"A, I'll always want you

B, because my heart is true

C, come, come, come closer

And I'll tell you of the ABC's"

-Frankie Lymon and the Teenagers

"It does not matter how slowly you go so long as you do not stop"

-Confucius

In her landmark book Learning to Breathe Fire: The Rise of CrossFit and the Primal Future of Fitness, former New York Times columnist J. C. Herz notes that Gold's Gym has statistically identified February 7 as the "Fitness Cliff," when checks in at the gym take a steep drop.

As Herz noted, February 7 is only 38 days after people came roaring into the gym with their New Year's resolutions.

My book Brand New Man: My Weight Loss Journey is about how I lost over 110 pounds and learned to embrace fitness concepts like CrossFit. Two key lessons that came from my weight loss journey were to learn to develop a solid plan instead of rushing into things, and if your plan isn't working, or if there wasn't really a plan to begin with, you need to ask yourself some informed questions and let the answers guide your journey.

Your first and most important conversation should be with yourself.

Many people go to a gym looking to lose weight. Before you go on any kind of weight loss journey, find the answers to the following questions:

1. What is your Body Mass Index (BMI)?

Body Mass Index (BMI) is a way to measure obesity calculating height and weight. There are numerous calculators on the internet such as at nih.gov.

According to the tables, a BMI of 30 or over is obese and fewer than 30 is not. On a person who is six-foot-tall, the 30 mark is about 220 pounds. On someone five-foot six-inches, it is about 185 pounds.

If your BMI is 35 or over, you may want to look at weight loss surgery. That is especially true if you are diabetic or near diabetic and have other life-shortening factors such as heart disease, sleep apnea or high blood pressure.

2. Do you drink, smoke or use medicines to cope with life?

I was fortunate that I did not smoke or use drugs and rarely drank. That made it easier to focus on the primary issue of obesity. For those who have other addictions, those habits have the chance of killing you as quickly, if not more quickly, than obesity. If you are going to focus on developing positive, long-term behaviors, it will be worth your while to get negative habits under control before taking on the obesity war. You can't win a war by fighting a battle on too many fronts. If you can limit the fight to obesity, you will be far more successful.

3. How long do you think you will live?

Few people consciously articulate this number, but you will find that almost all people unconsciously have a number in their minds. They can usually state it once they think about it for a minute.

The number is often based on how long their family members or friends have lived and how well their health is holding up. You will find that the number is a primary driver in decision making. People who don't expect to live a long time have a different game plan than those who plan on living to be 100.

Much of my business career has been connected to the life insurance industry and they have actuaries and underwriters who are extremely good at figuring out who will live a long time and who may not. The companies allocate billions of dollars based on those decisions.

If you smoke or skydive, you will pay more for life insurance than those who don't. It works the other way with a "rated age" lifetime annuity. If someone has an injury or occupation that will reduce their life expectancy, the annuity will pay them more per month than a healthy person of the same age.

The insurance companies have a good idea of how long they think you will live and in the back of your mind, you do too.

I bought an annuity when I was morbidly obese. Now that I am getting healthier, I feel like a gambler in Vegas who has figured out a way to "beat the dealer." When I get monthly checks into my very old age, I'll pat myself on the back for outsmarting the actuaries. It is not an easy thing to do.

People who think they are not going to make it much longer may not willing to make changes in their diet. Then there are people who recognize that if they change their habits, they have a good chance of being around a lot longer.

Thus, it's important to get "the number" out on the table and in the front of your mind.

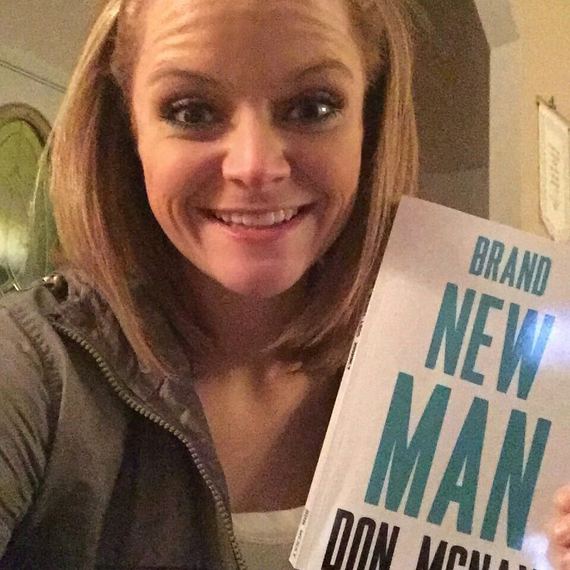

(Elizabeth Whitt lost 175 pounds and is profiled in the Brand New Man book. She is holding a copy of the book as a present on her 22nd birthday.)

4. What can you afford to fight obesity and what are you willing to allocate?

I paid for my weight loss surgery and a variety of services out of my own pocket. My health insurance did not pay for anything. Organic and healthy foods cost far more than the stuff with additives. I took enough time off of work to completely recover and was willing to do what it took, or pay whatever it cost, to get my health in order.

Not everyone has access to money, resources and support people. A lot of people are fighting to stay afloat financially and doing it with little or no outside help. It's economical to buy cheap food or go through the fast food drive-thru. If you are working two jobs, it's hard to find time to exercise. If you are a parent, especially a single parent, getting time to yourself can be tough.

Some people have the time and money to get healthy. Some people have to rob Peter to pay Paul. Income is a primary indicator of obesity and the two go hand in hand. Being healthier allows you to open up more income opportunities.

When I was in high school, my mother was working in a potato chip factory and decided she wanted to be a nurse. She was a single mother with two children, working in the factory in the day and studying at night. I didn't fully appreciate until I was older how hard that was. She sacrificed because she could visualize the workplace happiness and economic security that nursing would bring her. It was the hardest decision of her life, but also the best one. She loved every day that she was a nurse.

Giving up health for wealth was a tradeoff I made for most of my life. I'm lucky that medical science is allowing me to atone for my past mistake. Actually, my weight loss has helped my business. I'm more productive, active and alert than ever. Getting in shape can help make you money. And feel better. And live longer. Overall, that is a pretty good investment.

On February 8, I hope that you maintain your investment in exercise. And keep that going for decades to come.

Don McNay, CLU, ChFC, MSFS, CSSC, is a best-selling author and former syndicated columnist who lives in Lexington, Kentucky. He is the founder of McNay Settlement Group and is a structured settlement and financial consultant who serves as an expert in legal proceedings. His latest book, Brand New Man: My Weight Loss Journey, is being published by RRP International Publishing and will be available on February 27. You can read more about McNay at www.donmcnay.com