As 2014 draws to a close, the economic news from the Big Island is one of a consistent upswing as reported by local experts in construction, residential and commercial real estate with a positive outlook for 2015.

"We have seen a steady uptick in business on the Big Island this year for construction with a variety of new projects coming online including large building projects, such as Kohanaiki Resort. For roofing we saw an increase business, especially for residential projects due to homeowners having additional funds to spend on photovoltaic installation," stated Ron Lloyd, owner of Kokua Roofing, a local roofing company based in West Hawaii. "Looking ahead to 2015, I believe the building trades will remain the most likely drivers of expansion of our local economy over the next several years. I am seeing some interesting projects on the books for the island," Mr. Lloyd said.

"In looking at year-end data, we saw a busy year in permits being pulled for both residential and commercial building in 2014, which subsequently points to a strong outlook for future construction on Hawaii island," said Steve Machesky, owner of KCPM Inc. dba Kokua Contracting and Project Management. "A point to note is that rising construction costs are a contributing factor to the gross permit value," Machesky concluded.

The County building permits from January to November 2014 show that 4,618 permits were pulled for a total of $619,014,832 in estimated value of construction costs on the Big Island. July was the high month with 639 permits pulled for that month alone with an estimated value of $70,684,367.

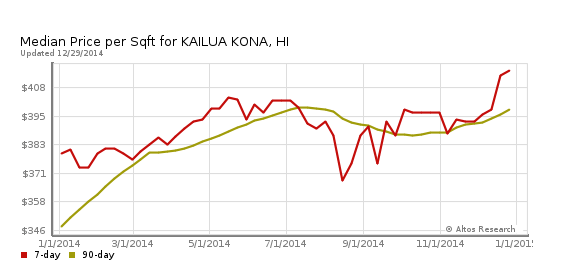

The news from residential real estate on the Big Island is encouraging. "I think median price will continue to rise, but not in the double digit figures we saw during the past two years. As the availability of lower priced inventory continues to shrink, and demand remains steady and even increases, prices will continue to rise. Until more home inventory is brought onto the market, the demand side will outweigh the supply side, and prices will continue to increase," stated Bill Babbitt, a Realtor with Century 21 All Islands Realty in Waikoloa.

The number of single-family homes sales on the Big Island in November dipped from 162 to 142, a 12 percent decrease for the month. The number of sales is about 2 percent fewer compared to 2013 year to date. Although the number of sales was down for the month, dollar volume for single-family home sales for last month is up by 24.5 percent. Year to date compared to 2013, dollar volume for single-family homes is up 2.4 percent. Sales volume for condominiums for November is down a whopping 47 percent, while down only 5 percent year to date. The median price for a single-family home on the Big Island is $317,000, up 7.5 percent over 2013 and for condominiums the median price is $286,000, up 12 percent over 2013. The median price for vacant land is $27,250, a slight decrease of 2.7 percent compared to 2013.

For West Hawaii, single family home sales lagged in November, reflecting an 18 percent decrease attributable to the slowdown in number of closed transactions due to the lack of available inventory, especially in the below $500,000 range.

The median price of a single-family home in North Kona jumped a whopping 23 percent year over year, from $447,000 to $550,000. The substantial increase in median price is largely attributable to more sales of higher priced homes in the luxury resorts, and fewer homes available below the $500,000 level.