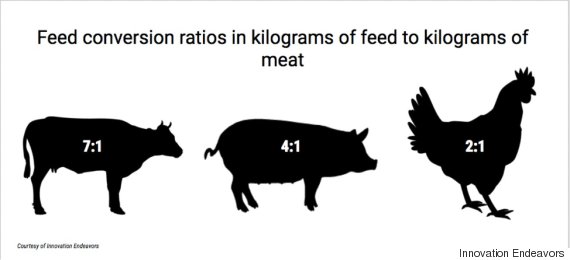

No matter how we cut it, the livestock production process is inefficient.

Cattle in feedlots need about seven kilograms of feed to produce just one kilogram of body weight. For pork, this ratio improves to about 4-to-1. For poultry, it's roughly 2-to-1.

But with all inefficient processes comes an opportunity -- in this case, a moonshot opportunity to revolutionize the way we think about food, resources, health, nutrition and the sustainability of our planet.

The food tech sector is exploding with startups, raising a record $5.7 billion in 2015 alone. Impossible Foods and Ripple Foods take a plant-based approach to recreating mainstream food products like hamburgers and milk. Clara Foods is using synthetic biology to recreate egg white proteins through yeast. Memphis Meats and Modern Meadow have been building the technology to produce animal products at scale by culturing meat cells in the lab.

It is clear that entrepreneurs and investors are excited to find alternative ways to support our growing global population. In particular, we see the latest innovations in synthetic biology, protein sequencing and tissue engineering opening doors to rethinking food and protein production.

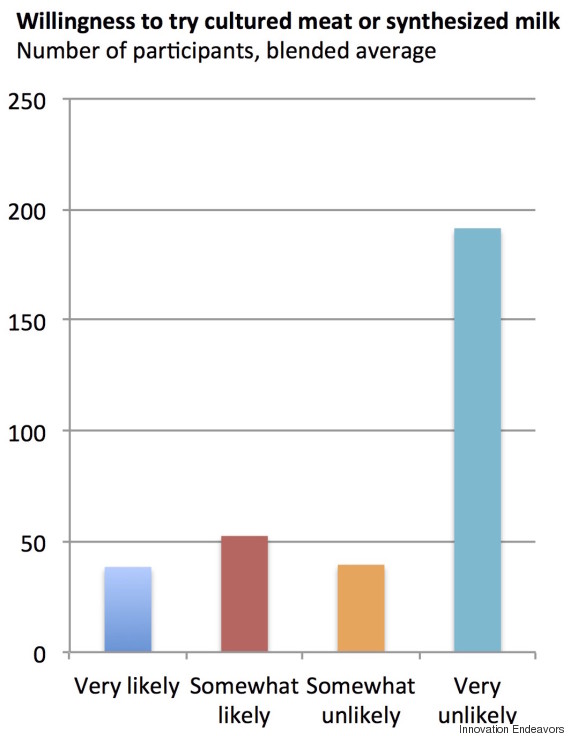

Given this new ability to rethink food production, we at Innovation Endeavors were interested to see what consumers think about these new types of food products. We conducted an online consumer survey of people all over the U.S and got responses from 317 individuals. The survey asked respondents questions about their willingness to try new types of "tech-enabled" food products as well as about their criteria for food-purchasing decisions. Although limited in sample size, the survey reinforces three key lessons on the new food tech sector: what matters to consumers, how to most effectively get products to market and why these products can fill a demand that is currently underserved today.

