For nearly two decades I have been an entrepreneur, founding, running and also investing my own money in new technology start-up businesses. Tax rates have never played a role, positively or negatively, in the ability to raise capital or decisions to invest it. Other general economic factors surely have, but not tax rates. As shall be explained below, there are a few tweaks to tax policy that might make a difference, but keeping these tax rates where they are, or letting them rise, is not one of them.

Never ones to miss an opportunity to lie about taxes, however, Republican chicken-littles are using the slow-growth in job creation--while far ahead of Ronald Reagan's at this stage in the recovery--to push rightwing claptrap that the pending rise of 4.6% in ordinary income tax and of 5% in capital gains tax rates is a sword of Damocles ready to fall on January 1, 2010 to choke off new investment.

Never ones to miss an opportunity to cower before rightwing claptrap, some Democrats are beginning to swallow those nostrums.

Although a larger discussion of the truths and falsehoods about tax policy is being prepared, this one is limited to the subject of the impending tax rate increases to capital formation and investment in new and early-stage enterprises, the place -- I do agree (which is why I like my industry) -- from which a job recovery is likely to be launched and sustained.

Let me be clear. I have a syndrome that, every April 15th, causes the muscles of my right hand to cramp. I would like to pay lower taxes, but I do not want to see people out of work, or denied healthcare, or see teachers or police laid off, or travel over bridges at risk to collapse, or spend an extra hour in traffic, or see my water, food or medications become unsafe, or have the elderly become part of my private health insurance that would raise my rates because of their increased likelihood of becoming seriously ill, nor live in a country that does not take care of basic necessities for those beyond working age,and so forth... just because it would relieve my muscle cramps on that day.

Moreover, even if I considered only my individual, financial self-interest, I do far better paying more taxes to build the foundations for a sustained, stronger economy. My salaries are higher, it is easier to attract capital when more people are doing well, and the value of what I am doing is worth more. It is not that my own expertise is better or worse -- merely, that I would be playing on a better team.

So, it is time for an entrepreneur to speak "the truth, the whole truth, frankly and boldly" about the relationship of the impending tax rate increases to investment: they will have no impact at all on new business investment. None. Zero. Zorch. Nada.

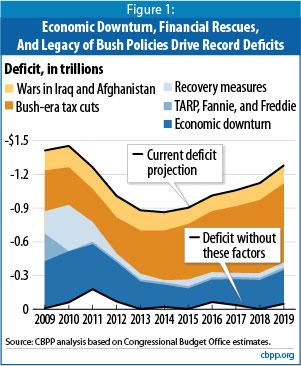

They may begin to heal the deep wounds the disastrous Bush Administration's tax cuts for the wealthy permanently inflicted on the country's fiscal security, and, in that sense, improve confidence critical for capital raising, but that would be indirect affects and difficult to measure because so many other factors impact confidence. As this graph from the Center for Public Policy & Budget, based upon Congressional Budget Office figures, shows, the Bush tax cuts were, and will continue to be, devastating to our fiscal health.

So, let me explain very simply why these tax changes are totally irrelevant to investment in new and/or growing businesses, the engine for job creation.

Entrepreneurs invest in (what they hope are) exciting new enterprises, or those in early-stages of growth. Once companies become profitable, their needs for risky investments recede.

An entrepreneur wants to start these new businesses because he/she has an awesome, amazing, neat, cool, nifty, revolutionary, game-changing idea, concept, invention or approach to a market. These people do not care about tax rates, they want to see their ideas flower.

What were the tax rates when Bill Gates started Microsoft, or Steve Jobs created Apple? There are two answers to that question. One is the rates -- 70% on ordinary income, 28% on capital gains, both far higher than what they will rise to when the Bush cuts expire. The other, more important answer -- neither Gates nor Jobs likely knew, and certainly did not care.

Investors, for their part, invest because they think the returns on that investment will be many multiples of their initial stake and because they like what the company is doing. The uncertainty of those future predictions dwarfs to the point of irrelevancy the tax changes' impacts on their ultimate return. These tax effects are, at most, "rounding error". In fact, the economic climate on the day the investment becomes liquid (either by doing a public offering or selling the company) is a much more important variable than tax rates.

That is not to say that there are not some matters of tax policy that impact the ability to raise capital for such investments. Probably the most important is that there is a differential between an ordinary income tax rate and the capital gains rate.

The second way to impact short-term capital raising and deployment for rapid growth of job-creating businesses is to provide a short-term benefit for capital deployed, say, in the next 18 months: zero percent tax for investments made in the next 12 months, 6% for those in the following six months. That is because we Americans like 'deals' (see, e.g., new homebuyers' credit and cash-for-clunkers), and it would force idle capital into a decision about how long to remain idle.

There are two tax policies changes that could have a long-term impact on increasing investments in American job-creating enterprises. The first is make it more attractive to hire Americans by moving social security and medicare taxes from salaries to a progressive sales' tax on all goods and services, thus equalizing the tax burden for products/services made in the US and abroad. The second is to provide a differential capital gains rate for investments in newly-issued equity (the money goes to the company) where 100% of the workforce is American than to gains from trading in secondary markets (money is exchanged between investors, no net job creation), say 14% for the former, 25% for the latter.

But, the 4.6-5% rate rises that will occur when the Bush tax cuts expire will have no impact whatsoever. They will simply be the new rates people will be paying, and not even be a factor in decisions to invest in our economic future, unless, as indicated above, they indirectly improve confidence that the US can make some hard decisions to improve its fiscal condition.

Speaking of those Bush tax cuts, by the way, it might be worth making the obvious point that those tax cuts are in place now. President Obama is actually overly generous to his predecessor when he talks about not "going back" to those failed policies. They do not expire until year-end. And, they have been killing our fiscal security by ballooning our deficits for the last seven years.

The most important factor in fostering investments in new industries is confidence. Confidence is a psychological matter, but it has to be based on realistic assessments of the future.

Foisting phony assertions about bogus effects on investments in new companies of small tax rate increases upon the public is a major, major disservice to the country.