Matthew Miller of San Pedro, Calif. spent $2,395 from his checking account during the month of October. He deposited $3,445 on top of a starting balance of $394. His ending balance: two bucks in the red.

Where did the rest of his money go?

To Chase Bank, in the form of overdraft charges, non-sufficient funds charges and other fees totaling $1,446. Miller said he called Chase repeatedly to try to figure out where he went wrong.

"Nobody can tell me what they're for," Miller said in an interview with the Huffington Post. "All they can tell me is, 'Yeah, it's wiping out your bank account.'"

Clearly, Miller's mistake was to use a debit card without much cash in his checking account. But it's impossible to tell from the statement exactly what he did wrong.

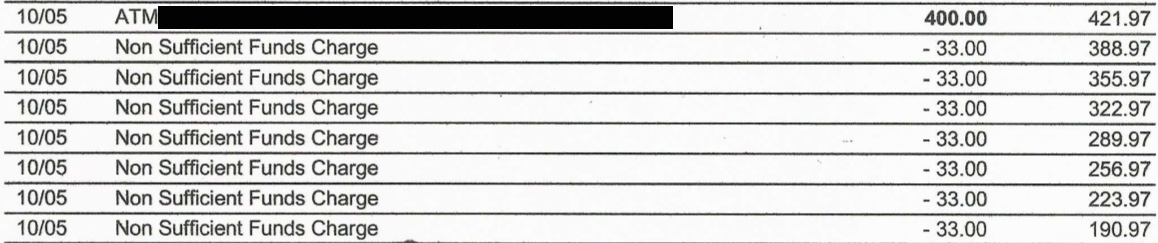

For instance, the statement shows that on Oct. 5, he made a $400 deposit at an ATM that brought his balance to $421. It was immediately clobbered with seven straight non-sufficient funds charges for $33 each that brought it down to $190. (Chase said in a recent statement that it doesn't charge more than six overdrafts a day.)

Ed Mierzwinski, program director for consumer advocacy group U.S. PIRG, reviewed Miller's statement and called the fee situation "one of the worst I have ever seen."

"On Oct. 5 you can see that they post his balance as if he appears to have a full $421.97 after that $400 transfer," Mierzwinski wrote. "But, they then take all the micro-transactions out first, against the $21.97, not the $421.97, causing a ripple of NSF charges... Basically, at the end of the day, they re-order the transactions to maximize the fees."

Similar batches of fees popped up on the 8th, 14th, and 19th.

On the day Miller deposited that $400, he used his debit card for a $16 set of boxing wraps from the gym, a $23 meal, a $6 smoothie, and a $4 download from iTunes. Did those purchases cost him $231?

Chase spokesman Tom Kelly declined to comment on an individual customer, but he said Chase wouldn't do things that way. He explained that NSF charges -- which Kelly said apply when the bank refuses to cover a payment -- post one business day after a transaction is rejected.

So what were the seven payments Chase rejected from Oct. 2, the previous business day? The statement doesn't say, and Miller has no idea. He said that over the course of the month, Chase apparently refused to honor the monthly phone bill, computer payment, credit card payment, and gym dues -- but those should amount to only a handful of NSF charges for the month, not two dozen. And if the statement is to be believed, Chase honored no fewer than a dozen transactions for more than what was in the account.

Chase's policy on posting order contradicts Mierzwinski's interpretation of what happened:

Generally, deposits will be credited to your account first and then we'll pay your items (e.g. checks, debit card transactions, ATM transactions and other debits to your account) from highest to lowest dollar amount each business day. Certain transactions such as wire transfers may post before others.

But Miller's statement appears to contradict that policy: his deposits are credited before debits only half the time. And as for the difference between overdraft charges and NSF charges, not even the statement can keep them straight -- the end of the document lists all 29 overdraft and NSF penalties as overdraft fees.

All this confusion could be attributable to the fact that Miller started his account with Washington Mutual. He became a Chase customer after Chase took over WaMu, the largest bank failure in U.S. history, last fall. Kelly said that Chase phased out the old WaMu computer system for California customers last week, and that proper Chase billing statements are more detailed. So maybe Miller's next statement will make some sense.

Chase and Bank of America both announced changes to their overdraft policies under threat of a congressional crackdown. The Chase policy, which will go into effect next year, will require customers to opt-in, will modify posting order "to recognize debit-card transactions and ATM withdrawals as they occur," and will limit overdraft fees to no more than three per day.

What makes Miller sad is that today is his 36th birthday.

"Your birthday is a time of evaluation," he said.

(He wrote in an email that he'd celebrate with a can of beans and a Twinkie; pressed about this, he said he'd go out to dinner with his mother and daughter.)

Here's Ed Mierzwinski's advice for consumers: Don't use a debit card at all, but if you do, always imagine that you have $100 less than your balance says you have.