PART I: The Wireline-Wireless Broadband and Internet Bait and Switch

PART II:

Let me explain why all of your communications rates keep going up or why there are 'data caps' imposed, and why many customers have overcharges on wireless. And let me explain why there is no serious competition in America to lower rates, and why high-speed broadband in America is mostly slow and expensive and not available to over 50% of Verizon or AT&T's wired territories, regardless of the hype.

And let me explain why Verizon's Boston plan, which we highlighted, represents the 'end game' - to shut off all wires except what the Wireless company will use, (with fiber-to-the-home as an afterthought), to hand over the business to the wireless company, as well as block competitors as these 'new buildouts' are not required to be 'open' to competition.

It all comes down to the fact that Verizon, AT&T and Centurylink have control over most of the wires as they are the incumbent, state-based utility companies. This has allowed them to also take control of the wireless services, (Centurylink, has a deal with Verizon Wireless) and they have been able to 'cross-subsidize' all of their other lines of business. So, there are just three very large holding companies, which do not directly compete for residential wireline services (even though every merger to make them larger was predicated on it) that control most of America's wired infrastructure (or they sold off areas they didn't want). And this also gives them control over most of the other competitors and businesses that rely on these wires, especially for "Business Data Services", formerly known as 'special access', and that includes wireless services.

This control impacts almost all competitors offering competitive phone or broadband services, or are deploying 'DAS', (small cell 'Distributed Antenna Service')--lots of small antenna wireless services that require fiber optics, or the alarm industry, that depends on dependable wired networks, or the wireless companies who compete today. And these plans have left most cities and rural areas' broadband future incomplete and not well served. Worse, even their wireline copper infrastructure has been left to deteriorate.

But let's put some facts on the table. (We will be releasing new reports about these issues, or read our previous reports from our new series "Fixing Telecom".)

- Harm to Competition

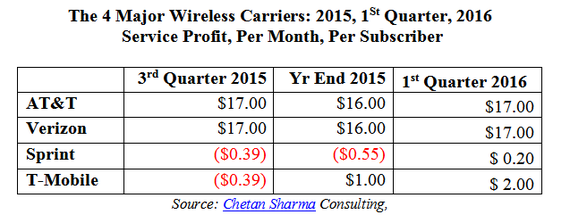

This summary of the four major wireless carriers, from the end of 2015, and first quarter, 2016 shows just how this game plan is playing out.

This research from Chetan Sharma Consulting, indicates that Verizon and AT&T are making $16.00-$17.00 a month in profits (EBIDTA) per subscriber, while Sprint and T-Mobile, who do not have control over the wires for their own use to provide services to their subscribers, were losing money in 3rd quarter 2015. T-Mobile ended the year with a slight profit, and in 2016 they are both profitable, but the differential between the incumbent wireline-based wireless companies and the other carriers is enormous.

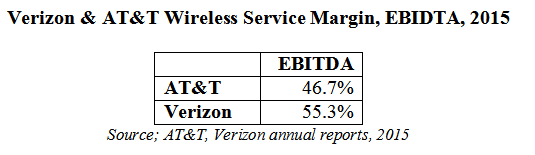

And it is clear from AT&T and Verizon's EBITDA wireless service margins (Earnings Before Interest, Taxes, Depreciation and Amortization) that they have had massive financial gains from the current wireless marketplace. AT&T Mobility's EBITDA service margin was 46.7% at year end 2015, up from 42% in 2014; Verizon Wireless was 55.3%, up from 48.6% in 2014.

While there are a host of other issues to consider as to why Sprint and T-Mobile are not as profitable, the one principle point is that Verizon and AT&T have been allowed to use their combined services to cross-subsidize the development and deployment of their wireless services and give their own affiliate companies advantages no other competitor has.

Here's What's Going On: It is getting Worse, Not Better.

As we pointed out in our last article, Verizon claimed in its 2015 annual report that it is a "digital-first mobile future" company while AT&T's 2015 annual report proclaims that it is "mobilizing your world". But both companies also have control over the wireline, state-based utility networks and this has helped them become the largest wireless companies - and to cross-subsidize their wireless business, as well as all of the other affiliate lines of business, including the 'Broadband Data Services' that businesses as well as competitors rely on.

