Billions in "Corporate Operation" expenses are being dumped annually into the state utilities to make "Local Service" look unprofitable.

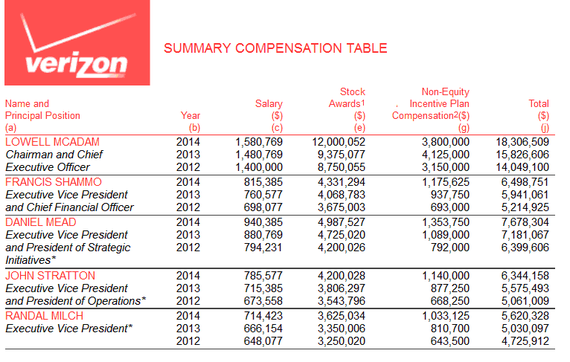

It would appear that Verizon New York's basic local phone service customers could be paying part, if not most of Verizon's executive salaries and expenses -- over $44 million in just 2014.

This is not counting the $141,000 for CEO Lowell McAdam's use of the corporate jet, which is itemized in the company's 2015 annual proxy statement. (And I love this -- "The incremental aircraft cost per hour is derived by adding the annual aircraft maintenance costs, fuel costs, aircraft trip expenses and crew trip expenses, and then dividing by the total annual flight hours.")

"Corporate Operations" expense is a garbage-pail line item that includes everything from "executive and planning" expenses to PR, lobbying and lawyers, and even 'labor relations' or 'affirmative action programs'. (See the FCC rules below for the actual language.)

Now, I have no problem with CEOs making lots of money; I believe in competition and capitalism. But I do have a problem when the company claims it can't fulfill its basic obligations to maintain and upgrade the networks and then we find that the 'expenses' can include almost anything the company can come up with. And I have a problem when the company gets multiple rate increases for 'losses', which appear to be manipulated so that the majority of expenses are dumped into Local Service.

And how the hell did they get away with this? Verizon New York is still the state utility and the prices are supposed to be 'fair and reasonable'.

Let me back up a bit:

- Verizon claims it can't afford to upgrade the networks to fiber optics because they are uneconomical.

- Verizon claims that the copper wires used for basic local service isn't profitable and loses money.

- Verizon claims that it has to shut off the copper because it is unprofitable so that it can offer advanced services via a plan to force-migrate customers onto more expensive wireless services.

Yet, as I mentioned in a previous article, in 2014, Verizon New York's financials showed an expense item called "Corporate Operations" , which came to a whopping $2.6 billion dollars -- that's just in one state and in one year. However, the majority of this expense, 60 percent, has been dumped into the "Local Service" category. This comes to about $1.57 billion in 2014. Problem is -- "Local Service" only brought in $1.44 billion and this one line item alone made Local Service unprofitable.

(I note that Local Service (sometimes referred to as "State" or "Intrastate") is one of three main categories of revenues and expenses in the Verizon state-based financial reports and historically it covers the copper-based phone service as well as the ancillary services, like nonlisted numbers or inside wire maintenance. There is also "Nonregulated" and "Access", sometimes called "Interstate".)

Worse, local rates have been raised multiple times, 84 percent since 2006, and local phone customers have paid an additional $750.00, not to mention about $300.00 extra for each added item, like nonlisted numbers.

This dumping of the corporate operations expenses created 'losses' and those losses were used as one of the main reasons for the rate increases. In fact, when we remove the $2.6 billion of these "Corporate Operations" expenses not related to Local Service and stop the other massive cross-subsidies, Local Service is profitable. And insult to injury, the copper wires could have been properly maintained and upgraded. In fact, the price of basic phone service should have been in steep decline as almost none of these expenses have anything to do with the care of the critical infrastructure or the upgrades of the networks that should have been done, or even relate to the costs of offering the service.

Instead,

- These expenses are paying to have the Verizon lawyers take legal actions, which can include attempting to block Net Neutrality or creating legislation to get more deregulation.

- It funds thousands of groups, including non-profits, as well as spin doctors and PR campaigns to defend Verizon from critics.

- And currently the Unions are in negotiations with Verizon; phone customers are paying Verizon's expenses to defend itself and eliminate the people who helped to build and maintain the networks.

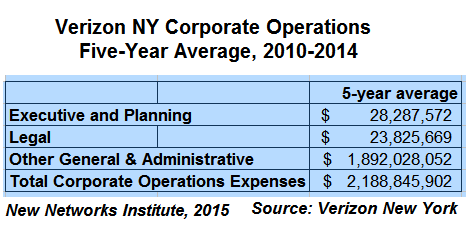

This summary is a five year-average of this expense item. In New York State, Verizon NY averaged $28 million in "Executive and Planning", $23 million in "Legal", and $1.9 billion for "Other General and Administrative" costs, with a total average of $2.2 billion annually.

