With most of the media focused on Obama's speech about health care on Wednesday, this item got largely overlooked.

Sweeping regulatory reform of the financial sector-thought to be a 2009 legislative given just four months ago-may now come down to a piece-meal approach, with the White House and its allies happy to see a couple prized components signed into law this year.

"I think it's unraveling,' says former FDIC Chairman William Isaac. "It is hard for me to see how this legislation gets done this year."

One year removed from a catastrophic, global, economic meltdown, and 26 months removed from the start of the credit crisis, our political establishment is either unwilling or unable to reform the system and punish the perpetrators of this debacle. The situation is so far beyond the pale that it makes one wonder if another catastrophe is even avoidable.

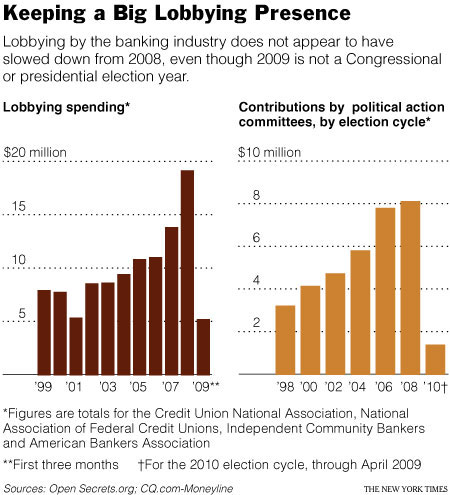

"And the banks -- hard to believe in a time when we're facing a banking crisis that many of the banks created -- are still the most powerful lobby on Capitol Hill. And they frankly own the place."

- Sen. Dick Durbin

The proposals also challenged the status quo of the financial services industry, which publicly supported the reforms in general but lobbied against many of the particulars behind closed doors.

"There's a lot of problems with this regulatory reform, so it could easily slip to next year," says one knowledgeable industry representative.

In fact the proposed changes are extremely mild in comparison to the deregulations that preceded them in the previous decades. But Wall Street simply can't wait to return to the speculative frenzy of the recent credit bubble, and now that most of the risk has been offloaded onto the American taxpayer, Good Times Are Here Again.

The all-consuming debate over health care has damped enthusiasm for tackling such complex legislation. Meanwhile, major U.S. banks have regained their footing, and some of their swagger.

Companies are selling exotic financial products similar to those that felled markets and the world economy last fall. And banks' appetite for risk has grown: The nation's top five banks collectively stood to lose more than $1 billion on an average day in the second quarter of 2009 should their trading bets go sour, a record level. Now, the federal government is locked in a kind of regulatory limbo. U.S. officials say they are committed to preventing history from repeating and have pleaded for fresh powers to do so. But today, they have few new options -- excepting another bailout -- should financial markets seize up again or a large institution totter.

"There's no fundamental change in the way the banks are run or regulated," said Peter J. Solomon, a former Lehman vice chairman who runs an eponymous investment bank in New York. "There's just fewer of them."

Perhaps the best indicator of Wall Street's revived exuberance is its continued pursuit of exotic financial engineering. The market for credit derivatives, widely blamed for helping destabilize markets, remains vast....Total return swaps -- a type of derivative that lost favor during the crisis -- are among the instruments regaining popularity, bankers and investors say....Even collateralized debt obligations, perhaps the biggest money-loser in Wall Street history, are staging a comeback of sorts.

So after trillions of bailouts and guarantees at the taxpayer expense, banks have used that taxpayer money to thwart any reform legislation, while returning to risky investment practices at an even greater level than ever. And when things blow up again, we can expect an even larger bailout than before. Or another Great Depression. Or both.

Nothing has been fixed. Nothing has been changed, because we gave money to the people that caused the problems and demanded nothing in return.

"The abatement of financial tensions has led some financial institutions to imagine they can return to the same modes of action prevalent before the crisis."

- British Prime Minister Gordon Brown, French President Nicolas Sarkozy and German Chancellor Angela Merkel, September 3

So what has Wall Street done with all that TARP bailout money? Well, they bough Ginnie Mae bonds because they are backed by taxpayers.

