One would think by now the debate has been resolved on which economic model created a better recovery from this Great Recession or Lessor Depression, as P Krugman has called it. But no, Germany's Finance Minister Wolfgang Schauble keeps pounding the drum for his, and the eurozone's failed austerity policies.

And this is happening with a new Hitler looming on Europe's border who is taking advantage of their weakness and threatening to repeat its history.

"The financial crisis broke out seven years ago and led many countries into an economic and debt crisis," says Schauble in a recent NYTimes Oped. "A pervasive set of myths -- that the European response to the crisis has been ineffective at best, or even counterproductive -- is simply not accurate. There is strong evidence that Europe is indeed on the right track in addressing the impact, and, most importantly, the causes of the crisis."

Really? One has only to compare Europe to U.S. economic growth since the Great Recession.

The U.S. response by the Federal Reserve was to do everything possible to stimulate demand by keeping interest rates as low as possible, as long as possible, to pump more money into the system, rather than hoard it.

It is not even a matter of degree, but of orders of magnitude. The U.S. has grown as much as 5 percent in a quarter, whereas Europe has grown no more than 0.3 percent since 2012. (Does Schauble even bother to look at economic data?)

One thinks that most economists should have learned from the 1930's Great Depression, Roosevelt's New Deal, etc., etc., that it takes a very proactive government to bring back the fallen 'animal spirits', as JM Keynes called the loss of confidence that kept consumers in the 1930s' economy from completely recovering, until WWII government spending brought back fully employed economies.

But no, Schauble, has turned Keynes on his head in maintaining that it is the loss of investors' confidence, not that of consumer spending, which powers 70 percent of economic growth these days. He seems to have absolutely no concept of the meaning of aggregate demand, another Keynesian concept that spells out exactly what drives economic growth

.

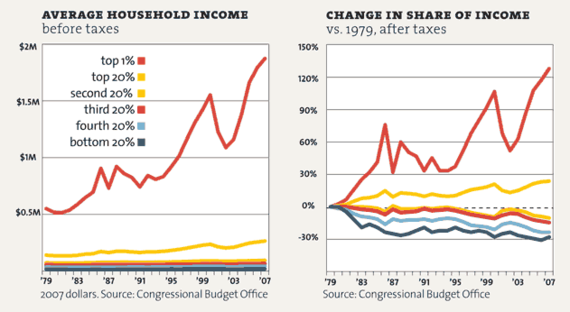

I.e. investors lose confidence in investing when the demand for their products and services declines, as it did drastically during the past two depressions. It is a basic misunderstanding of how economies work. Consumers ran out of money to spend, due in large part to the record income inequality that happened in 1929, and again in 2008.

When almost all wealth flows to the top, the wealthiest enact policies to prevent it from being redistributed downward to those that spend it, where it would encourage and strengthen a recovery.

Then money is hoarded, rather than spent or invested wisely, as is still happening worldwide (particularly in Germany with the largest budget surplus in the developed world). That's why economic growth has resumed in the U.S., but not in Europe, Which is currently teetering on the edge of its third recession since 2008.

But isn't Putin's Russia threatening war, even a nuclear war, if Europe doesn't cave in to its demands? That is a wake up call for Europeans to throw out their austerity policies, if they want to have enough strength to oppose him. Europe is fractured because of their poorly functioning economies. Otherwise history is about to repeat itself. Only instead of a Hitler, we have a Putin.

Harlan Green © 2015