The wires, fiber or copper, are part of the state-based utilities, such as Verizon NY and Massachusetts, and there are simultaneous issues.

- NOTE: "Cellco Partnership", which does business as "Verizon Wireless", is a separate legal entity from Verizon New York or Massachusetts, which are the state-based incumbent wireline utilities that control the telecommunications networks.

- Verizon has been able to let the wireless company use the wireline utility construction budgets for wireless instead of upgrading and maintaining the wired networks.

- Verizon has manipulated the accounting to make 'Broadband Data Services' highly profitable so any competitor or business pays exorbitant rates.

- At the same time, the affiliate companies, like Verizon Wireless, do not pay market prices for using the networks, so the wireless services also have obscene profits.

- Verizon NY's local phone customers had rate increases based on 'massive deployment of fiber optics' and 'losses' which are directly related to the 'affiliate' transactions, including Verizon Wireless and Verizon's Broadband Data Services.

These are some of the main reasons why they can claim that the local service networks are 'unprofitable' and can get rate increases or can 'shut off the copper'. The expenses are being placed in the state utility's Local Service financial accounting, while the fees paid by the affiliate companies are marginal--this raises the expenses and lowers the revenue to the incumbent utility.

And the cable companies? Verizon even has a deal with the cable companies, which was created when Verizon bought their wireless 'spectrum'. Verizon is now bundling their wireless service with the cable package in areas that are not upgraded. And since there is no direct competition, the cablecos can just inflate rates as well (another story).

So, data caps are created by the incumbent wireline and cable companies because they can. They can continually raise rates--for 20+ years because they can. And since they control critical infrastructure of wireline and wireless, including broadband and internet, there is no level competitive playing field. They can not upgrade areas, or 'shut off the copper' or cross-subsidize their businesses--because they can.

And, as discussed, Boston is a model of the end game. It is Verizon's test city to see if they can get customers to buy off on having a wireless service replace the wire to the home with lots of antennas that require fiber optics--known as FTTA, Fiber-to-the-Antenna.

Here are some more facts:

- Local Phone Customers of the State Utilities Were Charged for Verizon Wireless's CapEx Expenses.

Fran Shammo, Verizon's CFO, told investors in 2012 that the wireless company's construction expenses have been charged to the wireline business.

"The fact of the matter is Wireline capital--and I won't get the number but it's pretty substantial--is being spent on the Wireline side of the house to support the Wireless growth. So the IP backbone, the data transmission, fiber to the cell, that is all on the Wireline books but it's all being built for the Wireless Company."

And the New York State Attorney General in 2012 wrote that Verizon has been reducing staff and focusing on wireless:

"Rather than meet its obligations to provide wireline telephone customers with minimally adequate telephone service, Verizon is continuing to drastically reduce its workforce with the result that the company cannot meet its customers' repair needs in a timely manner. Verizon's management has demonstrated that it is unwilling to compete to retain its wireline customer base, and instead is entirely focused on expanding its wireless business affiliate."

Moreover, according to the NY Attorney General, about 75% of Verizon NY's wireline utility budget has been diverted to fund the construction of fiber optic lines that are used by Verizon Wireless's cell site facilities and FiOS cable TV.

"Verizon New York's claim of making over a 'billion dollars' in 2011 capital investments to its landline network is misleading. In fact, roughly three-quarters of the money was invested in providing transport facilities to serve wireless cell sites and its FiOS offering. Wireless carriers, including Verizon's affiliate Verizon Wireless, directly compete with landline telephone service and the company's FiOS is primarily a video and Internet broadband offering....Therefore, only a fraction of the company's capital program is dedicated to supporting and upgrading its landline telephone service."

- Customers are Paying for the Fiber Optic Deployments.

As we've documented using public documents, Verizon New York (VNY) received multiple rate increases for 'massive deployment of fiber optics' and 'losses'. Local phone customers ended up paying $1000-$1500.00 extra for these rate increases that started in 2006.

In June 2009, the NY State Public Service Commission (NYPSC) granted VNY a rate increase for residential POTS customers. The NYPSC press release explains this rate increase was due to "massive deployment of fiber optics" (and the release continues, explaining that VNY was "in need of financial relief" due to major losses).

