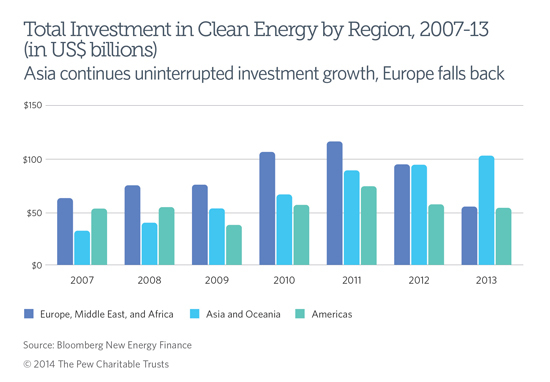

At first glance, 2013 appears to have been a poor year for clean energy investment in most countries, including the United States. Global investment fell 11 percent from 2012, to $254 billion, and additions to renewable power generating capacity declined by one percent, according to Who's Winning the Clean Energy Race? 2013, the fifth in an annual series of reports issued by the Pew Charitable Trusts. And the United States came in second to China for the second year in a row.

Appearances are deceiving, though. Clean energy remains a vigorous sector of the world economy, with enormous potential for investment and for reducing dangerous dependence on fossil fuels. But the year-to-year fluctuations and lagging U.S. performance show that America needs policies that provide certainty and allow our clean energy sector to compete in the global marketplace, if we want to keep up with growth in Asia.

Overall, the clean energy industry has matured. It is now a $250 billion component of the world economy. Despite the decline in total investment, prices for renewable technologies continue to drop, making them increasingly competitive with conventional power sources. Major clean energy stock indexes rose significantly in 2013, with public market financing up by 176 percent. And markets for clean energy technologies are prospering in fast-growing developing countries, which view distributed generation as an opportunity to avoid investments in costly transmission systems.

As always, there were winners and losers in the 2013 race for clean energy investment. Among the winners, Japan, Canada and the United Kingdom attracted increased investment, with Japan experiencing the fastest growth in the world, rising 80 percent to almost $29 billion. This moved Japan from fifth place to third among G-20 nations and reflects the priority that country has placed on renewable power since the Fukushima nuclear disaster. Most striking was a near doubling in the country's solar sector, which received $28 billion in investment, almost 30 percent of the G-20 total.

In the United States, clean energy installations collapsed with the expiration of the production tax credit. Still, a record 4.3 GW of solar was installed, and the U.S. continued to lead the world in the biofuels and energy efficient/low-carbon technology subsectors. It also remains the dominant recipient for public market, venture capital, and private equity investments. Nevertheless, it is fair to ask why China continues to lead in overall clean energy investment, attracting $54.2 billion in 2013. And the short answer is national policies.

China's government has put in place ambitious national renewable energy goals that are geared toward guiding robust investment: 200 GW of wind, 50 GW of solar, and 30 GW of biomass by 2020. In 2013, China had a nearly fourfold growth in solar power to an unprecedented 12.6 GW, and wind capacity grew by 14.1 GW. Its total capacity is a world-leading 191 GW. Few doubt China will achieve its renewable energy goals.

In contrast, the United States lacks national policies that will help provide certainty to investors, although more than 20 states and the District of Columbia have goals for renewable energy. While China added more than 30 GW of capacity last year, the United States added less than half that amount. China's five-year growth rate is 23 percent compared with 12 percent for the United States. China is also accelerating installation of ultra-high voltage transmission capabilities that facilitate integration of renewable sources.

It's clear that for any country to compete in the race for clean energy investment, ambitious energy targets will be paramount. In the United States, we need to renew our production tax credits for wind energy, implement a national renewable energy standard, strengthen our commitment to advanced biofuels, and improve the relevant financing vehicles. Only by doing so can we hope to regain the lead in a sector that is so critical to America's future development.

Pew Webinar: Who's Winning the Clean Energy Race?