Reading this Politico piece about how to get the economy growing in earnest again, I was struck by how out of sync the conventional/DC story is compared to what I and other growth analysts think is going on (h/t: DS).

Here's the agenda:

... tax reform that goes way beyond individuals and rates; much deeper Social Security and Medicare changes than currently envisioned; quick movement on trade agreements, including a proposed one with Europe; an energy policy that exploits the oil and gas boom; and allowing foreign-born students with science expertise to stay here and start businesses.

Do this and there could be not an economic recovery -- but a boom, many argue.

Really? I gotta say, I don't see it. In fact, pretty much everything on that list is a) conventional wisdom in DC and b) largely a distraction from where I think the evidence is actually pointing, as I'll stress in a moment. To be clear, raising more tax revenues and slowing health care costs are critical in terms of getting our long-term debt situation under control, and immigration reform that provides a path for folks here to stay is also a great idea. A domestic energy boom is already underway and trade agreements do squat for growth (which doesn't mean they're not worth it--but their growth potential is hugely overhyped).

What's holding back growth is inattention to the need for stimulus in the near term in an economy where monetary policy is at least partially hamstrung (zero lower bound), premature fiscal contraction (premature contraculation?), too much income and wealth inequality, and, over the longer term, the lack of a deep investment agenda in public goods, including education and worker training.

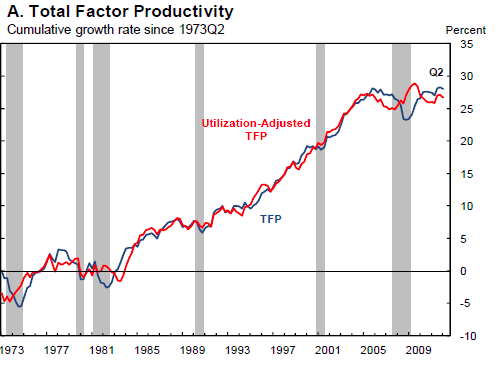

The figures here (see figs 2 and 3) reveal the decline in potential GDP--very steep in the 2000s--and the longer term weak demand problem that's characterized the last few decades, and, of course, even more so the last few years. This paper by John Fernald decomposes the growth slowdown into its various components, with an emphasis of productivity growth, which, as shown below, has been decidedly flat in recent years. (Total factor productivity, or TFP, is a more comprehensive concept that the usual unit of output per hour of work; the output part is the same, but TFP includes other relevant inputs, including capital and labor quality, so it's a much better metric for understanding growth trends; "utilization adjusted" just means adjusted for the business cycle).

Fernald identifies a slowdown in capital investment, particularly in IT, and the CBO's analysis of this problem finds that the flow "capital services" -- the pace of productivity-boosting inputs from our capital stock -- increased by 4.7%/year in the 1990s and only 2.4% in the 2000s.

And remember, tax rates on such investment were considerably lower in the latter decade than in the former. The whole "lower-taxes-on-job-creators-and-capital-wait-for-the-magic" is a big bust. It's supply-side, trickle-down wishful thinking and economies don't run on wishes.

I mentioned the need for stimulus to offset both the still-weak recovery and fiscal contraction in the near term. Not only will that help lower unemployment and boost stagnant paychecks. It can send critical demand signals to employers to gear up, which in turn gets investors' juices flowing again and brings idle investment cash in from the sidelines. There's even, I suspect, a full employment productivity multiplier wherein employers look for cost-saving productivity gains that they'd otherwise leave on the table when there's so much slack in the job market (and thus little pressure on wages/prices). Yet stimulus ideas don't even make Politico's list!

And jeez, even if private investors' animal spirits are in the dumps, with Treasury yields at historic lows and unemployment still way too high, is this not a great time to invest in productivity-enhancing public infrastructure? Have you tried to get around this country lately (at least the Northeast)? As my old WH colleague Peter Orszag put it the other day with Haiku-like precision: Treasury yields at 1.6% on one hand...Kennedy Airport on the other...doesn't make sense.

Much more to say about this in coming days. Giving a talk on it in NYC tomorrow, so I'll post those slides later as well.

Source: Fernald, 2012