"'We are always concerned about the impacts on ratepayers of any rate increase, especially in times of economic stress,' said Commission Chairman Garry Brown. 'Nevertheless, there are certain increases in Verizon's costs that have to be recognized. This is especially important given the magnitude of the company's capital investment program, including its massive deployment of fiber optics in New York. We encourage Verizon to make appropriate investments in New York, and these minor rate increases will allow those investments to continue'." (Emphasis added)

This was the 3rd increase and every ancillary service went up 50-300%. See our last reports from "Fixing Telecom".

And the NYPSC was not 'concerned' enough, it would seem, as they never audited the financial annual reports to investigate whether these increases were justified or how the flows of money were manipulated to create these losses.

The 'massive deployment of fiber optics', then, appears to have been done, in large part, not to wire homes in New York State but to wire the cell sites; the 'losses' were created by multiple things, including the fact that Verizon Wireless didn't pay for some, most, if not all of this construction; it had nothing to do with Local Service expenses. I'll get to that in a moment.

- Verizon Wireless Appears to Be Paying a Fraction of What Other Competitors Are Paying for Use of The Wireline Networks.

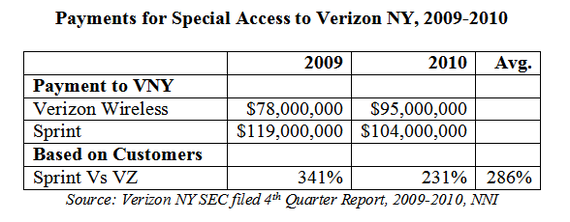

Based on Verizon New York's financial reports, Sprint is paying almost three times the amount Verizon Wireless (Cellco) paid, based on the number of customers in 2009 and 2010. In 2009, Verizon's Cellco paid Verizon NY, the state-wired utility company, $78 million and $95 million in 2010; Sprint paid $119 million and $104 million respectively - but Sprint had less than ½ of the customers.

By 2014, we estimate that in just New York, Sprint overpaid by $60 million as compared to Verizon Wireless; nationwide, Sprint was overcharged by over $½ billion annually. This also means that T-Mobile, and every other competitor, are most likely paying multiples for use of these networks, it would appear. (Note: Verizon Cellco's payments to Verizon NY are documented through 2014; Verizon stopped publishing what Sprint was paying in 2010.)

- Where are the Verizon Wireless Construction Expenditures? Missing.

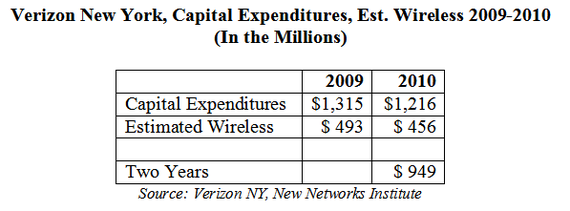

As previously quoted, the NY Attorney General's analysis of Verizon NY's capEx for 2011 claimed that 75% of the wireline utility budget of over $1 billion was used for the delivery of FiOS and wireless services. Let's walk through this example.

First, we present the actual numbers for VNY's capEx for 2009 and 2010 as told by the 4th Quarter SEC filings for these years. VNY reported no direct payments from Verizon Wireless, except the payments listed above. Even if this was 'amortized' over time in monthly payments for, say, three years, by 2010 there should be over $300 million as a separate payment for the work done.

However, the numbers are much, much worse. We estimate that in just 2010, Verizon Wireless's cell site construction budget was about $1.2-$1.4 billion in just New York. I.e., Verizon NY paid for the construction for the wireless affiliate and the total was most of the Verizon NY wireline capEx.

Verizon Wireless released its own press releases for these years and they show that Verizon Wireless only spent about $216 million in New York State and Northern New Jersey for 2010--However, Verizon Wireless had over $6 billion in revenues in just New York State for 2010.

