Having a hard time finding a decent-paying job? Thank Wall Street.

In a New York Times column on Tuesday, Bruce Bartlett, former economic advisor to Presidents Reagan and George H.W. Bush, explores the dark side of "financialization," which is economist-speak for how the financial sector just keeps swelling to take up an ever-greater share of our economy and wealth. Finance has gone from a boon to something that smothers other economic activity and the job market, Bartlett points out, citing several new studies.

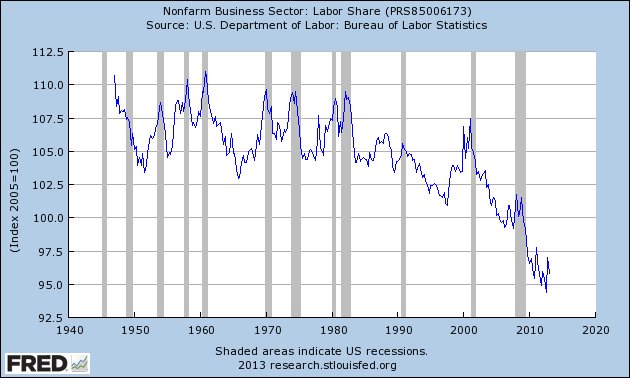

The financial sector is churning up a lot of wealth, all right, but the bulk of it is going to those people at the very top of the income stack, many of whom are in the financial sector. The share of U.S. income going to the average worker, meanwhile, has been shrinking steadily for the past 30 years, as you can see in the chart below. (Story continues after chart of sadness.)

Wages are shrinking not only in the U.S. but around the world, according to a recent report from the International Labour Organization, a United Nations agency. The ILO puts most of the blame for workers' diminishing share of income on financialization, which the agency estimates accounts for 46 percent of the global decline.

The two other usual suspects in the shrinking-wages mystery are globalization (the Chinese/Mexicans taking our jerbs!) and technological innovation (robots taking our jerbs!). These actually account for just 19 percent and 10 percent, respectively, of the decline in labor income, the ILO estimates.

"These results open up the possibility that the impact of finance may have been underestimated in many of the previous studies," the ILO wrote, "and suggest that overlooking the role of financial markets may have serious implications for our understanding of the causes of labour share trends."

Those in finance argue that they create plenty of jobs and midwife many more by providing the financing that keeps the economy growing. And that is true.

But as Bartlett notes, there are limits to the utility of a financial sector's size. Beyond a certain level, finance exists simply to feed itself, squeezing rents out of the economy while adding nothing more of value. And then there comes the point where the financial sector is so large that it starts to suck the life out of the economy. We may be at that point.

Since 1980, wages in the financial sector have ballooned to be 70 percent higher than wages in other sectors of the economy, Bartlett notes, citing a 2009 National Bureau of Economic Research study. During those decades, companies have grown ever more focused on short-term profits, particularly with increasingly powerful private-equity and hedge funds breathing down their necks all the time, the ILO notes.

The easiest cost to cut when you're trying to squeeze out some profits is labor, particularly when business is bad. That's one reason why workers' share of national income falls most sharply during recessions. And it has been painfully slow to bounce back in this anemic economic recovery. Hence, corporate profits and the stock market are at record highs, while wages have mostly been flat since the Great Recession.

The problem with this business model is that eventually you run out of paying customers. Rising income inequality has become a drag on economic growth, the International Monetary Fund found recently. And the financial sector's dominance has played a huge role in that inequality, maybe the biggest role.