Can you see a stock market crash coming? It turns out it's a lot easier to see one either in hindsight or from a distance than when you're inside a stock market bubble. American investors found that out in 1987 and again in the market crash of 2008-2009. Other global investors have always known that a huge U.S. market decline would impact their stock markets negatively.

But China has been living in its own bubble. And now that stock market bubble has popped decisively, causing huge losses for the Chinese investors (it is almost impossible for foreigners to participate) who used margin accounts to leverage their speculation. In the past year the Chinese stock market had created $6.5 trillion in new wealth!

The Chinese Crack-Up

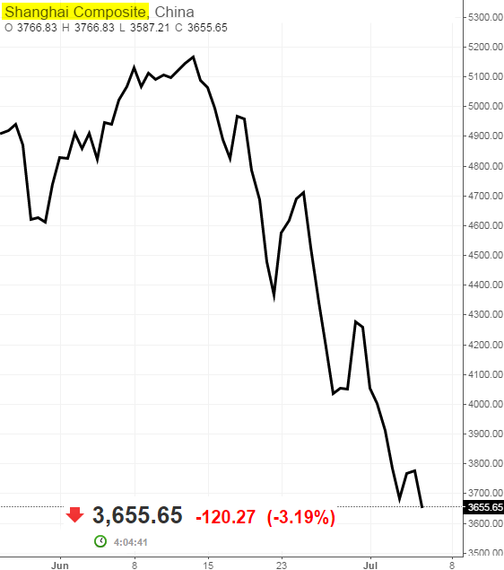

But that was before a dramatic crash that has taken place over the past five weeks. During that period, the Shanghai Composite index has lost 24 percent of its value. And the Chinese "small-cap" index, the Shenzen Composite, has lost more than 30 percent.

(By way of comparison, during the first week of the American stock market crash in 2008, the Dow Jones Industrial average fell 1,875 points, and lost 18 percent of its value. And by the time the market reached its ultimate bottom in March 2009, the Dow Jones Industrial Average was below 6,500 and had lost 54 percent of its value -- about the same as the 1987 market crash.)

But this was the first stock market experience for many newly affluent Chinese. The past year has seen money move from investments in real estate into the stock market, aided by Chinese central bank liquidity creation. The government wanted to keep its economy growing, even as the global economic slowdown hit demand for its exports.

Much of that money moved into the stock market instead of business (sound familiar?). Earlier this year, the CSI index of China's largest companies was trading around 3,500 before soaring to nearly 5,500 in June. The sudden collapse since June 12 took the CSI down to below 4,000, a 24 percent decline.

The index has a 14 percent gain for the year, but the decline has inflicted huge damage on investors -- the vast majority -- who got in near the top, wiping out an estimated $2 trillion worth of market value. And volatility -- daily swings of as much as 5 percent --has added to the financial shock.

The Fed vs. the Chinese Central Bank

You may remember that the Federal Reserve took swift action in 2008, not so much to rescue the stock market but to rescue the financial and banking system. The Fed stepped in and bought mortgages and all kinds of securities to pump liquidity into the market and "save" not only our economy but the globally interconnected network of loans between large banks.

But what the Fed did in 2008 and 2009 pales in comparison to what the Chinese central bank is doing now. In addition to cutting interest rates to record lows, the Chinese central bank has moved directly into the marketplace to buy shares and prop up stock prices, directly and through cash advances estimated at $19 billion to the nation's largest brokerage firms.

It is a panicked response to a stock market decline that, while frightening, shouldn't really have much of an impact on the Chinese economy, since the stock market represents less than 15 percent of household net worth there.

Why would the Chinese central bank act so precipitously? Perhaps it is inexperienced with free financial markets. Perhaps it has realized that the newly liberated Chinese economy -- and its markets -- can no longer be controlled by central planners, as it was for the past 65 years. And certainly, it reflects a lack of basic faith that, while free markets may go to short-term extremes, eventually they will reach a rational price point -- absent outside intervention.

If China is going to play a leading role in the global marketplace, that is a lesson it will have to learn. After all, think back: What centrally planned economy ever succeeded in ruling the world? Not the Soviet Union, for sure. You can have all the natural resources and geographical advantages -- but you can't have economic strength without free markets. And that's The Savage Truth.