Ergo, Verizon Wireless was able to use the Verizon NY wireline construction budgets for their upgrade of the wires to the cell towers and also paid a fraction of the expenses for using the networks. Meanwhile, Sprint and the other wireless companies would pay Verizon NY retail for doing any construction and as well as market prices for using the networks--and the differences are massive, especially nationwide. We have no reason to believe this is not happening in every Verizon state, not to mention in every AT&T and CenturyLink state.

- Competitors are Blocked from the New Fiber Optic Build Outs.

Adding to this, competitors, from the wireless companies to other DAS providers or companies offering broadband, and others are blocked from using the new fiber optic upgrades... even if they are being used for wireless.

In December 2015, the FCC's decision agreed with the United States Telephone Association (USTA), (the trade association and lobby for the large phone companies - AT&T and Verizon) petition and stated:

"We find that USTA has met the forbearance standard with respect to newly- constructed entrance conduit access in greenfield deployment situations."

What this says in English is--the FCC agreed with the USTA and decided that competitors should be blocked from getting access to new fiber optic build outs (known as 'greenfields') and that it 'forebeared', meaning while there are laws on the books to allow competition on the wires, the FCC will not enforce these laws.

In short, competitive providers are screwed. Unless the incumbent deems it, these companies can't have access to these new fiber optic wires to offer their own services without the expense of laying their own 'conduit' (a term that has technical meanings too complicated to explain here).

- Profit Margins on Access (Broadband Data Services) Are also Obscene.

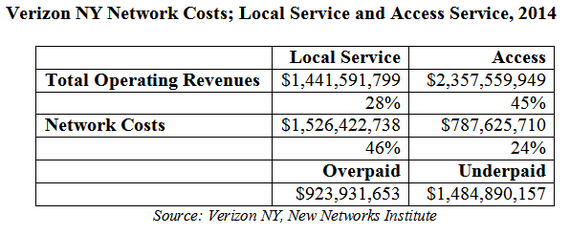

Another part of this multi-layer puzzle are the profit margins of 'Broadband Data Services', which can be either copper or wire. These are the revenues and network expenses from Verizon New York's 2014 Annual Report, based on the financial categories: "Local Service" and "Access", which includes Broadband Data Services. This shows the massive cross-subsidies.

"Local Service" are the revenues from basic copper-based "POTS", Plain Old Telephone Service, and ancillary services, like Call Waiting, while this accounting of "Access" represent the mostly copper-based access services, with the largest sub-category being 'special access', now called "Broadband Data Services".

In 2014, in just New York, Verizon made $2.4 billion in revenue from access, which represented 45% of the revenues, but only paid 24% of the network costs, (known as "plant" and "non-specific plant") including capEx construction expenses. Local Service, which only brought in $1.4 billion, or 28% of the revenues, paid the majority, 46%, of the network costs.

This is, of course, ridiculous as Verizon has not been putting money in to support the copper local services, and it should have paid a fraction of this expense.

Access Services, including special access, underpaid by $1.5 billion in expenses in just 2014 and in just Verizon New York. This made Access have over a 50% profit margin.

However, this does not include the "Black Hole Revenues", which are special access revenues that are not part of the accounting of the Verizon New York regulated books, but get the benefits of this manipulation of the expenses.

- Consumer Federation of America's Special Access Report: $150 Billion in Overcharging and Economic Harms Over the Last 5 Years.

On April 5th, 2016, Consumer Federation of America released a report on special access overcharging.

"Consumer Federation of America (CFA) today released a study that estimates that large incumbent telephone companies have engaged in abusive pricing practices for high-speed broadband "special access" services, with overcharges totaling about $75 billion over just the past five years. As a result, CFA estimates that the indirect macroeconomic loss to American consumers doubles that damage to a total in excess of $150 billion since 2010."

In short, data caps, high broadband and wireless prices, and a lack of competition - or even a lack of broadband deployments, are all tied to one thing--AT&T, Verizon and CenturyLink control critical infrastructure and have been able to cross-subsidize their other businesses, while harming competition and the public.

And they do not offer enough direct competition to lower any offerings by the cable companies--and thus there are no market forces in play--just mostly a monopoly or duopoly.

Moreover, the wireless companies are making decisions about who will or will not get upgraded.

And Verizon's Boston plan illuminates all of these ties - but to date no reporter or regulator, state of federal, has looked behind the curtain.