Millions of American households are currently struggling under the weight of large monthly interest charges as U.S. credit card debt has reached near epidemic proportions. According to Federal Reserve and U.S. Census reports, the average American household that has credit card debt is currently carrying over a balance of $15,000. If you, like so many other Americans, are in a situation of having too much credit card debt, there are solutions that can help you shed that debt fast. One solution is actually just a simple two-step method which can speed up the repayment process, allowing you to pay off your debt faster while also paying less interest.

Step 1: Stop the interest charges

To pay off your balances faster, the first thing you need to do is stop the interest charges. It's extremely difficult to make serious headway on a sizeable balance when you're getting hit every month with huge new interest amounts put on top of your existing debt.

Unfortunately, not many people know that almost anyone with decent credit can put an immediate halt to their interest charges by simply transferring their balance to a new credit card offering a 0% introductory APR term. The key trick is to find a credit card that focuses on both a long introductory period and also features a low balance transfer fee. Cards such as the Chase Slate, the BankAmericard, or CapitalOne Quicksilver card, are all options that fit these criteria well.

With these two features, you can reduce your debt quickly with minimal costs. Transferring your existing credit card debt to a card that offers a 15-month 0% introductory period, like the Chase Freedom card for example, which has one of the longest intro periods of cards on the market right now, is basically the same as getting a 15-month, interest-free loan to pay off your credit card balances.

Remember, it's important to put as few new charges as possible on your cards while you're going through debt reduction.

Step 2: Power through your balance during the 0% introductory period

Once you've transferred your balance to the best 0% intro APR offer you can find, you're now set up to quickly power through your balance. The reason your debts will now be paid faster is that with no interest, 100% of your payments will go towards reducing your balance, rather than being split and lining your creditor's pockets.

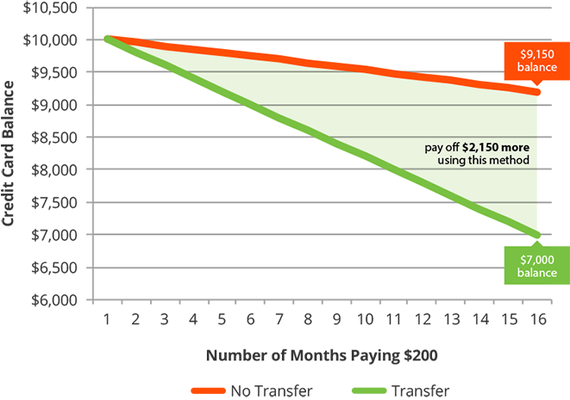

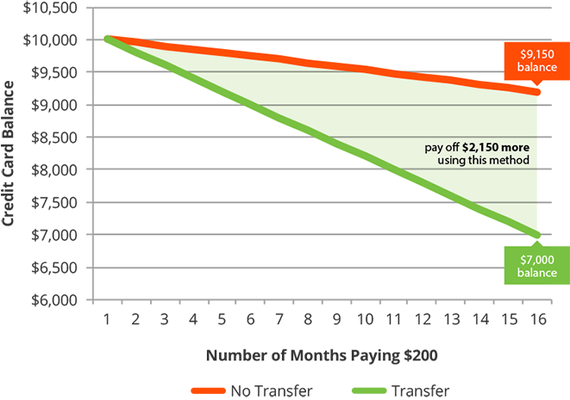

If you focus on your payments and paying your entire debt off within the introductory period, you can avoid interest entirely on your credit card debt. Even, if you don't change your payment behavior, you can still significantly reduce both the time it will take to repay your credit card debt and the amount of interest paid. Take a look at the chart below to see the impact transferring a balance can make. In the example, a person transferring a $10,000 balance would be able to pay off fully $2,140 more than someone who didn't transfer, over the same period while making the same exact $200 monthly payments.

With the balance transfer, this person would pay off $2,150 more over the same period. Clearly, it makes little sense to continue paying interest on your credit card debt. Every month you keep things as they are is another month your credit card company is making more money from your hard work. If you want to pay off your credit card debts faster, consider some of these balance transfer cards recommended by LendingTree's credit card research team.

If you want to transfer a balance without paying a transfer fee

Look for a card with no balance transfer fees and no annual fees like the Chase Slate® card, which also offers 0% introductory APR for 15 months. That will give you over a full year to pay off your debt interest free. You'll be able to transfer the balance of your higher-interest credit card(s) without any fees, and you won't be paying interest on any balance transferred within the first 45 days.

