Are you counting down the days until your summer vacation? So are lots of businesses.

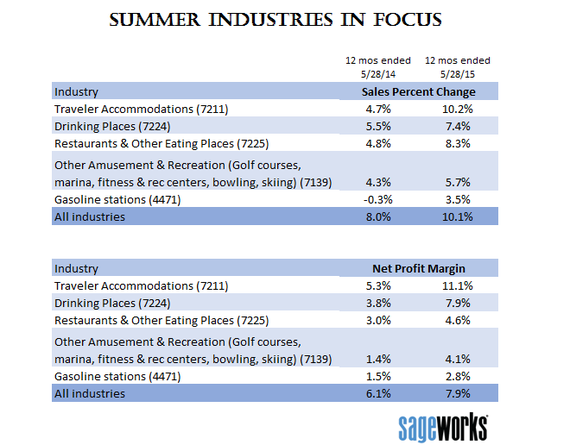

Several industries typically associated with summertime activities stand to benefit in the weeks ahead as vacationers get moving and as people generally enjoy a more relaxed, active lifestyle in the coming months. Already, some industries are experiencing better sales in the last 12 months than they did in the previous period, according to new data from Sageworks, a financial information company.

"All of these industries are outperforming last year," said Sageworks analyst Jenna Weaver. "They're heading into the big summer months for them, and they're already in a better place, with higher sales growth than they had in the previous 12 months."

More positive news for these types of privately held companies -- hotels and other accommodations, restaurants, bars, gasoline stations and other amusement/recreation companies -- are profitability gains compared with this time a year ago, based on a financial statement analysis.

"There are lots of good stories in this data," Weaver said. "All of these industries have improved in both sales and profitability."

Of course, privately held companies as a whole are doing better over the last 12 months than in the previous 12. Sales are growing at a faster rate (10.1 percent vs. 8 percent) and profit margins are stronger (7.9 percent vs. 6.1 percent). So some of the gains in summertime industries would be tied to the stronger economy overall, Weaver said.

A few industries, however, are clearly receiving more of a boost, perhaps from sector-specific trends, she added.

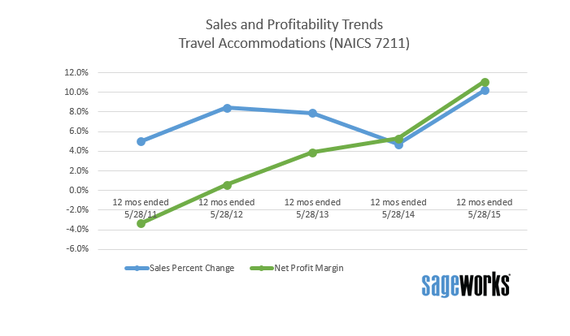

For example, sales have increased 10.2 percent for traveler accommodations (NAICS 7211), a category that includes hotels, bed-and-breakfast inns, cottages and cabins, based on financial statements filed in the 12 months ended May 28. Sales growth had ranged from 4.8 percent to 8.5 percent in the previous four 12-month periods.

Hotel profitability has surged, too, with average net profit margin topping 11 percent in the most recent period. "That industry has a good amount of fixed costs; they have the same buildings to support no matter what their occupancy is, so the sales increases can really help leverage those costs and boost the bottom line," Weaver said.

Sageworks' data is consistent with its earlier hotel-industry report for the full year 2014. Other data sources, too, have reported similar trends, calling out record occupancy and room demand at U.S. hotels, along with a five-year growth trend in revenue per available room (RevPAR). A growing global tourism population and limited additions to the supply of hotel rooms are being credited for the industry's performance and rosy outlook.

Bars, or drinking establishments (NAICS 7224), have also experienced markedly improved profitability over previous years, with average net profit margin approaching 8 percent in the last 12 months, compared with margins in the 2-4 percent range in previous periods. At 7.4 percent, sales growth has also accelerated.

"Drinking places, like the restaurant industry, are benefiting from people having more disposable income and eating out," Weaver said.

Even gas stations, which historically have among the thinnest margins in retailing, and an industry that includes golf courses, country clubs, marinas and fitness centers (NAICS 7139 Other amusement and recreation) have experienced improved profitability. Golf courses and country clubs have faced persistent unprofitability in recent years.

Through its cooperative data model, Sageworks collects and aggregates financial statements for private companies from accounting firms, banks and credit unions. Net profit margin has been adjusted to exclude taxes and include owner compensation in excess of their market-rate salaries. These adjustments are commonly made to private company financials in order to provide a more accurate picture of the companies' operational performance.

Image credit: Du Truong via Flickr CC