Most central banks do one thing well: they produce monetary mischief. Indeed, for most emerging market countries, a central bank is a recipe for disaster.

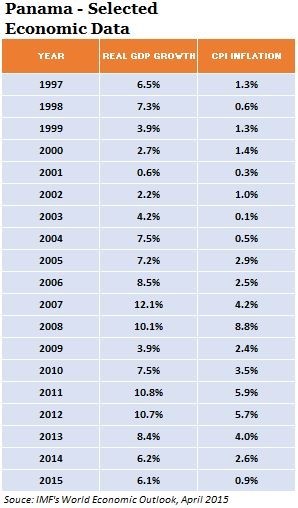

The solution: replace domestic currencies with sound foreign currencies. Panama is a prime example of this type of switch. Panama adopted the U.S. dollar as its official currency in 1904. It is one of the best performing countries in Latin America (see the accompanying table). In 2014, economic growth in Latin America and the Caribbean was a measly 0.8%. In contrast, Panama's growth rate was 6.2% in 2014. Not surprisingly, it was the only country in Latin America to have realized an increase in the number of greenfield FDI projects.

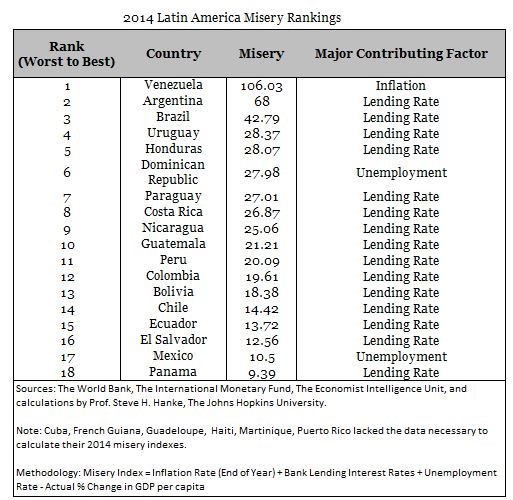

My misery index indicates just how well Panama stacks up to other Latin American countries. The misery index is a simple sum of inflation, bank lending rates and unemployment, minus year-over-year per capita GDP growth. The table below shows the misery index readings for the Latin American countries in which data were available in 2014.

Thanks to their central banks, Venezuela and Argentina top the list as the most miserable countries in the region. Panama, El Salvador, and Ecuador score very well on the misery index. All three are dollarized.