Everyday, the world creates 2.5 quintillion bytes of data -- so much that 90 percent of the data in the world today has been created in the last two years alone.

Interesting insights can be gained by connecting all these disparate data points -- even when it comes to predicting the winner of the next U.S. election.

Data Source: An Introduction to the Intrade Prediction Market

Prediction markets are created for making predictions on a wide range of topics, from presidential elections to celebrity divorces.

The current prices of the contracts on these markets can then be interpreted as the probability of an event taking place.

For example, if the "Obama to Win the Election" contract costs 70 cents today, it means the majority of market participants think there's a 70 percent probability that Obama will win the next election in November.

At the end of the "betting" horizon, if Obama does get re-elected, the value of the contract shoots up to 1 (i.e. a 100 percent probability), meaning that the player who bought in at 70 cents makes a 30 cent profit.

In essence, people who buy low and sell high (i.e. those who make correct predictions) are rewarded for improving the overall market prediction. All predictions aggregate the wisdom of the crowds.

Intrade is one of the biggest prediction markets in the world, and it's very popular with political enthusiasts.

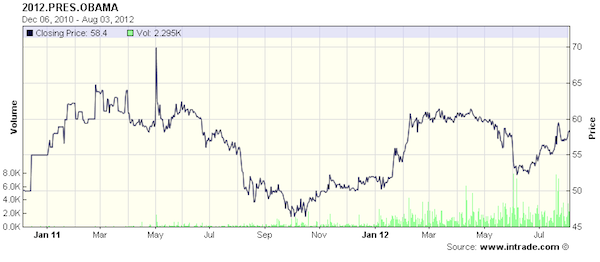

At the moment, the Obama contract costs 58.1 cents, meaning that there is a 58.1 percent probability that he gets re-elected.

Here's the trend in his contract value:

The Romney contract, on the other hand, currently costs 39.8 cents, meaning that there is a 39.8 percent probability that he gets elected.

Here's the trend in Romney's contract value:

Academic research suggests that prediction markets, like Intrade, are at least as accurate as other institutions predicting the same events with a similar pool of participants.

What this means as that prediction markets are, in theory, good proxies for the present-day reality and opinion of the masses.

With this is mind, we decided to build an equation to try and predict the future value of the Intrade contract for Obama's re-election.

Not only will the equation give us some sort of idea of his re-election chances going forward, but it may also shed some light on the factors that may contribute to his success or failure come election day.

How We Built the Equation

We plugged in historical values of the Obama Intrade contract, and trained our machine learning algorithms to predict the probability of re-election at the end of the next 20 days.

The equation we built ended up looking like this:

Obama_Win_Probability(n+20) =

+ 2.5983 * XLF_Close(n) +

+ 1.7627 * TravelSiteSearchVolume_28DayRangePlacement(n)

- 3.8048 * VIX_10SessionMaxMinDistance_vs_CurrentPrice(n)

+ 2.5786 * JobSearchVolume_28DayGradientChange_7MostRecentAvg(n)

+ 12.0102 * AAII_Bullish_4WeekMax

+ 13.9084

We're not going to go into a detailed statistical analysis here, nor are we going to describe each variable in detail. But if you're interested in the performance and construction of this model, a complete description can be accessed here.

So What Does All This Mean?

Basically, the equation says that Obama will get re-elected if the following things happen over the next few months:

Variable 1: If the financial sector stabilizes

Variable 2: If consumers start traveling more (i.e. we used travel as a proxy for consumer confidence)

Variable 3: If stock market volatility remains subdued (i.e. the VIX index)

Variable 4: If there is an increase in online job postings (a proxy for the job market)

Variable 5: ..and if investors become more bullish on the stock market (based on the weekly AAII survey)

Of course, none of these conclusions should come as a surprise. Of course an incumbent president will have a good chance of re-election if investors are bullish on the stock market, or if people are confident enough to go on vacation.

But nevertheless, it's useful to have an equation to monitor political developments.

So what do you think, which of these factors will influence the election the most?