Facts are not in fashion right now. Argument by anecdote, by attack, by fear, by anger, and by falsehoods, all are preferable to dry facts which might, just might, fail to support the case. One example is the myth of high corporate taxes, and the corresponding call for lower corporate tax rates.

The facts are presented in a neat table from the Office of Management and Budget, in the Fiscal Year 2013 Budget Historical Tables, Table 2.1, entitled "Receipts by Source: 1934-2017."

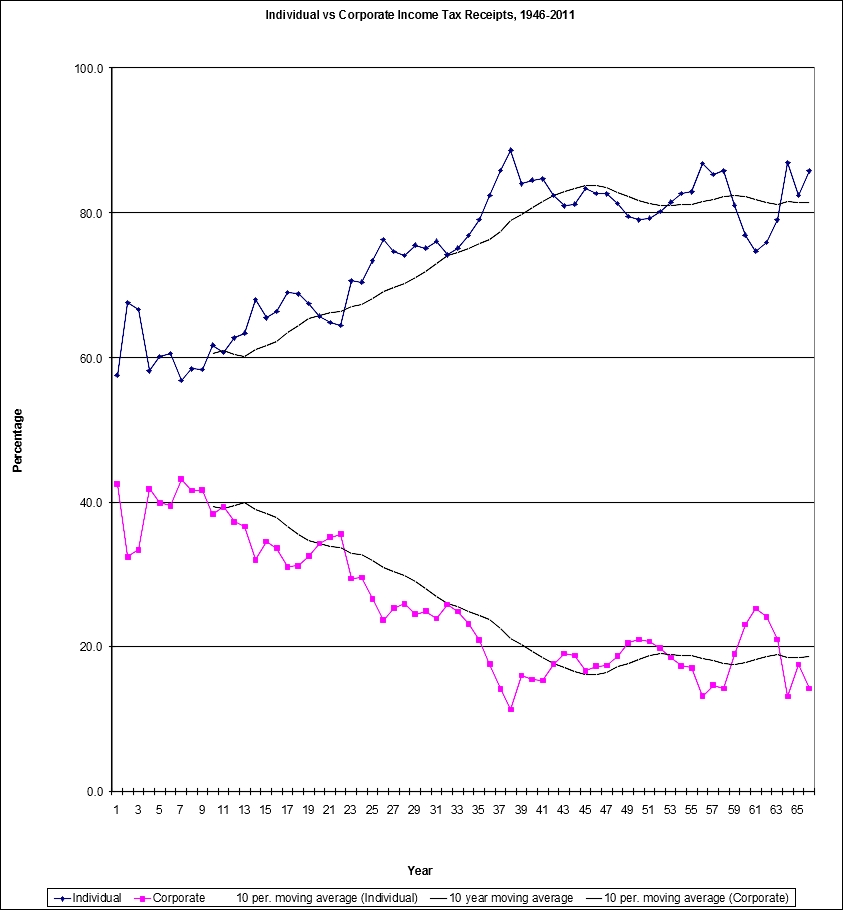

Looking at the total tax receipts from individuals and corporations, I have charted the percentages of this total for each source, from 1946-2011. Take a look at this chart. It shows that the percentage of the total from individual income taxes increased from about 60 percent in the late '40s/early '50s to over 80 percent in recent years. Correspondingly, the percentage of the total from corporate income taxes decreased from about 40 percent to under 20 percent.

Let's state it clearly: the individual income tax contributes over 80 percent and the corporate income tax under 20 percent of combined receipts from these two sources. The tax burden has shifted quite dramatically from corporations to individuals.

Could it be that the legions of corporate lobbyists succeeded in carving out thousands of tax favors over the years? Could it be that those who lobby for people are outnumbered and outinfluenced by the corporations? The numbers reflect the many tax code changes of the decades. The facts are clear. Corporations have reduced their share of the combined tax burden by 50 percent from 1946 through 2011.

Is this fair? Perhaps it is time to talk about a firm alternative minimum tax for corporations. Such an AMT would override the many special interest provisions in the tax code.

Think about it the next time someone complains about high corporate taxes...