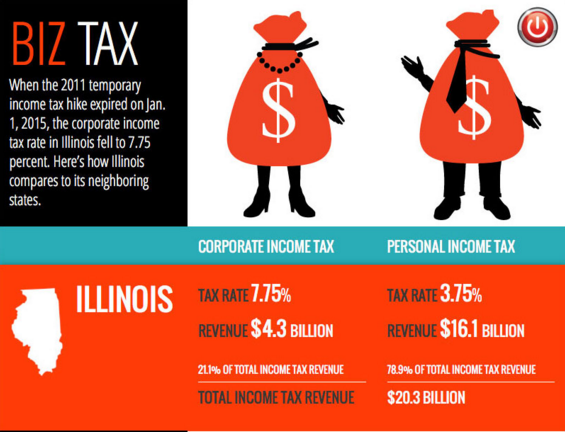

Illinois collected $4.3 billion in corporate income tax revenue in 2014, accounting for approximately 21.1 percent of the total income tax revenue generated last year.

At the time, the state's corporate income tax rate, which includes a 2 percent personal property replacement tax, was 9.5 percent -- one of the highest in the nation thanks to the 2011 temporary income tax hike.

When the temporary tax increase expired as scheduled on Jan. 1, 2015, the corporate income tax rate fell to 7.75 percent and the individual income tax rate decreased from 5 percent to 3.75 percent. While this might have been welcome relief for businesses and taxpayers, it cost the state an estimated $7 billion in income tax revenue.

From the Tax Foundation's "2016 State Business Tax Climate Index" report:

Illinois improved eight ranks overall, from 31st to 23rd, due to the sunset of corporate and individual income tax increases first imposed in 2011 as temporary levies to address the state's backlog of unpaid bills... This rate reduction translated into an improvement of eight places on the Index overall and ten places on the corporate tax component.

Take a look at our updated infographic to see how Illinois' corporate and individual income taxes compare to neighboring states, as well as the amount of income tax revenue generated in 2014 and percent share of total income tax revenue.

*Note the amount of income tax revenue is from fiscal year 2014, but the rates are current.