Everyone should know by now that the Treasury Department can borrow money at historically low rates. That is a major reason why some very smart economists think that the federal government should borrow more money in the short term (i.e., this year and next) and use that money to boost economic growth.

In the medium term (say, the next decade), however, the big question is how long we will be able to finance new government borrowing at such low rates. Today's low rates are a product of several factors. One is certainly the slow rate of economic growth, in particular the depressed housing market, which has reduced demand for credit. But another factor is the Federal Reserve's aggressive moves to keep long-term interest rates down; another is foreign central banks' appetite for Treasuries.

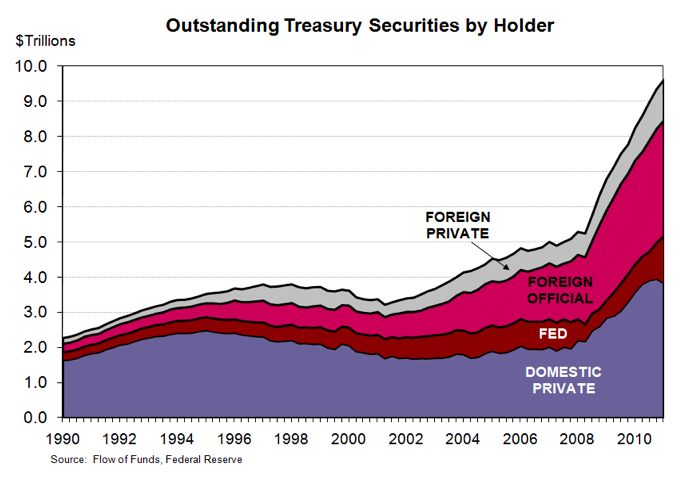

John Kitchen and Menzie Chinn have written a new paper (pre-publication version here) that attempts to disentangle these factors, which Kitchen summarized in a blog post. They show the large and growing role in the Treasury market played by the foreign official sector:

Kitchen and Chinn also measure the impact of purchases by foreign central banks on interest rates. They estimate that as those central banks increase their holdings of Treasuries by 1 percentage point of potential GDP, long-term interest rates (measured as the spread between 10-year and 3-month rates) fall by 0.33 percentage points. Since the Federal Reserve is expected to reduce its balance sheet as the economy recovers, if foreign holdings of U.S. government debt simply remain at current levels (as a share of GDP), they expect that 10-year yields would climb to 7.9 percent by 2020--rather than 5.4 percent as forecast in the CBO's baseline.

The underlying issue is that interest rates have been kept low in part by increasing foreign holdings of Treasuries; so to maintain those low rates, we need foreign central banks to continue buying more and more Treasuries, which cannot go on forever. The policy problem is that we don't want to overreact and shift to austerity prematurely (that is, while we can still borrow money cheaply), but we don't know how long foreign governments will continue increasing their Treasury portfolios.

The current privileged status of U.S. dollar debt is a recent phenomenon, which we describe in chapter 2 of White House Burning, and one that is by no means permanent. This is a major reason why we think that it is important to begin reducing structural deficits during the next decade. And that means we need to have an alternative to the scorched-earth policies of austerity (and tax cuts!) being pushed by Republicans and by a growing number of self-proclaimed centrists.

James Kwak is the co-author of White House Burning: The Founding Fathers, Our National Debt, and Why It Matters To You, available from April 3rd. This post is cross-posted from The Baseline Scenario.