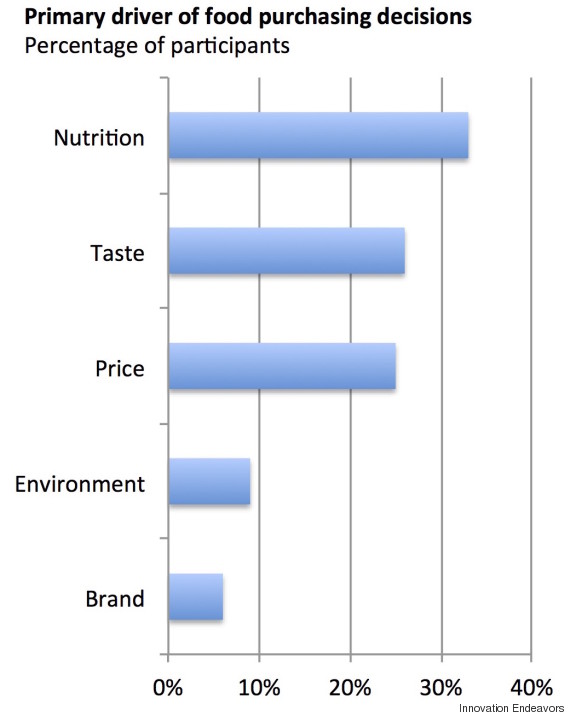

1. Consumers care most about nutrition, taste and cost.

Much of the latest food tech innovation centers around finding alternatives to animal-based products, with players focusing on how their products are better for the environment. For example, Modern Meadow talks about developing "cultured animal products without animal slaughter and much lower inputs of land, water, energy and chemicals." However, our survey indicates that "environmental sustainability" is not a priority for consumer food purchasing decisions. Achieving better nutrition, better taste and lower costs would be the ultimate trifecta. It's easiest to start with cost.

Due to the increasing demand for meat and the naturally low feed conversion efficiency of traditional animal production, economic and environmental costs of the current system will continue to rise. Simultaneously, the cost of technologies such as synthetic biology and tissue engineering are decreasing.

We anticipate that these non-traditional food production methods are close to being better in cost and efficiency. Given that about 25 percent of respondents cited price as the most important decision criteria in making food purchasing decisions, undercutting costs will be critical.

2. Selling ingredients rather than finished products.

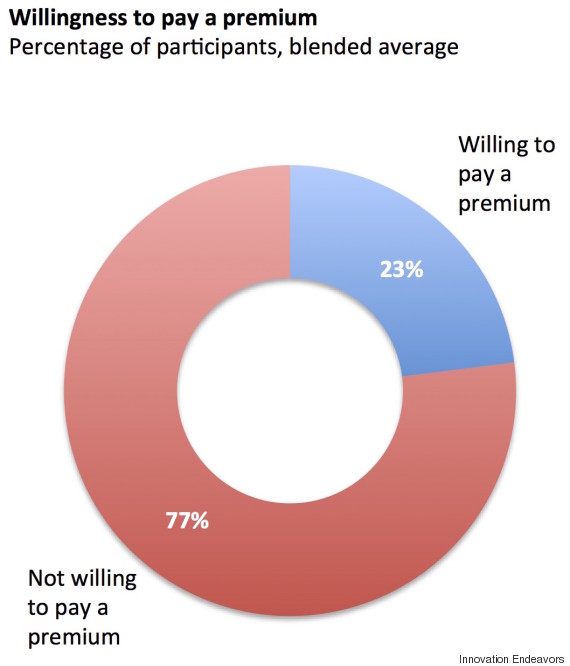

Food startups that create finished products have to cater carefully to consumer demand and perception. Our survey indicates that despite offering a higher quality product (both from a taste and nutrition perspective), novel food companies will struggle to command a price premium due to perception issues.

As a result, these companies will need to spend money on marketing and advertising; they need to build big brands and high levels of consumer awareness. However, selling ingredients to food product manufacturers offers a more straightforward path to market. It is easier to focus on developing new ingredients rather than full consumer products.

3. Pick virgin markets.

Clayton Christensen, Harvard business professor and author of The Innovator's Dilemma, argues that a disruptor is better off competing in virgin markets than against other suppliers. He emphasizes the advantages of creating entirely new consumers.

Rather than thinking of products as replacements for hamburgers, chicken nuggets, milk, etc., there is value in creating a whole new class of products that addresses a market demand never before fulfilled sufficiently. In particular, there is an opportunity to develop an allergen-free class of products for the most common allergies in children today (dairy and egg). We can make those available to people who currently can't consume them.

As an example of how these markets have grown, the dairy alternative market is anticipated to reach $19.5 billion globally by 2020. With the promise of allergen-free milk with no aftertaste and allergen-free mayonnaise with less cholesterol, we are optimistic that these higher-quality products will open up new markets.

The journey ahead might be long: consumer adoption might be slow, the externality costs of traditional production may take time to be accounted for and uncertainty around genetically modified organisms and the U.S. Food and Drug Administration might linger indefinitely.

However, we are not discouraged. A new food revolution is coming down the pipeline. Entrepreneurs should prepare to lead it.

Also on WorldPost: