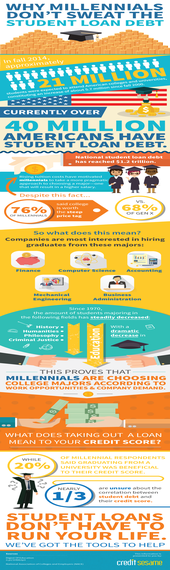

Millennials may be spending more for college and racking up record debt, but they don't mind, according to a new survey of 500 university graduates by Credit Sesame.

In summary, despite the skyrocketing cost of higher education, Millennials (individuals born between 1981 and 2004) have a more positive opinion of college than Gen X (born between 1964 and 1980). Many young people recognize the tremendous value of a four-year degree in the workforce today and, as such, are paying closer attention to what they study.

Here is a detailed breakdown of the survey results:

•Follow the Money: Just over 10 percent of Millennial parents made more than $150k a year, compared to a paltry 3 percent of Gen X parents. Over 25 percent of Millennial parents made over $110k a year, as opposed to just 4 percent of Gen X parents. Not surprisingly, at the other end of the pay scale, nearly a third of all Gen X parents made less than $32k a year, compared to 16 percent of Millennial parents.

•Pay Up: Over 25 percent of Millennials went to a university where the tuition was $25k or more, compared to only 6 percent of Gen X. By contrast, half of Gen X paid less than $10k a year at university, whereas only 27 percent of Millennials paid under $10k.

•For the Love of Learning: With tuition prices up, Millennials are taking a more pragmatic approach to choosing a major. Compared to Gen X, more than twice as many Millennials said salary was an important factor in selecting a major (33 percent vs. 14 percent).

•How Do You Really Feel About It?: When asked if college is worth the price, 76 percent of Millennials said yes, whereas only 68 percent of Gen X agreed.

Edvisors claims the class of 2015 is the most indebted class in American history, and yet, Millennials continue to defend higher education. It makes sense, given that "Americans with four-year college degrees made 98 percent more an hour on average in 2013 than people without a degree," according to an analysis of Labor Department statistics by the Economic Policy Institute.

The good news is student loans don't have to run your life. Here's how to take control of your student loan debt:

•Manage Your Loans - Actively managing your loans and reducing them whenever possible is not only a smart short-term decision, it can also benefit your financial standing in the long-term

•Seek Advice - Get personalized analysis and repayment options from companies such as Credit Sesame

•Beware of Interest Rates - If you can pay more than your required monthly payment--every time or occasionally--you can lower the amount of interest you have to pay. If you're considering paying off your loans ahead of schedule, start with the one that has the highest interest rate

•Talk To Your Lender - Having difficulty repaying your student loans? There may be an opportunity to defer your payments or even reduce the amount. Ask your lender

Though higher education was cheaper for Gen X, its value in the workforce was nothing like it is today. Many Millennials are responding to higher tuition and increased demand for employees with four-year degrees by choosing universities and majors that will yield higher-paying careers. Loans are unavoidable for many students, but it's important to remember that there are many ways to manage them and resources to help.