A tremendous amount of progress has been made, particularly with regard to the increased awareness of climate change, water scarcity, human rights, and the need to protect and enhance ecosystems and biodiversity. As a generalization, we are wiser, ask more informed questions, and are adopting better policies in an effort to protect and enhance our quality of life. Part of this shift has been induced by the less predictable economic and political climates, as well as society's realization to adapt to the realities of climate change. Simultaneously, we are also working to curtail our consumption of natural resources by pursuing and introducing new innovation into our lives in the forms of more efficient or transformative, products and services.

That's all good news.

Amidst progress on technology and sustainable development, something just doesn't feel right. Call it a gut feel...a hunch...a premonition. My hypothesis is simple: For all the good that sustainability is trying to achieve, society remains at equal, if not greater, risk of significant development challenges. To be clearer, as the word sustainability takes on a more ubiquitous worldview, and as business interests, in particular, double down on their sustainable investments, it's entirely possible that "we the people" may be blindsided by a stark reality...our credit score (with earth, and each other) is rapidly deteriorating.

Are We Defaulting on Our Mortgage Contract with Earth?

For all the good that big brands and big government are trying to accomplish, the truth is, most of it is a derivation of an efficiency/growth algorithm: use resources more efficiently, but sell more stuff to make up for the difference. The net result: higher margins (if done right) and growth for business, but ultimately continued negative impact on human health and the environment.

Incremental improvements in efficiency and resource optimization will get us only so far. To achieve prosperity that is balanced with nature we need radical shifts in how we conserve natural resources, consume products and services, and reconcile our values and behaviors with ideals of success and living.

Humanity has, in effect, a mortgage contract with earth. We're playing with financial capital gained by gambling natural capital. In the process we've put not just a few livelihoods at stake, but more important, the health and vitality of the planet and all of humanity. Are we paying down on our mortgage effectively, or simply refinancing our current lifestyles and rate of consumption?

Are we setting ourselves up for a cascade of failures, much like the way collateralized debt obligations (CDOs) were manipulated and led to the mortgage industry collapse and financial sector meltdown in 2007?

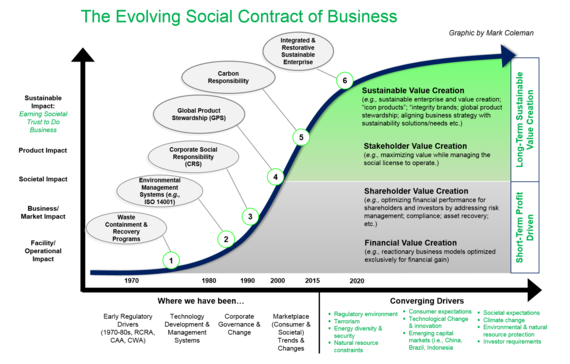

The Evolving Social Contract of Business

Today, the world's biggest companies are pursuing sustainability as a deliberate business strategy. Forty years ago, businesses needed to be told, and regulated, not to dump chemicals out the back door. Companies are now going beyond compliance and working hard on eco-economic operational improvements including integrating leaner production practices into their manufacturing operations to drive water, energy, and waste reductions. The best companies are also taking efforts a step further by innovating new products that consume fewer resources and produce less waste throughout their life cycle. This is excellent, but still represents a consumption-based model driven by efficiency gains that seek to extend resource utilization.

Most global corporations have something happening by way of sustainability. To stay relevant, respected, and reputable - they've had to. Corporate sustainability has been working toward a common language. Driven by third party financial rating agencies and organizations including the Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI), and the Carbon Disclosure Project (CDP), corporate sustainability reporting has become more consistent, transparent, and comparable.

As more global companies follow the guidelines and frameworks of SASB, GRI, and CDP than ever before, one has to ask, do these frameworks designed to foster greater transparency to investors, regulators, shareholders, and the public provide the full picture? The short answer is no, of course not. These frameworks were not intended to be all-inclusive analytical summaries of the planet's vitality.

But is this enough? As business models transition toward sustainability, one might assume that human health and the environment must be improving in-step. But according to most global indicators, we are not improving at the speed or scale necessary to shift humanity toward sustainability.

As institutional investors, in particular, put more credence into these frameworks (and perhaps strategically invest more capital into certain companies and sectors), the question on whether are we looking at the right data points takes on a different context. In short, do we run the risk of not seeing the forest through the trees? Ultimately we may have a fundamental issue with the highly subjective definition of sustainability versus how investor-defined sustainable businesses are effectively valuated and rewarded for their performance.

