There's more bad financial news for Vancouver-based Northern Dynasty Minerals, the last remaining company in the now-depleted Pebble Partnership - the company behind the reckless scheme to build a massive open pit mine in the heart of the world's greatest wild salmon fishery, the Bristol Bay fishery of southwest Alaska.

According to Northern Dynasty's own Consolidated Financial Statements filed last month (as well as Deloitte LLP's audit and the company's Management's Discussion and Analysis for the year ending December 31, 2015), there is now "material uncertainty that casts substantial doubt about the company's ability to continue as a going concern."

This conclusion follows inexorably from debt and deficit numbers like the following:

- The company incurred a net loss of $33,829,000 (all amounts in Canadian dollars) during the year ended December 31, 2015.

- It incurred a net loss of $31,347,000 during the year ended December 31, 2014.

- As of December 31, 2015, it had a deficit of $379,124,000.

- According to the company and its own auditors, its deficit of more than $379 million and its recent significant net losses indicates "the existence of material uncertainties that raise substantial doubt about the company's ability to continue as a going concern."

- As of December 31, 2015, the company and all its subsidiaries have only $7.5 million in cash and cash equivalents to pay for its operating requirements. Northern Dynasty admits that "Additional financing will be required in order to progress any material expenditures at the Pebble Project."

- If it is unable to secure financing to "generate sufficient cash flow to meet obligations as they come due," Northern Dynasty may "consider reducing or curtailing its operations."

And if you're wondering where the company's money is going, just ask the lawyers:

Since 2013, Northern Dynasty's legal costs have increased more than sixty-fold from $275,000 in 2013 to $17 million in 2015. In fact, in 2015 the company's legal costs of $17 million comprised approximately half of its net losses for the year. For these exploding legal costs the company has only itself to blame since again, according to the company, they are the direct result of three lawsuits filed by Northern Dynasty against EPA.

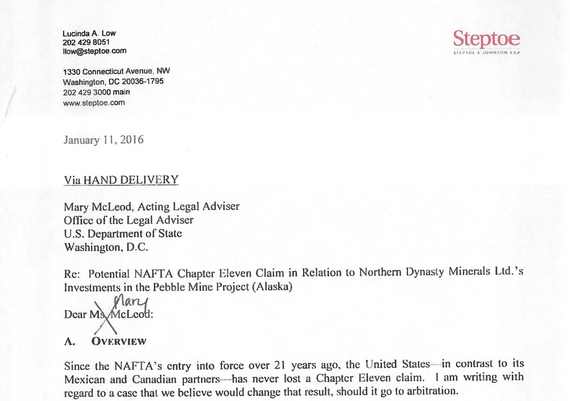

In the coming year, look for these kinds of expenses to multiply as the company pursues other frivolous legal claims, including apparently for financial reimbursement from U.S. taxpayers. In January, the company contacted the U.S. State Department threatening a claim for damages under the North American Free Trade Agreement ("NAFTA") Chapter 11, alleging that EPA's "decision" on the Pebble Mine "was taken in a grossly abusive, arbitrary and deliberately opaque manner, in breach of standards of due process and good administrative procedure, in violation of U.S. law, and in breach of Northern Dynasty's legitimate expectation . . . ."

In other words, Northern Dynasty has now notified the State Department that it is considering a request for arbitration under NAFTA based on the same old claims that is has unsuccessfully pursued in U.S. courts - asking this time not for injunctive relief but for a financial bail-out! Stay tuned . . . .

While the Pebble Mine scheme may appear all but dead, Northern Dynasty's outside lawyers are alive, kicking, and doing very well indeed. As long as there is money to fund their pursuit of frivolous claims, look for this to continue - notwithstanding "substantial doubt" about the company's "ability to continue as a going concern."

It's time to stop the Pebble Mine. Take action now.