The rise and decline of the American metro is cyclical. I know, people tend to take the current state of a region and erroneously think it's been that way forever, or that it will stay that way forever. But the vitality of urban areas are fluid -- prone to decline and rebirth, just like everything else.

For example, take Boston. "Over the 60 year period between 1920 and 1980, Boston's population had fallen from 758,000 to 563,000," writes urban economist Ed Glaeser. "And Boston's real estate values in 1980 were so low that three quarters of its homes were worth less than the bricks and mortar cost of construction."

Fast forward 30 years and Boston is championed as a thriving information city, with real estate values through the roof.

What metros are the next Boston?

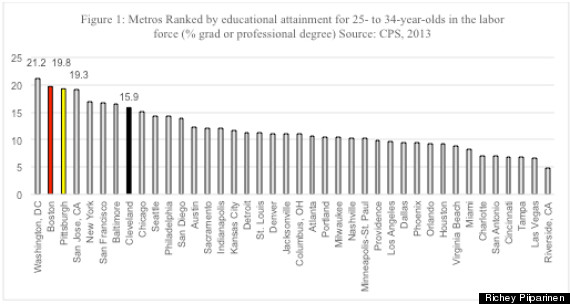

A new report brief I co-authored for the Center of Population Dynamics at Cleveland State University called "Ranking America's Top Young Adult Labor Forces: A Rust Belt Rising?", sheds some light on this question. The report ranked America's most highly-skilled young adult workforces, which is calculated as the percentage of 25 - to 34-year-olds in a regional labor force with a graduate or professional degree.

Before discussing the findings, some rationale as to why the data was sliced this way. First, looking at the human capital levels of young adults is a better leading indicator as to where a metro's economy is headed. Second, measuring the percentage of workers with a graduate or professional degree gets at the idea of a "magnet city", or those metros that have established or emerging clusters of knowledge that are pulling in the highly educated from around the world. This clustering leads to job growth. From the report:

[A] region's highest-skilled workers are drivers of economic growth. Specifically, a metro's top talent--think engineers, scientists, and doctors--are key agents of knowledge production and transference , which -- when translated into the marketplace -- mean new firms and the evolution of existing firms. Those metros that have a high concentration of highly-skilled young adult workers have a head start in the race toward the "next" new economy.

Figure 1 displays the results. The nation's largest 40 regions were ranked. The top ten highest-skilled metros are filled with the regular suspects, including Washington, D.C., Boston, New York, San Francisco, and Seattle. However, there are a few surprises, particularly Pittsburgh and Cleveland, which rank as having the 3 and 8 most highly-skilled young adult workforces in the nation, respectively.

In many respects, the results go against the projections of urban visionaries who think regions like the Rust Belt are doomed. The thinking here is that the San Francisco's and Boston's of the world will continue sucking up all the top talent, because they are the largest "magnets." That said, the biggest magnets also have the biggest costs. Hence, you are beginning to see a movement of talent and investment arriving back into the nation's inland. Steve Case, CEO of the investment firm Revolution and co-founder of AOL, terms this pivot "The Rise of the Rest". Economists call it "geographic arbitrage", or "the practice of high-paid professionals moving to less expensive markets." Notes Case:

From an investment standpoint, it makes sense to invest in other places...From an entrepreneurial standpoint, the cost of living is lower in Detroit and Nashville than in San Francisco. So you can go a longer way with less capital. That's an arbitrage for investors who can invest at lower evaluations and for entrepreneurs, you can get more bang for the buck.

This arbitrage goes beyond investment capital. As noted in the New York Times recently, high housing costs are pushing young adults into middle-American markets where home ownership isn't a pipe dream. And where the talent is clustering, firms are following. For instance, Google is investing heavily near Pittsburgh's Carnegie Mellon. The thinking goes: why attract top talent into exorbitantly costly areas when you can build your firm's presence in low-cost areas where the top talent is produced? Look for this trend to continue. From the Harvard Business Review:

It goes without saying that no matter how much talent a company might have, there are many more talented people working outside its boundaries. Yet all too many companies focus solely on acquiring talent, on bringing talent inside the firm. Why not access talent wherever it resides?

If the results of our latest analysis are any indication, talent is increasingly residing in the Rust Belt.

And the cycle of life continues.