This post has been corrected.

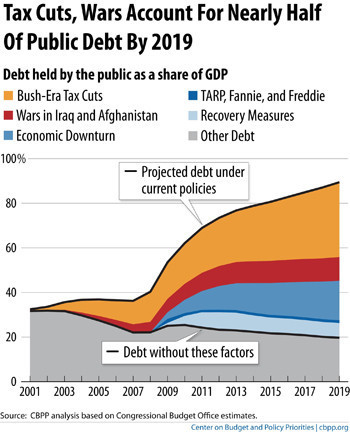

If the Bush-era tax cuts are renewed next year, that policy will by 2019 be the single largest contributor to the nation's public debt -- "the sum of annual budget deficits, minus annual surpluses" -- according to new analysis from the non-partisan Center for Budget and Policy Priorities.

These tax breaks, combined with the cost of fighting wars in Iraq and Afghanistan, will account for nearly half the public debt in 2019, measured as a percentage of economic output, the CBPP's analysis shows. Even the cost of the economic downturn, combined with the cost of the legislation passed to stem the damage, won't be as burdensome as the weight of the Bush-era tax cuts, the chart below suggests. See if you can find the debt associated with the Trouble Asset Relief Program and the rescue of Fannie and Freddie:

Tax cuts for the highest earners were renewed late last year, as part of a deal that extended tax breaks for middle earners and reauthorized unemployment insurance. In an April speech, President Barack Obama laid out a plan to reduce the nation's deficit and debt, suggesting that he would strive to make sure the tax cuts for the highest earners expire naturally in 2012.

If tax cuts do expire as scheduled, that would win significant debt relief for the government, CBPP says:

[S]imply letting the Bush tax cuts expire on schedule (or paying for any portions that policymakers decide to extend) would stabilize the debt-to-GDP ratio for the next decade. While we'd have to do much more to keep the debt stable over the longer run, that would be a huge accomplishment.

Correction: An earlier version of this post incorrectly stated in one instance that the tax cut portion of the chart refers to tax cuts for the top earners. In fact, the Bush-era tax cuts apply to a broader range of income levels.