Keeping tax cuts for the wealthy could cost the U.S. big time.

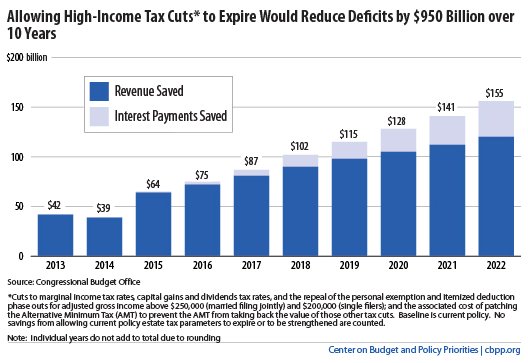

Letting the Bush-era tax cuts of 2001 and 2003 expire on schedule at the end of 2012 would bring the government nearly $1 trillion in revenue over the next 10 years, according to a new report from the Congressional Budget Office. That’s $823 billion in added revenue and $127 billion in interest to be exact, for a total $950 billion in ten-year deficit reduction.

The House voted in favor of extending the cuts earlier this month, but Obama has vowed to veto the measure, and lawmakers are likely to address the dispute after the elections. For his part, President Obama has said he supports extending the cuts for the middle class, or those making less than $250,000, while returning to the rates seen under President Clinton for anyone making more.

And it's not just lawmakers arguing over the cuts, a variety of organizations have sparred over their efficacy as well. On the one hand, the tax cuts are the single greatest contributor to public debt, according to the non-partisan Center for Budget and Policy Priorities. On the other, some argue that letting the cuts expire may hurt small businesses, as well as provide an incentive for the wealthiest Americans to focus on forms of income that are less taxable.