Falling PricesThe most recent statistics indicate that the general price level is declining in Britain. Even though measured rates of inflation have been quite low since the 2008 crash, negative inflation - deflation - is a rather rare phenomenon for the UK (though frequent in the euro zone for last few years). Because of its strangeness and pro-austerity ideology, it has generated considerable confusion.

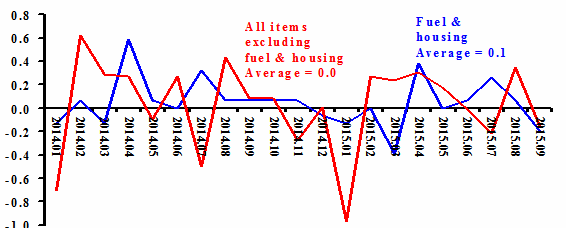

The chart below shows two measures of what has happened recently to prices, the rate of change of the fuel and housing index and the index of all times omitting the former. While the two measures do not show a common pattern they send out the same message - zero inflation measured month-on-month.

These numbers do not give a full story of what is going on with prices in the UK. Even over this short period of 21 months quality improvement occurred for many items in the household consumption basket. Because the price indices do not adjust for quality change, we should read the chart as indicating deflation, a falling price level. Were this adjustment made it is likely that the Bank of England inflation target of two percent is in practice no inflation.

Month-on-Month Percentage Changes in Consumer Prices, 2013-2014

"No Inflation": Good or Bad News? Everyone knows that lower prices mean that the "pound in your pocket" buys more "goes farther." That has to be good news, yes?

This common misconception provides an excellent example of the famous saying, "commonsense tells us the world is flat" (U.S. journalist Stuart Chase). From any place you stand the earth appears flat. Similarly, to any individual or household a lower price for a product appears to be clearly beneficial. After all, that is what falling prices means - buying the same amount for a lower price.

However, the world is not flat, and deflation is not what it seems. For at least four reasons most individuals and most households should view a falling price level with considerable alarm.

First and most obviously, in the private economy the price of any product equals the sum of intermediate cost, wage costs, rent, interest and profit. If the price goes down the sum of these components goes down. Working back through all stages of product we can in the aggregate leave out intermediate cost. Long term contractual arrangements tend to determine rent and interest.

Therefore, when prices fall either wages or profits (or both) must fall proportionately more in order to compensate for the fixed interest and rent. Falling prices mean falling income. The "pound in your pocket" may buy more when prices fall, but you have fewer pounds to spend. If profits do not fall, as seems the case during 2014-2015, falling prices mean falling wage incomes.

For most UK households the news is even worse, because the second important consequence of lower prices is an increase in the real value of debt. With lower money incomes but the same nominal debt, the burden of servicing that debt increases. Inflation devalues debts and deflation inflates them. Zealous fighting of inflation serves the interest of bankers and creditors in general.

Almost 100 years ago J. M Keynes succinctly summarized well the impact of inflation, "Deflation...involves a transference of wealth from the rest of the community to the rentier class and to all holders of titles to money; just as inflation involves the opposite" (from A Tract on Monetary Reform).

Third, a market economy gains its dynamism through the reallocation of labour and other resources across sectors, from low profitability and low productivity activities to those with higher growth and higher returns. Rising prices is the mechanism that brings the reallocation about. Stable or falling prices betray a dormant reallocation process, an economy stagnating.

Thus, we come to the fourth negative consequence of deflation. It signals a lack of aggregate demand to drive economic growth. The link between inflationary pressure and economic growth is one of the few generalizations about the economy that is beyond challenge. As the rate of economic growth increases, unemployment declines and labour shortages, especially in skilled occupations, begin to appear. These shortages generate rising wages, then rising prices.

Deflation is very bad news for the eponymous 99% and even worse for the poor -- fewer pounds in pockets, higher cost of servicing debts and a stagnant, moribund economy. Most people think the contrary, because of the real wage fallacy.

The Real Wage FallacyThe arguments for low inflation gain traction because of what appears a powerful empirical relationship. Not withstanding the four arguments above, statistics show that when prices go down real wages go up.

Whatever income a person receives, it is simple arithmetic that a decrease in consumer prices increases purchasing power. But to then assert that real wages rise because prices fall constitutes a syllogism. The assertion only has validity if money incomes and prices change independently of each other, which they do not.

During 2001-2006 when the UK economy expanded, nominal wages rose an annual rate of 3.9% and consumer inflation at 1.6%, for a real wage increase at 2.3%. Over the last two years, money wage rose at an annual rate of 1.8% and consumer inflation at 0.9%, implying an annual increase in real wages of less than 1% (ONS, Weekly Earnings).

The same process, the tempo of economic activity, determines both wage growth and inflation; they rise and fall together, and real wage growth is the difference between the two. For real incomes rise consistently when the labour market is tight and shortages appear.

Therein lies the fallacy, because while rising wages pull prices up at a slower rate, stagnant and falling prices draft wages down by more. Those that claim lower prices will raise household purchasing power are peddling pernicious nonsense.