Efficiency Does Not Equal Sustainability

Further clouding the picture is how to ethically address the needs of the developing world. More than half the world's population lives on less than a few dollars a day. Big business views the developing world as an emerging market: untapped, uncapped, and with unlimited potential. True, developing markets present a strong opportunity for business growth. However, if future development is pursued exclusively in the image and shadow of American capitalism, the world simply will not have enough food, water, and other life-essential natural resources to go around.

For many business strategists, sustainable growth equates to greater productivity shrouded in efficiency. They understand that natural resources have limitations, at least from an economic point of view. The more efficient they are at extracting, converting, and using resources to produce consumer products, the more money they can retain as profit. And we all know that profit is redistributed equitably. So everyone wins. Right? Not exactly.

Efficiency provides a wonderful veil for sustainability. Don't get me wrong, using precious natural resources more efficiently is essential, no matter how you want to look at this issue. But, my observation and point here is that seldom do we question the use of the resource outright, at face value. Rather, we look for solutions in efficiency, stewardship, and wise use versus challenging our intellect to innovate something completely novel.

Consider the pursuit of restraint and conservation versus efficiency and productivity in economic terms. Wall Street wants financial returns. Efficiency gets you there quickly. Sustainability gets you there as well, but requires a long-view on how, when, and where value is created. Sustainability requires a new way of thinking, greater diversity and engagement of all stakeholders, and integrated approaches for allocating resources to solve complex and interrelated societal needs.

Energy is essential for economic growth and prosperity. But we shouldn't be confined to think about economic growth in terms of optimizing energy use exclusively through greater efficiency. For electricity, the kilowatt-hour never consumed (i.e., conservation) provides the most immediate returns for reducing costs and carbon.

We should also be more open to the idea that perhaps the resource is not needed in the first place. We need energy, but does it need to come from the traditional utility grid? Can it be generated and delivered from an on-site generator, or integrated with a flywheel or fuel cell to provide additional value such as enhanced reliability and back-up support? Do we really need as much soy, corn-syrup, palm-oil, or milk-derived ingredients in processed foods as there are? Are there other substitutes, or can we omit certain ingredients all-together while significantly reducing upstream impacts on the environment and improving our dietary health?

Positive progress has been made by businesses reducing carbon through more efficient use of energy and other resources. Corporate concern and attention on carbon is necessary, particularly as the impacts of climate change pose significant risk to operational resiliency. But as global dialog and directional strategies have focused on carbon, other material aspects of business sustainability (many of which indirectly impact total global carbon emissions) have not been addressed. Corporations and governments have selected carbon as the almighty "god particle" of sustainability performance. Solve the carbon thing - and all will be alright.

Corporations and governments have selected carbon as the almighty "god particle" of sustainability performance. Solve the carbon thing - and all will be alright.

Of course I'm oversimplifying and undervaluing the tremendous progress global brands such as Unilever, IKEA, Nike, Patagonia, Nestle, Interface and others have made to integrate sustainability throughout their operations. These well-recognized "sustainable brands" have spliced sustainability into the DNA of their business strategy, shaping the collective consciousness (and daily culture) of their consumers and employees.

But for all of those top tier companies that are working toward integrated solutions, transparency, and reporting - there are hundreds and thousands more businesses in the supply chain that still don't get it. If there is a god particle to manage in sustainability - it's not carbon, a material, a waste or effluent. It's our collective consciousness and intelligence that can, when creatively harnessed, alleviate bad stuff and bad things from being emitted or happening in the first place. We have that potential within us - we just haven't been able to tap it.

Sustainability is very much an issue about sovereignty and integrity. We are the stewards of our own fate. Global businesses and governments are focusing their efforts to optimize their sustainability performance toward one, albeit critical variable, carbon. But we know that sustainability landscape has a broader context than just carbon. While carbon represents the smoking gun of humanity's negligence on protecting nature, our arsenal of additional atrocities remains stocked, and we've yet to fully stand down.

To truly make progress, sustainability requires a more holistic view of the complex variables impacting the confluence of living-social-technological-and-economic systems including addressing issues such as water scarcity, poverty, income inequality, human rights, access to education, rare earth minerals, hazardous materials management, security, trade, and so on.

Cavemen Playing with Matches

Our expanding awareness and passion for everything sustainable has begun to shift the context in which we live. Electric cars, smart phones, cloud computing, on-demand movies, the Internet of Things (IoT), commercial space flights - these realities were science fiction for the masses not that long ago. Today they have become commodities of a service-based hyper-connected economy.

Keep in mind that since the dot-com bubble of the late 90s there has been an onslaught of global events, data and information breaches, and corruption that have cast a long shadow of distrust and cynicism throughout society. People are agitated, desensitized, and super stressed at the same time. Society has benefited immensely from technological innovation. But it's also been battered and bullied by unsuspecting deviates that seek out and wield power from the dark-side of innovation.

