Cash is the life blood of a business. With too little of it, a business just can't survive. In the past few weeks, more and more business owners have inquired about various business cash concepts that I would like to discuss:.

Understanding working capital and short-term financing

Entrepreneurs and business owners in general should understand working capital and short term financing. In this brief article, I will try to show you some tools to help business owners understand how efficiently they are using short term financing. I think understanding working capital and short-term financing is especially important for small operations and entrepreneurs because they typically do not have a lot of cash to spare, thus managing what they do have very efficiently is essential. Short-term cash management and short-term financing are just a few important things to look at, but they are by no means effective completely by themselves.

Working capital

Working capital is a very simple measure of current assets and liabilities. Both current assets and current liabilities are short term in nature. By taking the difference of these two metrics, we are able to see if there are more current assets than there are current liabilities. Current liabilities must be paid within a year and current assets are the assets that can be converted into cash within a year. Working capital is one measure of the company's short-term financial strength. You want positive working capital. If you have less current assets, that can be turned into cash, than current liabilities, there is a higher chance that you will not be able to pay off your current liabilities with your current assets. You might need to find other ways to pay down the short term liabilities (like getting more financing or selling equipment) to pay down the liabilities. Ultimately, if you are unable to pay your creditors, you could go bankrupt. This is one simple way of measuring your short-term financial strength but it isn't perfect. Sometimes negative working capital can be an indication of establishing excellent relationships with vendors that may give you 60 days or more to pay bills. Sometime too much working capital can be an indicator of slow collections or too much unutilized cash.

Working capital = Current Assets - Current Liabilities

Cash conversion cycle (CCC)

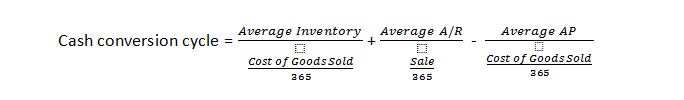

The cash conversion cycle tells you how long it takes from the time cash is used to buy or make products to the time money is collected. It is critical to strong short-term cash management. You should care about this ratio because it is one measure of how efficiently you are managing your cash. If cash is tied up in transit, you cannot use it to grow your company or pay your bills. Some companies even have a negative cash conversion cycle. This happens when the company receives cash from customers before it has to pay the vendors they buy from. This is not unusual and there are many companies that have such an advantage. The cash conversion cycle can get a little complicated. You can lower your inventory to decrease the cash conversion cycle, but you do that at the risk of running out of product. You could also change your policies for accounts receivable by giving less time for customers to pay. The problem changing your accounts receivable policies is that you could lose your customers. As you can see, there is a delicate balance. There are other ways you can decrease the cycle, like offering discounts (under the right conditions). Discounts are incentives for customers to pay earlier and receive a discount for the early payment. Below is the formula for calculating the cash conversion cycle.

Operating cycle

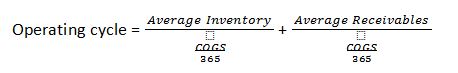

The operating cycle is the time it takes from acquiring inventory to the time it takes to get cash from selling the inventory. This is another number that should typically be low when you are managing working capital.

There are several ways capital can be financed. Some of the common ways it is financed is through:

- Payables and accruals

- Bank loans, notes, commercial

- Long term debt and equity

There is often a combination of methods used to finance a business. If you are unfamiliar with the forms of financing and the risks and advantages that each has, talk to a professional to find the best structure for you.

Float

Float is the delay in time for a payment to get processed. It is important to know what kind of float you are dealing with. Just because you have the money in your business does not mean you are able to use the cash right away. You probably have to take the money out of the envelopes and take it to the bank and have the bank process it into your account. So, even if you have efficiencies in the way your money cycles out of your hand and back, the time it takes to actually process it will eat into your ability to use the money. This can add up over time.

Remember this

These are a few things to think about when you are trying to increase the efficiency of your short term cash management. We have given you some initial tools to think about when managing your cash. Every business has different business needs when it comes to short-term cash management and short-term financing. Talk to a professional f you are unsure what is the best way to effectively handle your cash management.