For the past few years, the Republican approach to governance has been to cause a series of Breaking-Bad-like cliffhangers, with ever-more destructive consequences. It has gotten so ridiculous that even the Peter G. Peterson Foundation, one of the tireless deficit scolds encouraging Republican behavior, has finally gotten tired of it.

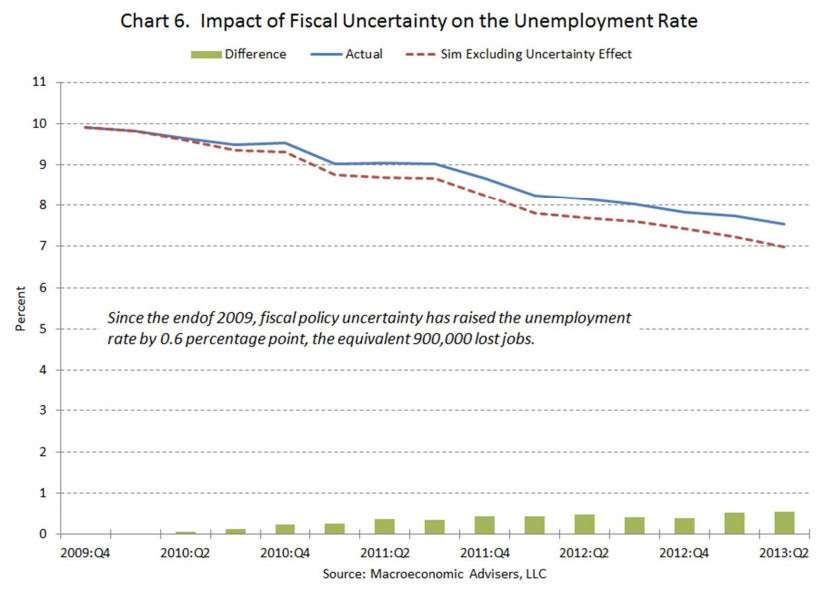

This government-by-crisis approach has cost the U.S. economy about 900,000 jobs and raised the unemployment rate by about 0.6 percent, according to a study by private forecasting firm Macroeconomic Advisers, commissioned by the Peterson Foundation, of all things. Peterson continues to wax apocalyptic about America's long-term debt, but appears to finally have gotten disgusted with Republican tactics in dealing with it. (Story continues below chart.)

"Partisan divided government has failed to address our long-term fiscal challenges sensibly, instead encouraging policy that is short-sighted, arbitrary, and driven by calendar-based crises," Joel Prakken of Macroeconomic Advisers said in a press release. "One can only hope that our policymakers will implement more sensible policy in the future."

Sure, let's hope that, but the evidence is that House Republicans don't care at all about the damage they are doing, because they seem hellbent on doing far more damage. In its new study, Macro Advisers estimates that the government shutdown has already shaved about 0.3 percent from economic growth in the fourth quarter, consistent with an recent estimate by Goldman Sachs.

A short debt default -- which could be just short days away -- could cause unemployment to spike to 8.5 percent from 7.3 percent and cost 2.5 million jobs, Macro Advisers estimates. A longer default, lasting a couple of months, would cause an even deeper recession, pushing unemployment to 8.9 percent and costing 3.1 million jobs.

And all of this damage would come on top of what has already been done to the economy by Washington's Republican-driven obsession with debt and deficits in the past few years, even as the economy stumbled out of its worst recession since the Great Depression. To be fair, that obsession has been encouraged by Pete Peterson's perpetual deficit scolding and President Obama's arguable over-indulgence.

Maybe Obama should have spent more energy arguing, as his former adviser Larry Summers does in a Financial Times column on Tuesday, that the debt fight is exactly the wrong fight to be having right now. We should be talking about what more the government can do to stimulate the economy. Instead, the Republican deficit obsession, indulged too often by Obama, has led to the sharpest cut-back in government spending since the end of the Vietnam War. It has led to the economy-bruising payroll-tax hike and the sharp spending cuts of sequestration.

All of this has weighed on economic growth -- which in turn has made government finances worse than they needed to be. Macro Advisers estimates that the austerity of recent years has cut GDP growth by 0.7 percent and cost 1.2 million jobs already.

But that's to be expected: It's no shock that economic policies that shrink spending also shrink the economy. What is maybe more striking is just how much damage has been done simply by all the agita that Republicans have created in recent years. And even if we do get a last-minute deal to avert default this week, it will probably mean we'll get to have another destructive crisis in February.