If something looks like a duck, walks like a duck and quacks like a duck, it is usually a duck -- except in China. In China, you can have 30 billion square feet of unused office and residential capacity -- the equivalent of 23 square feet for each of China's 1.3 billion people -- and the "China can do no wrong" crowd will call it evidence of a permanent long-term boom. In most countries, that kind of excess would be called evidence of an imminent collapse. Not in China.

Western pundits are divided about whether such statistics foretell continuation of China's perma-boom or imminent collapse, but China is a country where market forces have less impact than the will of the Chinese government, so the boom should remain sustainable as long as the government says it will -- or ensures that it is. In a country that needs to grow 9 percent per annum just to keep up with the ranks of new entrants into the job market, and that had an average growth rate of 10 percent over the past decade, a long-term boom prediction may just be right, even though official statistics may be suspect.

If we have learned anything about China since it adopted "socialism with Chinese characteristics" in 1993, it is that the country has defied all conventional logic and reasonable predictions about how it would grow and come to impact the global economy. One benefit of being an authoritarian government is that it doesn't have to care what its people, or the rest of the world, think. Thus far, the government has done a stellar job of keeping the juggernaut that is the Chinese economy humming.

It has naturally made mistakes along the way -- just as every other government has -- but at the beginning of the current economic crisis, the Chinese government acted like the bastion of fiscal conservatism when compared with the U.S. Federal Reserve. Although the Chinese government can certainly be criticized for its heavy hand, it can also be argued that the heavy hand is what has enabled China to weather the crisis relatively unscathed, and to continue to do so. The world has become dependent upon China to drive the global economy, so we should all wish the government well in its task.

So is the duck on which Chinese economy is built on sustainable fundamentals or is it a pile of quicksand? There is much conventional evidence that the foundation of China's fantastic growth is unsustainable, but that has been the case for years, and it continues to grow and grow. For example, bank lending nearly doubled between 2009 and 2008, the sale of residences rose by 44 percent in 2009 and two-thirds of the country's gross domestic product consists of fixed-asset investment; this is clearly unsustainable. But these statistics mask some hidden strengths, such as that most homes are paid for in cash, urban disposable income has risen an average of 7 percent per year since 2000, and real output per worker rises between 10 and 12 percent per year. It could therefore be argued that there are checks and balances in place that enable China's economy to maintain equilibrium.

Minxin Pei, a senior associate at the Carnegie Endowment for International Peace, notes that China's banking system, which is dominated by half a dozen enormous state-owned banks, has almost unlimited access to low-cost credit, enabling it to engage in unbridled real estate speculation and giving the banks an incentive to keep the seemingly endless cycle of high growth going. Earlier this year it was reported that there are approximately 65 million empty apartments that Chinese citizens have purchased not to occupy, but to flip at some time in the future. We know how that kind of behavior ended up in the U.S. and elsewhere. But local governments depend on the tax revenue generated from such purchases, so they, too, have a vested interest in keeping the bubble growing.

Some western economists predict that the housing bubble will need to be punctured before inflation rises to such an extent that it risks causing social disharmony -- something the Chinese government is rather anxious to avoid. Although inflation was officially 4.4 percent in October and 5.0 percent last month, food and other prices are rising at a much faster level, prompting many to question whether inflation is in fact as low as the government claims it is. A variety of economists and think tanks are pointing to a hard landing for China's economy next year, but it has been in this situation before and has repeatedly confounded the critics with either a soft landing, or no landing at all.

A thought provoking article in Forbes earlier this year claims there is no bubble, and that the amount of leverage typically used to purchase real estate around the world -- which is the reason so many markets have gotten into trouble -- is simply not a major factor in China. Given that such a high proportion of homes are paid for in cash in China, most home buyers can actually afford to buy their homes. It adds that the government has imposed restrictions on the size and number of certain types of homes to erode some of the demand, and that as a result of the housing and office space glut, rental prices have dropped, taking some steam out of the equation. So the Chinese government has a handle on the real estate market as only it can.

Why the Steamroller will Continue

China's financial system should be seen as a source of strength for the Chinese economy, however imperfect it may be, because of its ability to support the financing of infrastructure and other investments needed to sustain rapid growth. That the banking sector is dominated by state-owned banks that can lend at will at low cost certainly has its advantages, and is a prime reason why China's economy may be expected to continue to grow in the 9-10 percent range for the coming decade and beyond.

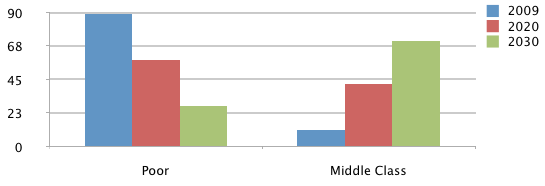

Another reason is that China's population is becoming wealthier -- and not just in the country's coastal cities. A 2010 report by the Brookings Institution says that China's middle class is poised to rise significantly not only because of the country's economic growth rate, but because more Chinese are continuing to break out of the ranks of poor. It is estimated that consumer driven domestic consumption will account for up to 50 percent of GDP by 2015, up from 33 percent last year. That is a guarantee of high growth going forward.

Projection of China's Poor and Middle Class (2009-2030)

Projection of China's Poor and Middle Class (2009-2030)

What all this boils down to is that there is every reason to believe that a combination of government economic control, a high degree of liquidity, rising incomes and consumer spending, and the government's ongoing ability to tap on the brakes whenever the economy gets too hot should mean that the housing bubble that has developed is unlikely to burst any time soon. If it does, it can be controlled more meaningfully in China than in most other countries. The doomsayers and pessimists have been wrong every time they have predicted the Chinese economy's imminent demise. They will continue to be wrong.