on those marketplaces subject to meeting certain minimum requirements. Similarly, if a Regulation A+ company were to meet the listing standards of an exchange such as NASDAQ, it may also list its shares. Elio took advantage of this by becoming the first Regulation A+ company to trade on the OTCQX.

5.SEC Comments Have Been Light

Extensive comments from the SEC lengthen the time and cost it takes to qualify an offering and in some cases can grind the review process to a halt. Under Regulation A, between 2002 and 2011 it took an average of 228 days for 82 offerings to complete their review. By contrast, of the 23 Regulation A+ companies that have qualified their offerings so far, a significant number are completing SEC review in under 90 days with limited SEC comments.

With a steady trickle of new Regulation A+ filings every week and a growing number of qualified offerings, indications so far are that Regulation A+ is showing much promise.

The information in this article is of a general nature and should not be relied upon as legal advice.