These days, having $1 million to your name is nowhere near as impressive as it used to be. And yet, putting away $1 million in a savings account is a major goal that requires a solid plan of attack to reach.

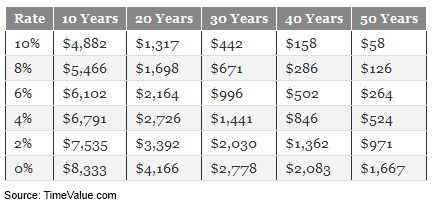

For instance, the chart below shows how much money you would have to save each month, depending on time frame and estimated annual return, to reach a $1 million balance.

Of course, this all works well in theory -- if you know of a way to earn a guaranteed 10 percent a year, please, sign me up.

Due to our low-rate environment, there are a number of additional strategies you'd have to put into place if you ever hope to contribute $1 million to your savings in your lifetime.

1. Pay Yourself First

Paying yourself first means making saving money a line item in your budget, and making it the top priority -- even above bills. The only way to ensure you hit aggressive savings goals is by putting the money away before rent, car loan payments and groceries can eat it up.

Andrea Travillian, president and founder of Take a Smart Step, agrees, "My husband and I have found the key to building our nest egg early has been to save from the start and make that a priority ... our savings is the first budgeted item," Travillian said.

2. Start as Early as Possible

As you can see from the chart above, the sooner you start saving money, the easier it is to reach $1 million. It's tempting to put off saving money, but don't bank on a higher salary or future windfall -- even someone who makes up for years of no savings and contributes the same amount of money toward his $1 million goal won't be able to catch up to someone starting at a younger age.

The same reason why the first $100,000 is the hardest to save applies here: compound interest. The more money you have over a longer period of time, the easier it is to save even more.

"This is the snowball down the mountain that turns into an avalanche," said financial writer Uncle Bill. "The growth comes from the compounding as the investments pay off. It is getting started that is the hard part."

3. Take Advantage of Your Employer Match

If retirement savings make up a part (or all) of your $1 million savings goal, you can eliminate some of the heavy lifting on your part and take advantage of free money. Most employers offer a match to employees' retirement savings either as a percent of salary or contributions. Either way, it's an opportunity you shouldn't pass up.

4. The $500 Plan

The iPlanRetirement blog lists a couple of interesting strategies for reaching a $1 million savings goal -- and in just 20 years. The first is referred to as the $500 Plan. Essentially, you begin by saving $500 per month in your first year. Then each additional year, you increase your monthly savings by $100. So, for example, in 2014 you would save $500 each month. In 2015, you would increase your monthly savings contributions to $600. In 2016, up it to $700 and so on.

This is a slow-and-steady approach that will get you to your goal more rapidly as time goes on, however, it only works if you have substantial income to set aside every month.

5. Save Your Raises

So what if you don't have the necessary funds for the $500 Plan? The other strategy proposed by the iPlanRetirement blog is the Save Your Raise approach. Assuming you currently make $45,000 per year, you should expect an annual raise of 5 percent. Don't increase your spending along with your raises, and allocate raises toward savings. According to ERB, this will get you to $1 million in 20 years.

6. Increase Your Income But Not Spending

Even if you aren't getting any raises, there are a plethora of options for increasing your income. Give yourself a raise instead by exploring these options, and follow the same principles above to reach $1 million.

7. Take on Some Risk

Finally, as evidenced by our chart above, you'll never reach $1 million by depositing your money in a savings account alone. A major savings goal requires the help of substantial returns, and the only way to realize necessary earnings is by taking on risk with market investments. Again, the sooner your start the more risk you can afford to take on and the easier saving $1 million will be.

Photo credit: amanda tipton