Wall Street also used the TARP money to give themselves huge bonuses. More than anything else, Wall Street has used the bailouts to speculate on stocks and bonds.

What the Wall Street banks haven't done is lend money to businesses so that they can hire employees.

"The pace of bank credit tightening has become draconian in scope and now stands at the recessionary levels last seen in 1991 and 2002," credit analyst Christopher Garman said in a report. "This promises a rapid increase in default rates over the next few quarters."

What the Wall Street banks haven't done is lend money to consumers so they can pay their bills.

About 65 percent of domestic banks -- up notably from about 30 percent in the April survey -- indicated that they had tightened their lending standards on credit card loans over the past three months, and about the same fraction of respondents -- up from roughly 45 percent in the April survey -- reported having tightened standards on consumer loans other than credit card loans.

Only the healthiest borrowers, the ones who need it the least, have access to credit these days. We could have let the Wall Street banks fail and have gotten into that situation at a much cheaper price.

All things considered, you have to wonder if the Green Shoots and Recovery talk has any validity if the bank's lending patterns don't reflect it. On the other hand, the Green Shoots talk has been very effective in reducing the political pressure for banking reforms.

Which brings us back to the proposed banking system reforms.

The first thing that jumps out at you is all the ways that the Federal Reserve would be entrusted in regulating and reforming the financial system. The Fed would be in charge of detecting and thwarting systemic risk.

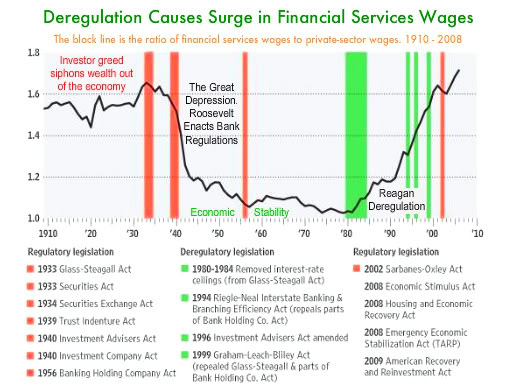

The irony could not be greater because the Federal Reserve was the leading advocate of deregulation in the financial system over the last two decades, believing that the financial markets are self-regulating.

Not only that, the Fed was caught flat-footed by the economic meltdown. They completely failed to detect the credit bubble, despite repeated warnings from outside the Federal Reserve, and then failed to understand the magnitude of the situation until the system was on the verge of collapse.

What's more, the Fed has shown no signs of a change in attitude. They continue to view their role as janitor of disasters, not a preventer of them. Their only accomplishment so far has been a massive transfer of bad debt from private hands to public hands.

"Nothing has changed except that we have larger players who are more powerful, who are more dependent on government capital and who are harder to regulate than they were to begin with. We're in a far less stable environment."

- Nomi Prins

Then there are the things mostly missing from the proposed reforms. For instance, limits on executive compensation, an idea that America is fighting on a global scale.

Then there is the half-hearted attempt are regulating the rating agencies, the people who got paid to say that subprime mortgages were "safe".

Basically, even if all these proposals were implemented, which isn't going to happen, it still wouldn't be nearly enough.

"The American regulatory structure is in total disarray and what has been proposed to fix it is partial, and even then there is heavy resistance," said Hal Scott, Nomura Professor on International Financial Systems at Harvard Law School.

"I don't see us coming out with any significant change to the structure."

"Their answer is basically a permanent TARP."

- Philip L. Swagel

What I find to be most interesting from the reform proposals, and from the political debate, is the complete absence of discussion concerning the most obvious of suggestions - rolling back the deregulations.

I think the reason this isn't being discussed is because any debate about past regulations would illuminate just how pathetic the proposed reforms are.

Regulating casino capitalism

"America's economic system is where it is today because gambling became the financial sector's principal preoccupation. The pile of chips grew so big that the Money Industry displaced real businesses that provided real goods, services and jobs."

- Harvey Rosenfield

Did you know that Bank of America, J.P. Morgan Chase, and Wells Fargo are currently in violation of federal banking law, but the government won't enforce that law?

The law in question is the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, passed by a Democratic Congress and signed by a Democratic President.

