I usually find economist Robert Shiller's commentaries resonant and insightful, but this one seemed more confusing than enlightening. The thrust of the piece is the concern that government activities to promote innovation can just as easily stifle it.

The piece introduces the notion of corporatism, from a new book by Ed Phelps. What means "corporatism"? It's:

...a political philosophy in which economic activity is controlled by large interest groups or the government. Once corporatism takes hold in a society...people don't adequately appreciate the contributions and the travails of individuals who create and innovate. An economy with a corporatist culture can copy and even outgrow others for a while...but, in the end, it will always be left behind. Only an entrepreneurial culture can lead.

While Shiller's less worried than Phelps that this is a national problem, he's concerned about some of what the President is trying to accomplish in this space:

...President Obama has been talking a lot about innovation as a job creator this year, and while some of his intentions may be good, I'm afraid that some of his proposals look a little corporatist, and might suppress individual initiative.

I don't get it. While "entrepreneurial culture" will always be essential, many innovations that turned out to be economically important in the U.S. have government fingerprints all over them. From machine tools, to railroads, transistors, radar, lasers, computing, the internet, GPS, fracking, biotech, nanotech -- from the days of the Revolutionary War to today -- the federal government has supported innovation often well before private capital would risk the investment (read about it here).

Shiller's critical, for example, of the manufacturing innovation institutes that the White House has been both touting and setting up. He's certainly right to ask what it is these new creations do and why we need them -- I've been bugging adventuresome journalists to get out to one and tell us the story. But most manufacturers I've spoken to about them tell me they fill an important niche, essentially building a path through the Death Valley between the university lab and the factory floor. If so, that's a classic coordination failure in which markets have been known to underinvest.

Second, how do these institutes stifle innovation? By way of explanation, Shiller tells his own tale of developing and selling the innovative home price index that bears his name (and that of his collaborator, Case). But if the feds were off in another corner trying to promote some other slice of innovative work that they viewed as under-supported by the market, as they certainly were when he and Case were developing their index, he fails to explain how that hurt them or anyone else. Would the fed's efforts have distracted venture capitalists? I've not seen evidence of that; by definition, the private folks are looking elsewhere, which is usually why the feds go in.

To be clear, my argument is not at all that government efforts in this area are all successful or are somehow always free of the corruption that is too common when politics enters the fray. My points are that a) many important innovations have involved government support somewhere along the way, and b) while one could and should worry about waste in this area, I've not seen evidence, nor does Shiller provide any, of stifling.

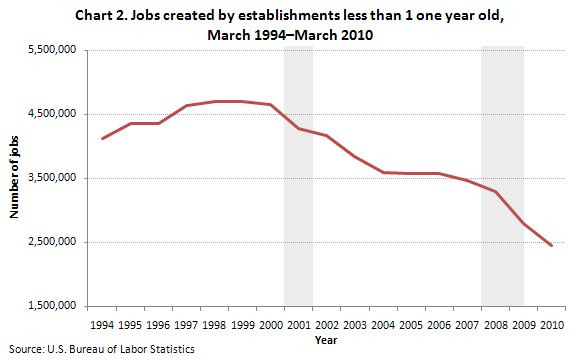

Here's a figure I often come back to in this debate. I admit that it is no more dispositive than Shiller's case, but at least it's some circumstantial evidence. It shows jobs created by very young establishments in the 1990s and 2000s. The dismal trend in the 2000s is one reason why job growth in that expansion was so lame -- solid research has shown that surviving, young firms are critical in terms of job growth. It's also reasonable to consider this trend a rough index of entrepreneurial innovation, or more precisely, its impact on job growth.

Source: BLS

I don't recall much that was going on in terms of government innovative efforts in those years and I suspect a careful look across history would not find evidence of the government stifling innovation, especially on net (i.e., also accounting for ways in which government research and support has "crowded in" private innovation). More likely, what was happening in the 2000s was the bubbly financial sector was sucking profits, ideas, talented human capital, and yes, innovation down what was ultimately an economic black hole.

So I'd suggest we be more careful in where we point the corporatist finger.

This post originally appeared at Jared Bernstein's On The Economy blog.