The stock market had an awesome year last year, rising roughly 35 percent. Many investors, inspired by the market's strength, have now decided they want to get in on the gains. However, now is not the ideal time to put money to work in stocks. In fact, it's a horrible time to do so.

In his classic tome, "The Intelligent Investor," Benajamin Graham writes, "An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative." Looking at the "safety of principal" and "adequate return" potential for stocks gives us a very good idea of how attractive they are currently as an investment.

To evaluate "safety of principal," or how safe your money is once you put it in stocks, it helps to look at how stocks are currently valued. According to four proven valuation metrics (tracked by Doug Short -- see chart), stocks are currently overvalued by about 67 percent. What this means is that historically stocks have currently traded at an average valuation that is 40 percent below today's prices. In other words, you could lose 40 percent on your investment in the stock market today and it still would not be considered cheap.

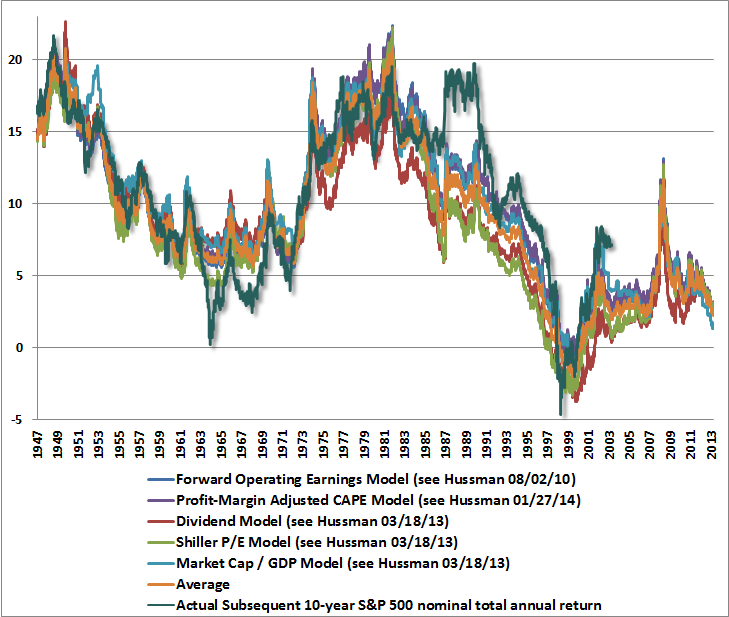

In terms of "adequate return," my experience working with individual investors tells me most people would like to earn anywhere from 8 to 10 percent annually from investments made in stocks. What most people don't understand is that the price you pay determines your rate of return. So when you pay a high price you're guaranteed a lower rate of return over time and vice versa. Today's high valuation levels mean that investors can only expect to make about 2 percent per year over the next decade (as calculated by John Hussman -- see chart).

So investors making new commitments in the stock market today are essentially risking 40 percent on the downside to earn 2 percent per year on the upside. That's a risk/reward equation that just doesn't make any sense to me.

And it's probably why guys like George Soros are limiting their exposure to stocks right now. Yesterday Mr. Soros revealed that he has actually taken the other side of this risk/reward equation by placing a large bet to the downside. His track record clearly proves he's a very "intelligent investor." Are you smarter than Mr. Soros?