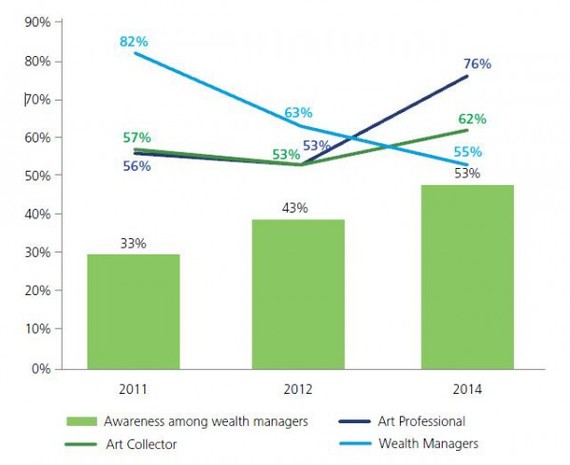

Family offices are increasingly into art investments. This interest is fuelled by the extensive economic crisis experienced in 2009. However, financial institutions are reluctant to accept art collection as a feasible alternative class of assets, for it entails high costs of transaction and issues relating to transparency, regulation and prospective low liquidity. Hence, the 82 percent of wealth managers who advised families to include art in their portfolio in 2011, went down to 63 percent in 2012. This is clearly seen in Figure 1.

Figure 1. Source: Deloitte Luxembourg & ArtTactic Art & Finance Report 2014

By 2014, only 55 percent of wealth managers favored inclusion of art collections in their client's wealth portfolio. A study conducted by Wharton Global Family Alliance showed that families increased investment to properties and companies almost doubled. According to the study, 5 percent of investments made by family offices in 2011 were on precious metals and art collections such as paintings by the internationally renowned artists, Alexander Sergeeff and Christina Oiticica. Allocations to these areas have grown five times recently. The Wharton report sampled 106 family offices across 24 countries; with 41 percent of samples from the US. Sixty six (66) percent of the families held over $500 million worth of assets.

"Heart of Katukina" by Christina Oiticica

Demand for Art Investments

Evidence shows the demand by customers is pushing family offices and private banks to consider art investments. Collector interest has risen, from 53 percent in 2012 to 62 percent in 2014. In my interview with Sergeeff, also known as Sasha, he says "The buyers for my paintings are always professionals, coming from the different parts of the world. After the financial crisis, my clients are richer and older, starting at age 40." He further adds, "Fifty (50) percent of people purchasing my paintings are repeat buyers; fifty (50) percent are in the 40-50 year old bracket and another 50 percent are 60-70 years old." His artworks can be considered "masterful, stylistically rich and vibrant."

Christina Oiticica, the wife of the famous writer Paulo Coelho, said 60 percent of buyers of her works are men, and 40 percent women. They are professionals within the 40-70 age bracket. She said, " My buyers are not art investors, but persons who fell in love with a particular piece and could afford to buy it." She further adds, "The repeat buyers really love my work; they follow me and show interest whenever I have new artworks." About her artworks and style, we can refer to them as "beautiful, natural and feminine."

Sasha adds, "Approximately 150-200 of my pieces have been purchased and resold by a single client. But this is always done in private transactions." He has sold his paintings to collectors, celebrities, politicians and admirers. He further says, "The best customers always paid immediately, and some even paid more than asking price. The worst customer I has was someone who ordered a painting, paid a deposit and disappeared. I never heard from him anymore. I waited for 10 years, then eventually sold the painting to another buyer."

Christina says, "This matter of purchase and re-selling has not happened yet to me." She says, "Art is an asset. A collector or an investor is above all passionate about art, and will choose a direction to follow. Those who chose my work to be part of their world believe that what I do is unique, original and makes sense. In the long term, this will be an interesting choice for one's portfolio."

"Bella Mattinata" by Alexander 'Sasha' Sergeeff

"Gate of Gaia" by Christina Oiticica

Preserving the Family Wealth

In terms of the appreciating value of art, Sasha says "The value of my artwork doubles every 10 years. Having spent 30 years in the art market, the key is to know the right price for the painting or any object of art." Christina, on the other hand, sees a 5 percent appreciation in the value of her art every 5 years.

Family offices particularly believe that artworks and collections are an important asset class in diversifying family wealth as well as a strategy to weather future market volatility.

Investing in art collections can provide a scope of unrivaled financial returns. For established family offices, the motivation to invest is to ensure sustained family wealth. Family offices can attain high returns by meeting the capital needs in the art market. They can offer market entities such as auction houses and art dealers the capital they need to make well-timed investments, in contrast to unreasonable terms imposed by conventional banks that are unacquainted with dynamics and practices in the art market.

Christina Oiticica and Paulo Coelho

Alexander 'Sasha' Sergeeff

Art Investments for Future Generation

The move to make direct investments is motivated by a combination of financial and emotional factors. Studies reveal that direct investments by family offices are largely driven by economic concerns. Yet most investors, particularly those going the art way, are motivated by varied reasons. These include the need to maintain control, make a social impact, stay active, educate the family and protect wealth through generations.

Family offices that invest in art collections do it as a strategy to maintain a high level of activity and control over their investments by physically owning the art. With direct investment, the extent of commitment is required so a family office has to put together an in-house team or outsource a professional from the art market. Failure to do this will mean it would be impossible to find, manage and monitor a portfolio of art investment. The best thing about getting a team is that it is easy to control though it can be a challenge to attract and retain talent.

Family offices also invest directly to maximize social impact. Given their ability to scale, business models that are financially sustainable are capable of achieving more impact than philanthropy. Art investments are taking the form of private museums as most collecting families use this avenue to share their passion and interest in art as a way of giving back to society. There is rising focus towards use of art collections to attain a sense of personal and communal contentment among families that have exceptional art investment.

Decreasing financial returns is pushing single family offices to invest directly. Concerns over the high cost of hiring external managers and potential for conflict of interest are the other reasons why single family offices are opting for direct investments according to the Wharton Report. Single-family offices are serving families with a net worth of over $100 million like Microsoft Corporation co-founder, Bill Gates, and Michael Dell of Dell Computers. Investing in art provides growth prospects for professional, enhances awareness of global art among family members and passes understanding of a family's art collection to future generation.