When I started working in emerging markets - or "least developed countries" as they were less politely known in 1990 - aid and investment were regarded as two starkly separate approaches to supporting development. Developing countries in Asia, Africa and Latin America attracted some investment capital, but most of the money flowing to them was in the form of aid-- grants. That has changed dramatically in recent years as cross-border investment by business has expanded dramatically and is becoming an ever more powerful force for good in the developing world.

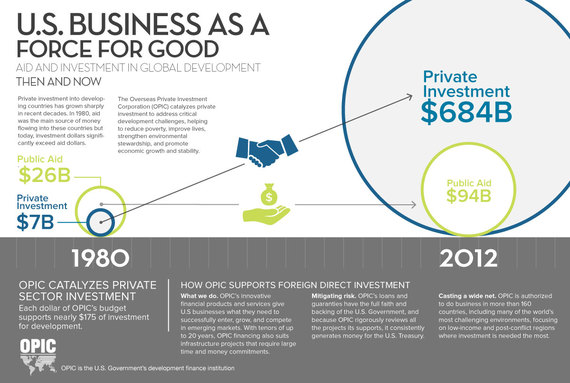

Decades ago, private capital flowing into developing countries was a small fraction of aid dollars. Since then, that private capital investment has grown roughly 100-fold and the ratio of aid to investment has flipped. Today, every $1 in aid to developing nations is dwarfed by nearly $7 in private investment. This means much more economic development in poorer countries can be accomplished with private capital instead of with taxpayer money; like building affordable housing or power plants, for example. Of course, aid will always be needed to address the most intractable problems - things private capital cannot do on its own. And that grant aid can often be deployed in smart ways that can catalyze much larger amounts of private capital. But the overall shift to leveraging the private sector for development is profound and irreversible. And it is absolutely necessary, as no amount of public or philanthropic money can address all the world's challenges.

From the late 1940s through the 1960s, public funding for infrastructure and the "green revolution" in agriculture were the centerpieces of international development. By the 1980s, the "Washington consensus" revolved around "conditionality" and "structural adjustment" -- shorthand for fewer subsidies and better fiscal discipline, and a focus on economic growth. The 1990s brought a backlash, with civil society groups pushing debt relief and a focus on the poorest populations. This has been transformative, yet no transformation has been more profound than the shift from pure grants to the leveraging of private capital for development.

In the 1970s, the Overseas Private Investment Corporation (OPIC) was carved out of the U.S. Agency for International Development (USAID) to create an agency specifically dedicated to financing U.S. business investment in developing countries - to catalyze those private capital flows to serve economic development in those countries

American businesses and investors today understand that markets are indeed global and that, if risks can be mitigated, emerging markets are full of opportunity. These investors have witnessed how investments that boost economic development create jobs, introduce advanced technologies, and have a sustained positive impact on the way people live and work. Development finance institutions (DFIs) such as OPIC can provide loans or risk insurance that make investments in these less developed markets feasible. As new markets have opened up and grown, demand from businesses for financing has grown in parallel, creating an imperative for DFIs to grow apace; and they have.

At the time of its founding, OPIC was one of the world's first DFIs. Today 20 industrialized countries, including China and Japan, have DFIs that are actively investing in places throughout Latin America to the Middle East, Sub-Saharan Africa and Asia - often competing with U.S. companies for resources and market share. In the past decade, the aggregate portfolios of all DFIs grew four-fold, from $10 billion to over $40 billion - and that growth is accelerating.

These private sector development solutions that DFIs support bring much-needed long-term economic growth. The money invested in sustainable economic development by U.S. businesses might be small in comparison to government budgets, but these investors are nimble and focused. Investments might be dispersed, but their collective impact on upward economic mobility is powerful. While governments need to build consensus for business climate reforms, companies are capable of rapid trial-and-error that yields leap-frogging solutions. These investments are helping to build power plants and water purification facilities, improve healthcare and agriculture yields and increase lending to small businesses. And they come with the added benefit of not costing the taxpayer. OPIC has returned money to the Federal government for 37 consecutive years - it is a model of development that pays for itself.

Of course, private, commercial investment cannot solve all the world's development challenges. Grants will always play a vital role in addressing certain humanitarian needs and in jump starting the initial development that can help pave the way for investors. It is also clear that some large, high-profile investors have not always been model citizens. Extractive industries and low-end textile manufacturers have too often earned the ire they attract over environmental and labor issues. But DFIs like OPIC that uphold strict environmental and social standards can be a model for other investors and have powerful, positive impacts.

For example, OPIC finance and insurance projects committed in the last year alone are expected to support nearly 10,000 local jobs. In several countries surrounding Syria, Iraq, and the areas now controlled by ISIS, the jobs we support have given young people an alternative to radicalization.

We have also supported major solar utilities in Chile, a geothermal power plant in Kenya, and a small startup from Seattle that is introducing affordable home solar kits in rural parts of India. Families who are accustomed to seeing the lights go out when the sun goes down will be able to buy just enough electricity at just the right time to allow their children to read textbooks for school. In an astonishingly short span of time, a technological innovation in one part of the world can improve lives thousands of miles away.

These are just some of the things that investments in development can accomplish. In a world facing multiple major challenges from malnutrition to energy poverty, insufficient healthcare and infrastructure, it's important that we use our money wisely. FDI is one of the critical tools we have for channeling capital in an efficient and effective manner. In a nutshell, it's bang for the buck in places that need it most.