An added plus for the Chase Slate card is that you only need good credit to be approved as opposed to excellent. So, it's a bit easier to get in than most cards offering this level of incentive. Unfortunately, this card doesn't offer a strong rewards program, but that shouldn't deter you since when you're paying off debt, you want to avoid making new credit charges as much as possible. This would nullify any significant advantage most reward programs offers.

If you want to maximize the interest-free intro period on your transfer

If you transfer your current balance onto the

, you won't have to pay any further interest on that balance until well into 2017. The card features the longest interest-free intro period here, a full 18 months of 0% APR. If your goal is to stop paying interest for as long as possible, then this is your card. While this card does charge a 3% balance transfer fee, if you realistically know you will have to carry that balance for a while, this card becomes a no-brainer.

As an example, assume you have a $10,000 balance on your current cards at a 15% rate. Over the 18 billing cycle term, you would have paid $2,522 in interest. Switching to this card would cost an initial $300 in fees, but then nothing else the rest of the way, for a net savings of $2,222. Not bad.

If you want cash rewards with a shorter interest-free transfer period

While neither the Quicksilver nor the Freedom (see below) cards top out our balance transfer list, both offer an intriguing combination of a decent length 0% balance transfer period and a top of class cash rewards program. This is good if you want to consolidate your credit card balances, save through the balance transfer, but also earn rewards on any new spending you make. The Capital One® Quicksilver® Cash Rewards Card card makes things simple: you earn 1.5% cash back on all your purchases, with no limit and no category restrictions. We included the card in our balance transfer list because it offers 0% intro APR until November 2016 on all balances transferred.

While you might not maximize reward offers when you're paying back debt because you should be avoiding new spending, you can still use this card and get cash back for expenditures on needed goods such as groceries or gas. You can then reinvest those rewards towards helping pay off your balance faster.

The Quicksilver does charge a 3% balance transfer fee but only requires good credit to get in. If you're looking to transfer a balance and still make purchases, you can use this card to avoid paying interest during the intro period AND earn cash rewards.

Chase's new

card is essentially an improved version of the old Freedom card. They bumped the base cash back rate all the way up to an industry leading 1.5% with no spend limit or category restrictions. Unlike most other high paying cash back cards, you don't have to worry about categories or have to activate anything. You'll receive the full 1.5% back as you spend, on all spend, automatically. In addition, Chase is temporarily offering a cash bonus to new card-members. If you charge $500 on it in the first 3 months, you'll earn a $150 cash bonus. If you use this card for your basic needs as you're paying down debt, you can easily hit that $500 mark and invest that $150 cash bonus back towards your credit card payments.

Chase is currently offering new card-members 15 months of 0% interest towards new purchases. So during that period, you can use the card without paying any interest on balances you tally, while still earning cash back. The card requires only good, not excellent credit, making it easier to qualify for.

The Freedom Unlimited card charges a 5% balance transfer fee which is the highest on our list of options but at 15 months of 0% interest along with solid cash rewards, you can still use this card to your advantage depending on the balance amount you intend to transfer and your current interest rates. This card might not be the first choice you would use for a balance transfer, but if you've maxed out the limits of your other credit card options, this can certainly be an additional tool you can add to the mix.

Disclosure: This content is not provided or commissioned by the credit card issuer. Opinions expressed here are author's alone, not those of the credit card issuer, and have not been reviewed, approved or otherwise endorsed by the credit card issuer. This content was accurate at the time of this post, but card terms and conditions may change at any time. This site may be compensated through the credit card issuer Affiliate Program.

* Savings calculation: Credit Card Balance * (1+Average Card Rate/365)^639 days - Balance Transfer Fee - Average Household Credit Card Balance

Balance transfer fee is minimum of 3% or $10

** Monthly interest calculated on $10k balance at 18% as: 10000*(1+(0.18/360))^365-10000)/12

Support HuffPost

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

At HuffPost, we believe that everyone needs high-quality journalism, but we understand that not everyone can afford to pay for expensive news subscriptions. That is why we are committed to providing deeply reported, carefully fact-checked news that is freely accessible to everyone.

Whether you come to HuffPost for updates on the 2024 presidential race, hard-hitting investigations into critical issues facing our country today, or trending stories that make you laugh, we appreciate you. The truth is, news costs money to produce, and we are proud that we have never put our stories behind an expensive paywall.

Would you join us to help keep our stories free for all? Your contribution of as little as $2 will go a long way.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you’ll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.