Prior to passage of this act, banks were restricted from operating widespread, multi-state branching networks. Plus, many states had their own restrictions on banks. These restrictions dated all the way back to the National Bank Act of 1864. The result was a nation full of relatively small banks. The idea was that competitive equality was good for the industry. Local banks invested their money locally, while large banks drained funds from rural areas and directed them to large cities.

The Riegle-Neal Act deregulated this limitation on the financial industry. Now banks could go national almost without restriction. The result has been a dramatic decrease in the number of small banks in the country.

However, there was one caveat built into the bill - no single bank could have more than 10% of all the deposits in the country.

The 10% limit remained in effect for a little over a decade. When the crisis struck in 2008, the Treasury and Fed encouraged the consolidation of the banking industry between the weak and the strong. The 10 percent cap became the victim of the crisis in the same way that laws against torture were also ignored.

"The goose that lays golden eggs has been considered a most valuable possession. But even more profitable is the privilege of taking the golden eggs laid by somebody else's goose. The investment bankers and their associates now enjoy that privilege. They control the people through the people's own money."

- Louis D. Brandeis, 1913

One of the primary means for Wall Street banks to bring in revenue these days is charging fees for pretty much everything. They will haul in 38 Billion dollars on overdraft fees this year, with a median APR of 4,547%. That's enough to make a loan shark blush. They will rake in another $48 Billion from credit card swipe fees.

The best example of predation by the banks is in the form of payday loans. The major banks have always been silent owners behind this loan shark filth that suck the life blood out of the poorest, but lately they have come out into the open.

A few of the nation's largest banks -- including Minneapolis-based U.S. Bancorp, Wells Fargo & Co. of San Francisco, and Fifth Third Bancorp of Cincinnati -- are now marketing payday loan-type products, with triple-digit interest rates, to their checking account customers.

Would it surprise you that as recently as 1979 this sort of usury was regulated and illegal? Would it also surprise you that it was a Democratic Congress and a Democratic President that revoked those laws?

The law in question was the Depository Institution Deregulation and Monetary Control Act of 1980. William Greider explained in his book Secrets of the Temple, "Passage of the Monetary Control Act had very little to do with how effectively the Federal Reserve could control the supply of money. It's purpose was to protect the Federal Reserve's political base."

The law did a lot of things such as requiring banks to operate under the Federal Reserve umbrella (commercial banks were leaving the Fed at the time), gave banks more opportunities to merge and consolidate, raised deposit insurance levels, and, oh yeah, allowed S&L's to speculate in commercial real estate. But it also did one other thing that seems very relevant today.

Eliminates State mortgage usury ceilings and restrictions on discount points, finance charges and other charges...

The most important part of the Glass-Steagall regulation of the New Deal was Regulation Q. This law regulated the amount of interest and fees that banks could charge for over 47 years.

The Monetary Control Act gutted Regulation Q, and all state usury laws were unilaterally suspended. The law was a political trade-off. The Federal Reserve became stronger at the banks expense, but the banks endorsed the law because they got the most prized gift of all - a free pass to prey on the most vulnerable in American society, and they got a multi-billion dollar tax cut to boot.

It seems rather ironic that the give-aways to the wealthy that Reagan and the Republicans of the 1980's were famous for started entirely with the Democrats.

"I think we will look back in 10 years' time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930's is true in 2010. I wasn't around during the 1930's or the debate over Glass-Steagall. But I was here in the early 1980's when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness."

- Senator Byron L. Dorgan, Democrat of North Dakota, 1999

"The concerns that we will have a meltdown like 1929 are dramatically overblown."

- Senator Bob Kerrey, Democrat of Nebraska, 1999

Much ink has been spilled over the demise of Glass-Steagall in 1999. In fact many of the ills that plague the financial world today go back further and are not being discussed today. Reviving Regulation Q would be the most moral and Christian act we could do today, but it is not being discussed. Rolling back the Riegle-Neal Act would permanently fix the problem of banks being "Too Big To Fail", and thus saving the taxpayer of ever having to do another disastrous bailout of these crooks.

In the meantime, even before any reforms are voted on, it would be nice if the government would simply enforce the laws already in place, such as the 10 percent cap rule.