And note; this is happening in every Verizon territory. The monies for this expense are divvied up between Verizon's state-based incumbent holdings as far as we can tell, which means that every state along America's the East Coast, from Massachusetts to Virginia, is charged this corporate largesse.

Where are the regulators? The NY State Public Service Commission (NYPSC) has performed no audits or investigations and has allowed all of this massive cross-subsidy to run amok. And this problem has been getting worse. Over the last five year period, 2010-2014, this expense item went up 161%.

Now, there are those who will talk about deregulation and that these are outdated rules, etc., (though they never actually examined the state-based financials we just discussed.) However, they should explain how the NYPSC agreed to multiple rate increases on basic phone service, starting in 2006, based on losses that were not audited and were created by the expense items in this category that had nothing to do with local service.

The FCC's Rules on Telecommunications

The revised Uniform System of Accounts (USOA) is a historical financial accounting system which reports the results of operational and financial events in a manner which enables both management and regulators to assess these results within a specified ac- counting period.

§ 32.6720 General and administrative.This account shall include costs incurred in the provision of general and administrative services as follows:

(a) Formulating corporate policy and in providing overall administration and management. Included are the pay, fees and expenses of boards of directors or similar policy boards and all board-designated officers of the company and their office staffs, e.g., secretaries and staff assistants.

(b) Developing and evaluating long-term courses of action for the future

operations of the company. This includes performing corporate organization and integrated long-range planning, including management studies, options and contingency plans, and economic strategic analysis.(c) Providing accounting and financial services. Accounting services include payroll and disbursements, property accounting, capital recovery, regulatory accounting (revenue requirements, separations, settlements and corollary cost accounting), non-customer billing, tax accounting, internal and external auditing, capital and operating budget analysis and control, and general accounting (accounting principles and procedures and journals, ledgers, and financial reports). Financial services include banking operations, cash management, benefit investment fund management (including actuarial services), securities management, debt trust administration, corporate financial planning and analysis, and internal cashier services.

(d) Maintaining relations with government, regulators, other companies and the general public. This includes:

(1) Reviewing existing or pending legislation (see also Account 7300, Nonoperating income and expense, for lobbying expenses);

(2) Preparing and presenting information for regulatory purposes, including tariff and service cost filings, and obtaining radio licenses and construction permits;

(3) Performing public relations and non-product-related corporate image advertising activities;

(4) Administering relations, including negotiating contracts, with telecommunications companies and other utilities, businesses, and industries. This excludes sales contracts (see also Account 6611, Product management and sales); and

(5) Administering investor relations.

(e) Performing personnel administration activities. This includes:

(1) Equal Employment Opportunity and Affirmative Action Programs;

(2) Employee data for forecasting, planning and reporting;

(3) General employment services;

(4) Occupational medical services;

(5) Job analysis and salary programs;

(6) Labor relations activities;

(7) Personnel development and staffing services, including counseling, career planning, promotion and transfer programs;

(8) Personnel policy development;

(9) Employee communications;

(10) Benefit administration;

(11) Employee activity programs;

(12) Employee safety programs; and

(13) Nontechnical training course development and presentation.

(f) Planning and maintaining application systems and databases for general

purpose computers.(g) Providing legal services: This includes conducting and coordinating litigation, providing guidance on regulatory and labor matters, preparing, reviewing and filing patents and contracts and interpreting legislation. Also included are court costs, filing fees, and the costs of outside counsel, depositions, transcripts and witnesses.

(h) Procuring material and supplies, including office supplies. This includes analyzing and evaluating suppliers' products, selecting appropriate suppliers, negotiating supply contracts, placing purchase orders, expediting and controlling orders placed for material, developing standards for material purchased and administering vendor or user claims.

(i) Making planned search or critical investigation aimed at discovery of new knowledge. It also includes translating research findings into a plan or design for a new product or process or for a significant improvement to an existing product or process, whether intended for sale or use. This excludes making routine alterations to existing products, processes, and other ongoing operations even though those alterations may represent improvements.

(j) Performing general administrative activities not directly charged to the user, and not provided in paragraphs (a) through (i) of this section. This includes providing general reference libraries, food services (e.g., cafeterias, lunch rooms and vending facilities), archives, general security investigation services, operating official private branch exchanges in the conduct of the business, and telecommunications and mail services. Also included are payments in settlement of accident and damage claims, insurance premiums for protection against losses and damages, direct benefit payments to or on behalf of retired and separated employees, accident and sickness disability payments, supplemental payments to employees while in governmental service, death payments, and other miscellaneous costs of a corporate nature. This account excludes the cost of office services, which are to be included in the accounts appropriate for the activities supported.