When it comes to protecting yourself with auto insurance, where you live is often a bigger factor than what you pay for the insurance you buy. While many people think that the more you pay for insurance, the better you will be treated when filing a claim, the facts don't support this belief. This is the first of a two-part series. In this first post we identify the worst states for auto insurance buyers. These are states where the auto insurance prices are high and the protection is less than other states.

High Prices do not Mean Good Protection for Auto Insurance Buyers

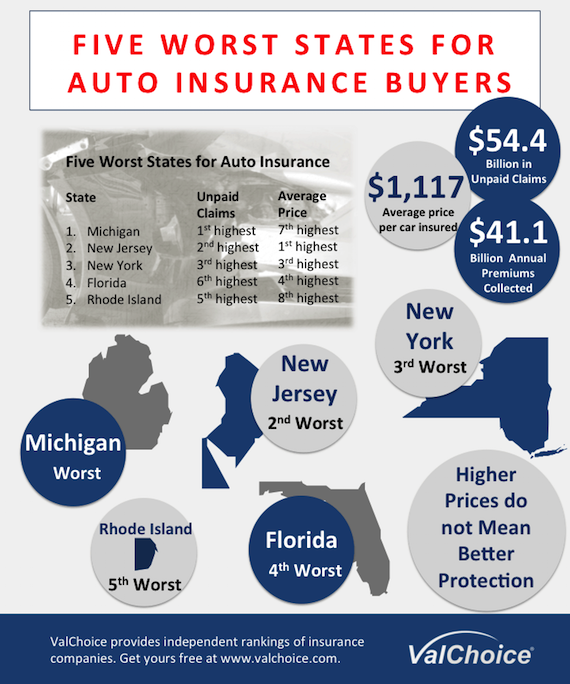

To identify the states where auto insurance buyers must be particularly careful, ValChoice looked at two important factors: 1) The average annual cost of auto insurance and 2) the amount of unpaid auto insurance claims outstanding in the state. The results of the analysis were that the following five states stood out as the worst states for auto insurance buyers to get the protection they deserve:

- Michigan: Worst for unpaid claims, 7th highest price

- New Jersey: 2nd worst for unpaid claims, 1st highest price

- New York: 3rd worst for unpaid claims, 3rd highest price

- Florida: 6th worst for unpaid claims, 4th highest price

- Rhode Island: 5th worst for unpaid claims, 8th highest price

In total, these five states have $54.4 billion outstanding in unpaid claims. This equates to $921 per man, woman and child in those five states. In 2014 the total auto insurance premiums collected in these five states were $41 billion[i]. This means, these five states have 32% more outstanding in unpaid auto insurance claims than is collected each year in insurance premiums.

What Auto Insurance Buyers Need to Know

The take away from this analysis is that when buying insurance, price is not a good measure of protection. It goes without saying that advertisements are the worst way of deciding where to buy insurance. Instead, analysis of which companies provide the best value is the only option to ensure consumers get insurance with the price, protection -- claims payment -- and service they expect and deserve.

The calculations to identify the five worst states for auto insurance buyers were done as follows: The total amount of unpaid auto insurance claims[i] at the end of 2014, in each state, were divided by the number of auto insurance policies[ii] sold in the state. This amount was then added to the average price of auto insurance in that state[ii]. The result is the combined average annual price for insurance plus the per capita, outstanding, unpaid claims amount amount.

Clearly consumers need more information than is available from advertisements to properly protect themselves and their loved one's with insurance. Insurance regulators need to make available more meaningful information that helps consumers purchase the insurance that serves them best. Transparency like this is what firms like ValChoice are making available to consumers.

[i] © AM Best Company, Used by Permission

[ii] Insurance Information Institute, iii.org

Follow Dan Karr on Twitter: www.twitter.com/ValChoice