What is the true state of the US consumer? The Federal Reserve seems pretty confident that consumers have both the means (savings, disposable income, access to credit) and willingness (confidence) to grow aggregate spending at a relatively robust pace in 2016 and beyond. And they have lots of reasons for their optimism: unemployment is way down; incomes are starting to grow at a better pace; aggregate household net worth is way up; and consumer debt levels have come down quite a bit from the days prior to the financial crisis. But just because the conditions are in place for better consumer spending, that doesn't mean it will necessarily happen. Over the past few months, it has become clear that the willingness to spend, if not the means to spend, has been missing from the equation - at least temporarily.

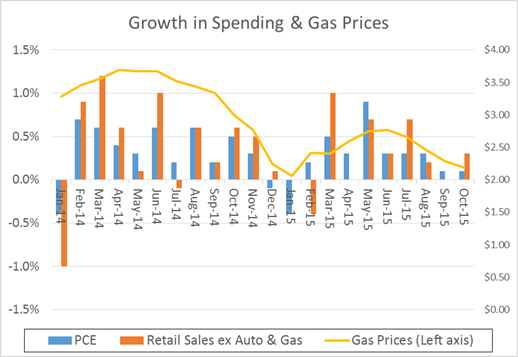

The graph below shows the month-on-month growth rates in two commonly used gauges of consumer spending - Personal Consumption Expenditures (PCE) and Retail Sales excluding Auto & Gas. We also depict the trend in gas prices with the yellow line. You can clearly see that despite a sizable drop in gas prices over the past few months, growth in consumer spending has decelerated. This flies in the face of conventional wisdom, which suggests that a windfall such as lower gas prices would lead to greater spending elsewhere.

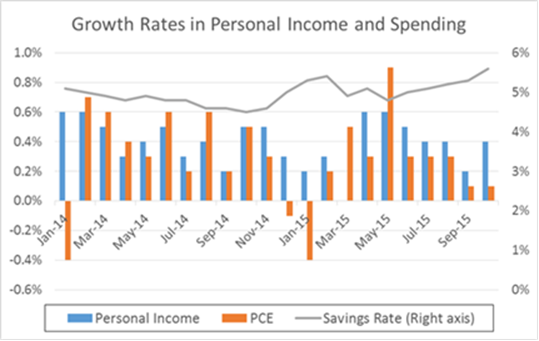

The second graph below shows growth rates in Personal Consumption Expenditures (PCE, same as above), along with growth rates in Personal Income and the monthly Savings Rate (Personal Savings as a % of Disposable Personal Income). The graph shows that for the past six months, Personal Income has been growing at a faster rate than PCE. When income grows faster than spending, the savings rate (represented by the gray line) goes up. So, it appears that consumers have not only become reluctant to spend their gas-price windfall but also their additional earnings.

As an aside, this newfound impulse to save, while bad for the economy in the short term, is actually very good for the long-term health of the economy. Why? Because the consumer had become dramatically overextended prior to the financial crisis. And while consumer debt levels have come down some on both an absolute basis and as a percentage of income, the ratio of consumer debt to personal income is still high from an historical perspective. Moreover, some of the decrease in consumer debt since the financial crisis simply represented a transfer of debt from consumers to the federal government through a sharp increase in transfer payments, a category which includes Social Security, Medicare, Medicaid, unemployment insurance, and VA benefits, among others. Eventually taxpayers will be on the hook for that debt as well as the massive increase in federal government debt resulting from fiscal stimulus, two lengthy wars, and a massive projected increase in entitlement spending as baby boomers retire. The simple fact is that despite all the talk about deleveraging, total economy-wide debt - to include all government, consumer and business debt - remains at record-high levels. And so any further "deleveraging" by the consumer (and the federal government, for that matter) should reduce the likelihood of future financial crises.

So what explains the sudden squeamishness of the US consumer? We think there are several answers, but here are my frontrunners. First and probably most importantly, the overwhelming majority of the gains in income, wealth, and spending since the end of the recession are attributable to a very small percentage of well-off Americans. Since the masses haven't seen the kinds of income and wealth gains that the well-to-do have, it makes sense they aren't able to spend as freely. Said another way, only a relatively small percentage of Americans have the means to spend more.

Secondly, and somewhat related, study after study has shown how ill-prepared the average American is for retirement. As baby boomers start to age, it makes sense that many of them are deciding to set more aside for the inevitable. And given the pig-through-the-python that baby boomers represent, we don't think this is a trivial consideration for the economy at large. As relates to this point, a large percentage of Americans don't have the willingness to spend more as well.

And finally, we think there is widespread lingering trauma from the financial crisis. If we look back to history, it took a generation or more for people to regain their appetite for risk following the Great Depression. Since the financial crisis was the biggest financial calamity since the Depression, maybe we should expect it to take longer than 10 years for people to lose their fears and begin spending freely again. Alternatively, though, we can say that the buildup to the financial crisis was characterized by a massive amount of debt that should never have been accumulated. If this buildup of debt was a once-in-a-century anomaly, maybe we shouldn't be holding our breath for the consumer to start spending in reckless fashion once again!