The 1970 Illinois constitution states that Illinois' state income tax must be applied with one rate paid by all taxpayers.

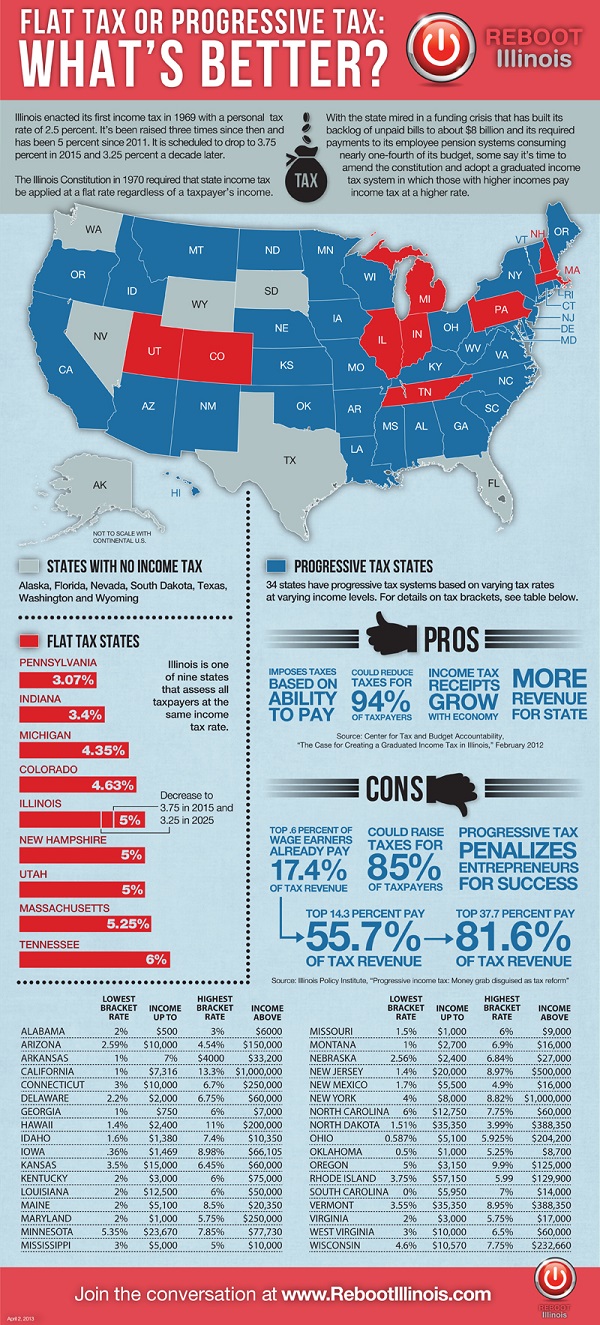

Illinois is one of nine states with flat-rate income tax. There are 34 states that use a graduated income tax system in which the percentage of income tax owed goes up with a taxpayer's income. Seven states, meanwhile, have no income tax.

In 2011, Illinois raised its income tax from 3 percent to 5 percent in order to combat both a multi-billion-dollar backlog of unpaid bills and to prop up a failing public pension system. But two years later, the backlog of unpaid bills hovers around $8 billion and despite nearly all the new tax money going into the pension system, the state now carries a $100 billion unfunded pension liability. The new tax rate brings in roughly another $7 billion a year, but most of that will disappear on Jan. 1, 2015, when the tax rate is scheduled to fall back to 3.75 percent.

Against this background, a bill has been introduced in the Illinois House to amend the state constitution to allow Illinois to consider adopting a graduated income tax. Proponents say a progressive system will bring in more money for the state while reducing tax bills for middle- and low-income taxpayers. (Here's one view in favor of a progressive tax system.)

Opponents, though, say all of this is merely a money grab by a government that has run the state into the ground through poor management. They say that ultimately a progressive system would result in the vast majority of taxpayers paying more each year -- especially when contrasted with the pre-2011 3 percent rate and even the 3.75 percent flat rate scheduled to become law in 2015. (Find a detailed explanation of this view here.)

So where does Illinois fit in the national state income tax picture? Here's a look. We've also included a table at the bottom of the chart that shows the widely varying range of tax brackets and income levels other states use to define their progressive tax systems. You'll be hearing a lot about this issue in the months to come, as supporters of a progressive system for Illinois want to see a constitutional amendment placed on the November 2014 ballot.