Part 2 of a Two-Part Series

America's 75 million boomers are about to become our largest-ever retirement generation. And as they migrate into their later years, health will be the ultimate retirement wildcard. For many, health and health care expenses will be the difference between a retirement filled with opportunity, independence, and financial security, or a retirement diminished by worry, vulnerability, and financial challenges.

"All the Money in the World Isn't Worth a Cent Without Good Health."

That's a direct quote from a focus-group participant who took part in our just-released national study titled Health and Retirement: Planning for the Great Unknown. To investigate the many ways in which health impacts retirement and retirement planning, my firm, Age Wave, partnered with Merrill Lynch to survey 3,300 pre-retirees and retirees nationwide -- from all walks of life and socioeconomic strata -- to uncover their concerns and worries about health and health care expenses in retirement.

One of the most fascinating findings revealed in our research is that there appear to be four distinct boomer HealthStyles, with some boomers set on a course for a healthy retirement and others facing increased challenges with their retirement health and health care costs. The profile for each HealthStyle describes how people approach their health and health care, as well as how they are preparing for health care expenses in retirement. Although most of us will find ourselves generally identifying with one of these four HealthStyles, that doesn't mean your HealthStyle can't change: You can transform your HealthStyle by taking the appropriate actions.

The four core profiles of boomers are: Healthy and Proactive (29%), Lucky but Lax (10%), Course-Correcting and Motivated (29%), and Challenged and Concerned (32%).

Figure 1: Four Boomer HealthStyles

Healthy and Proactive

Healthy and Proactive boomers take charge of their health and health finances and take pride in doing so. They are the most actively engaged in healthy behaviors, such as exercise and eating well; have the most positive attitude about their health; and feel well prepared for health care costs in retirement, having proactively researched retirement-related health care costs and insurance options. Few of these boomers allow things to get in the way of taking care of their health (25%) and fewer still see themselves as limited by a chronic condition. If they are married or in a relationship, there's a good chance they have had discussions with their spouse/partner about retirement health care topics. As one focus group participant pointed out, "My husband and I have thought this through, and generally we feel prepared for a wide range of potential health care costs. There are no guarantees in life, but we feel better having planned for various curveballs that life may throw our way."

Lucky but Lax

Lucky but Lax boomers have been dealt a good hand in terms of their health and are fortunate to be relatively healthy so far. However, they show little interest and effort in taking care of themselves or planning for their health finances. As they get older, these attitudes and behaviors could potentially leave them vulnerable to future unexpected health disruptions. In focus groups, we heard those with this profile make comments like, "I've been blessed with good health. I assume that will always be the case," "I don't really pay attention to my health at all. There really isn't any reason to," and "Diet and exercise are for other people, not me." Only about a third engage in key health behaviors (35%), yet compared to others their age, fewer currently have a chronic condition. However, as they get older, their health-related good luck may change. Those in this segment rarely seek out information to improve their health (37%) or research retirement-related health care costs and insurance options (23%). Nor do they discuss these issues with their spouse/partner. Yet many (62%) feel some concern about the impact an illness could have on their financial situation.

Course-Correcting and Motivated

Course-Correcting and Motivated boomers have experienced a health wake-up call, such as an illness or chronic condition diagnosis, which has motivated them to try to improve their health. As one of our focus group participants candidly reported, "It took several two-by-fours to the head before I started paying proper attention to my health." Their proactivity now includes seeking out information about how to improve their health (80%) as well as adopting healthier behaviors (55%). In addition, they are very interested in technology that can help them better manage their health. These boomers are very concerned about the impact illness could have on their financial situation (68%). As a result, many are taking steps to prepare by researching retirement-related health care costs and insurance (46%). If they are married or in a relationship, about 4 in 10 have discussed retirement health care topics with their spouse/partner.

Challenged and Concerned

Challenged and Concerned boomers are struggling with health and health care challenges, yet are not actively taking very good care of their health. Many have chronic conditions, which keep them from doing the things they enjoy (48%), but only two out of five engage in key health behaviors (42%). Their reason: many say other life worries and responsibilities get in the way of taking care of their health (58%). This segment is the most concerned about the impact illness could have on their financial situation (72%), and the most likely to feel overwhelmed and confused by health care cost and insurance information. Only about a third have researched retirement-related health care costs and insurance options (36%). Among those who are married, less than a third have discussed retirement health care topics with their spouse/partner.

Changing Your HealthStyle: Five Strategies for Healthier Aging

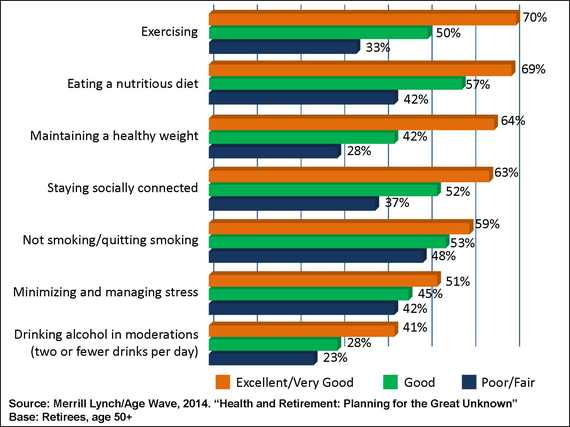

It's important to remember that no matter how old you are, it is never too late to gain positive results from healthy behaviors. Even small improvements in health behaviors can create a lifetime of health dividends. As figure 2 shows, retirees who achieve high levels of health get there by proactively engaging in healthy lifestyle habits.

Figure 2: Health behaviors among retirees, by health level

Five important strategies to enjoy healthier aging include:

- Exercise regularly. We've heard this a million times, however, the message is even more potent for older adults. People who begin exercising in their 60s or 70s are three times more likely than those who don't exercise to age healthfully and not develop a major chronic disease, depression, or physical or cognitive impairment.

- Eat a nutritious diet. A healthy diet can improve heart health, fortify bones, and reduce the risk of stroke, type 2 diabetes, and cancer.

- Maintain a healthy weight. People age 45-64 who eat better, maintain a healthy weight, and exercise a few hours a week can reduce the risk of cardiovascular disease by 35%.

- Stay socially connected. Studies show that having a low level of social interaction is just as unhealthy as smoking and can be even unhealthier than lack of exercise or obesity.

- Maintaining healthy lifestyle habits. Again, most of us know the right things to do, such as avoiding smoking, managing stress, and minimizing drinking. It's never too late to gain health benefits from quitting smoking. The benefits are almost immediate, and quitting at age 65 adds two to four years on your life. People who drink two or more drinks per day have a 62% higher chance of having a stroke.

As David Tyrie, head of Retirement & Personal Wealth Solutions for Bank of America Merrill Lynch points out, "Investing in health can be just as important to retirement happiness--and even to financial security--as investing in an investment portfolio. This research clearly shows that there is a crucial--and often times overlooked--relationship between health and wealth planning."

Of course, that's just part of the health in retirement solution; gaining an understanding of your potential retirement health care expenses is the other important step. To explore additional ideas and information around your health care expense retirement planning, you can download the full study report.

I look forward to hearing your suggestions and comments. I wish you great success on your quest for greater health in retirement. And if the subject of retirement interests you and you'd like to watch a playful and futuristic keynote speech on "The Transformation of Retirement," click here.

Earlier on Huff/Post50: