Big Move in China's Yuan Today!

Global markets woke excited today after China's central bank surprised the world by "forcing" a 1.9% weakening of its currency. Most currencies in the world move in a relatively free fashion, i.e. without significant intervention by a country's central bank. A 2% one-day move for these "free floating" types is rather large, but still something that we witness several times a year. For China, a 2% move in one day is a much bigger deal - it's the largest daily move in over a decade. China's central bank "decides" what value its currency will take, whereas for most countries, the market supply versus demand for the currency dictates the value. It's widely known that China's economy and asset markets are under stress, and it's good for all economies if China's policy makers take more serious action. Today's move is likely the start of a whole new trend; China needs to depreciate its currency in the ballpark of 15% to keep up with the Joneses.

As is widely known, China's economy has been sputtering for the last four years. While any major country like the U.S. or Japan would give an arm or a leg to have economic growth rates north of 5%, for China, a slowdown to "just" 5-6% is cause for both domestic and foreign alarm. To stay in control, the Communist party leaders need to keep their citizens relatively happy - keep people employed, increase wages through time, make sure there's enough pork and rice, and recently, try to keep a lid on pollution. The 2008 crisis hit China just like every other country in the world. The government was able to keep the nasty repercussions at bay for awhile by spending tons of money building the infamous roads to nowhere, speed trains to everywhere, and constructing massive cities that are still empty.

Now Chinese leaders are facing a dilemma - the country is still slowing, and they have just a few big levers they can push to get the economic engines to turn over. The country can't export its way into prosperity when most of its trading partners are stumbling along (like Europe and Japan). They don't want to free up the property market again, as they are worried about creating and/or bursting real estate bubbles. Government plans to get consumers more active are slow and long-term in nature... it takes a lot of time to create a social safety net including healthcare and unemployment benefits, and then convince citizens to stop saving so much and start spending. Much of the business community is dominated by inefficient state-owned enterprises, which aren't known for innovation or technology. The government coffers are not empty, but since the country is now awash with unused infrastructure, this kind of spending would be like throwing money away.

A typical free-market recipe for a country in such a dilemma would be to let markets have their way and let prices adjust: suffer short term pain for the long term gain. In the rest of the world, in the aftermath of 2008, currencies and wages have acted like big adjustment mechanisms. Unemployment spiked, wages fell, and then slowly the labor markets have been healing. Likewise, countries that had borrowed too much, and imported way more than they exported, saw their currencies depreciate significantly until those imbalances were rectified. Because China is a controlled economy, its leaders have avoided weaker currencies and wages out of fear of political instability. As a result, the Chinese yuan has actually gotten stronger against the dollar, and very much stronger against the currencies of its main trading partners (Japan, Europe, and South Korea). China's goods have become more uncompetitive and its export markets are suffering significantly.

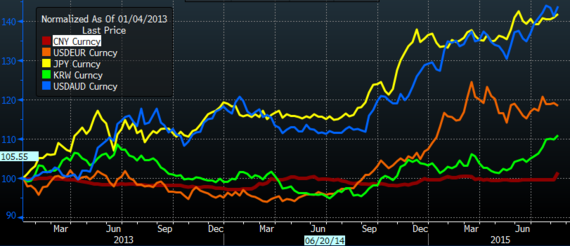

The chart shows the degree to which the Chinese yuan has stayed strong, in the face of a huge weakening in the currencies of all of its largest trading partners. All currencies are measured relative to the US Dollar, and I've normalized them to the beginning of 2013 so we can see their relative strength or weakness. The chart shows how the Japanese yen and the Australian dollar have moved 40% weaker through time, while the euro is almost 20% weaker (higher shows relative weakness). Itself a semi-managed currency, the Korean won has depreciated by a relative 10%. The red flat line is China's currency; the currency has remained relatively unchanged, and today's 1.9% blip upwards is a drop in the bucket. To make a serious difference on the economy, the central bank will have to allow the currency to depreciate steadily for the coming months. They will move very slow, as they don't want to create a panic and incite investors to race for the exits.

Of course this change in trend will get currency and rates traders quite excited in the near term, especially those who dabble in Asian markets. In the medium term some countries will be the losers: those who export to China will find their goods less competitive. Germany, Asian countries and commodity producers have already been selling less to China because of its economic slowdown; now they could sell less because their exported goods look more expensive as the Chinese yuan goes down. However, in the long run the rest of the world should want China to avoid a significant economic slowdown, as the country is one of the largest drivers of global economic growth. Our economic and financial fates are intertwined. We should also be happy to see some policy reaction that moves prices in the direction a free market would have dictated long ago.

For my personal blog site, click here.

Twitter: @SaraZervos