It seems humans don't really understand the power of creation or truly value the responsibility of destruction. If we did, we might revisit, for example, the flawed logic of a nuclear-chemical-biologic warfare. Seldom do we hit pause and think about impacts beyond the invention when it comes to creation. Give society a new toy, and society will find a unique way to play with it. But, we cannot leave well-enough alone, so we will, with a little ingenuity and time, discover a dozen more unpredicted ways to use the toy, most of which will create risks and yield impacts undesirable to human health and the environment. We're like cavemen playing with matches, caught up in thinking we've discovered fire, but unprepared for when we get burned.

We're like cavemen playing with matches, caught up in thinking we've discovered fire, but unprepared for when we get burned.

The proliferation and convergence of modern technologies puts us on the verge of a perfect storm. Technology is taking a back seat to political and market-based ideologies which are moving fast. Look at data breaches and IT security issues, distributed energy and microgrids, drones, driverless cars and the internet of things (IoT). An ideology rooted in efficiency, and enveloped in sustainability, is driving change, fast. But we don't yet have the necessary frameworks in-place, calibrated to address systemic ethical, legal, and security concerns. Just look at the recent Apple vs. FBI data encryption case.

Preventing the Big Short of Business Sustainability

Truth is, we're overcomplicating sustainability. We're developing complex policy, technology, and financial solutions to problems that, at their core, have a common thread: human behavior. We like to design, develop, manipulate, and control our world. But are we in control of ourselves? Our choices, decisions, values, beliefs - these are reflected in everything we see, touch, hear, smell, taste and sense. We've created a reality that we dislike so much we're constantly creating alternate realities to take us away from the truth. As we continue to distance our true self from the realities of how we care for each other and the earth, we only increase the odds of defaulting on our proverbial mortgage.

An ideology rooted in efficiency, and enveloped in sustainability, is driving change, fast. But we don't yet have the necessary frameworks in-place, calibrated to address systemic ethical, legal, and security concerns.

Financial capital can be built quickly, and fall even quicker. In contrast, natural capital takes generations to build. In most cases, natural capital does not replenish within one human life time. Economic theories and capital markets have traditionally viewed depletion of natural resources exclusively in economic terms. If natural capital is needed, markets will put a price on it, and financial capital will step in and make the purchase at market rate.

This holds together in a world where the carrying capacity of natural capital does not exceed the rate of consumption by humanity. Reality check: we don't live in that world. It's estimated that if everyone on earth consumed products and lived as American's do, it would take five earth's to fulfill that demand. Five earths! With that perspective in mind, it's no wonder NASA is spending billions to explore Mars and other galaxies.

As technology gets out ahead of our ability to articulate what sustainability is, let alone legitimately measure and report out on it, we run the risk of creating a bubble. The bubble, fixated on talking about growth, risk, and efficiency, is primarily financially motivated and measured. For this model to work, we need more dialog, greater transparency, and more truth-telling on how ecological-and-financial indicators are interrelated. Shouldn't sustainability and the pursuit of better living be an open source model for all?

Let's face it, earth does not have a back-office ready to issue humanity a credit default swap when we overdraw on our ledger. Surely if it did, our premiums would be much higher that we are currently paying. The clock is ticking. If we continue with life and business as usual humanity will face a mortgage meltdown of colossal proportions.

This isn't about predicting the future, or the current financial solvency of individuals or nations. This is about how our generation, alive here and now, rises up to accept the tough truth before us, that we are our own worst enemy. Only we can save us from ourselves. There is no miracle technology, no secret potion, and no worm-hole portal to another dimension awaiting our arrival. We're delusional destructionists living in a world of finite resources. We're beyond the hope of making incremental improvements in efficiency.

Our time is, as it's always been, right now, in the moment. There will be those that say we can never rid the world of greed, corruption, human rights issues, and poverty. There will be those that say these issues are too pervasive, unrelenting, and too complex to even try. These naysayers are the ones that profiteer from the up-and-down side of financial markets. There is great political opportunity and financial wealth to be made in chaos. Every crisis needs a hero. Think about that.

Collectively we've written a mortgage contract between humanity and earth that simply does not add up. The adoption of new technology, persuasiveness of politics, and arrogance of financial markets provide a false sense of security. History tells us we cannot bank on this kind of insurance exclusively. Before we default on our contract, it's time for us to challenge the fundamental principles of what it means to be human and humane.

We've consistently proven that we are notoriously good at destruction. So let's begin by destroying those traits propagating social, environmental, and economic injustices, and which limit us from achieving our truest and highest sense of self and collective intelligence.

Author Acknowledgements: A special thanks to some global friends including Eva Otanke in Latvia, Stylianos Voyatzis in Greece, and Rajiv Ramchandra in India who provided critical review, perspective, and insight for this piece.