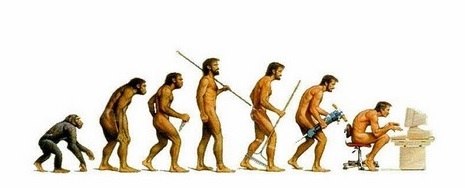

Amongst the many macro forces shaping the context for decision-making and business innovation are a few old beliefs. "Survival of the fittest" is one of them. It's a term you'll likely hear at the conclusion of a hostile takeover or mergers and acquisitions when the thrill of the hunt is complete. Oddly, "survival of the fittest" used in the business context doesn't have much to do with what Herbert Spencer in 1864 meant when he coined the term to explain Charles Darwin's principle of natural selection -- '"fitness" referred to reproductive success. Business latched onto the deal-making drama associated with predator-prey that goes with perpetually fighting to survive. The predator-prey image has metaphorical appeal to business rationale for destroying competitors, one way or another, to reduce players on the field or, optimistically, hoping to strengthen their own capabilities. The lust for the deal may well explain why the U.S. is seeing a 43% increase in hostile takeover deals over the previous year according to Thomson Reuters data.

Neither deliberate destruction nor buying your competitors brings much control to growth. In today's creative economy, when a competitor buys out another in order to reduce the competition, if they can't also attract and keep top talent, they've won the battle only to lose the war.

Rationalizing the destructive elimination of a competitor and negative social impacts on employees, clients and customers using "survival of the fittest" points to a company doomed to fail. Force and manipulation might work with products and services but when you are in the people business, where people sell products and services to clients and customers with very different values, relationships have equity. The value embedded in the relationship drives the capacity to adapt to emerging conditions. It's a completely different game.

Today's creative economy is founded on values and a higher standard of ethics for creating a better world -- one that has humanity as part of the equation. Self-interest as the sole motivation is not enough, consequently tolerance for force and manipulation is waning. Not enough people benefit. Instead, the value for customer service, for truth and transparency, for employee engagement and customer relationships outplays short-term tactical manoeuvres to destroy companies. Employees bought in hostile acquisitions know they can walk away. If the workplaces are soul-sucking employees know they have options. When companies state they value providing high quality service to the client, but can't deliver on it, transparency and congruency become critical to the company reputation. Increasingly, customers will decide with their dollar. And what about shareholders?

Steve Denning points out:

The fact that we have the highest level of M&A deals since (a) the peak of the dot-com bubble in 1999 and (b) the peak of the housing bubble in in 2007, should give us a clue as to what comes next. Studies show that most of these deals end up destroying long-term shareholder value... This M&A activity is just one of the negative consequences of having an over-sized financial sector and an endless supply of free money from the Fed.

If that weren't enough evidence, the failure rate for mergers and acquisitions runs somewhere between 70-90% according to HBR.

Losing good companies to intentional destruction or failed mergers and acquisitions depletes the chance for a country's economy to gain from the contribution of knowledge workers and to adapt to unpredictable change. Anyone adhering to the mantra "only the fittest survive" clearly hasn't noticed the rules are changing. And in case it's not obvious, a company that is operating by out-dated beliefs cannot make growth-oriented decisions.

Are the old tactics still at work? Yes, unfortunately which means there is a lag in know-how and in capacity to perceive the wider landscape and see what's ahead. As long as the bi-focals are centered on share price, the opportunity to strengthen resiliency is lost.

Today, "survival of the fittest" is better defined as those companies best adapted to the conditions of the creative economy. Adapting to emerging conditions requires an entirely different worldview, bolder yet kinder decisions, ethical standards, and genuine employee engagement not possible from a company with both feet rooted firmly in the past.

Perhaps the real driver behind the glut of takeover attempts reflects the thrill of the deal (being in "flow") and all of its physiological rewards. If so, perhaps taking up an extreme sport would pose less harm to the economy and limit negative social impacts. Until those one level above the deal-makers review hostile takeovers for efficacy, enabling more rational decisions, you have options:

- As an employee it means you have a choice. Do you stick with a soul-sucking workplace? Or chose a company more in tune with values of care for the customer, the wider social and environmental issues with higher benefit to the shareholder?

None of these questions are easy and reflect the fact that to evolve and thrive requires decisions based on care for the customer relationships and for people as a core value. It is the ultimate crucible for higher levels of leadership in business in order to restore trust in the creative economy where the only the most agile and employee-customer focused will thrive.

Dawna Jones loves to provoke the evolution and transformation of company cultures to become more 'fit', agile and innovative. Since the thinking that got us here is not the thinking that will get us out, she presents a different way of seeing and thinking about the everyday challenge of creating cultures and workplaces where employees can contribute their creative talent in unprecedented ways. She's the author of Decision Making for Dummies, a speaker and a tad nomadic.

Credit for the image here.