Vietnam has implemented an almost-foolproof regulation to promote business growth. And in doing so, they are exceeding global development forecasts through a new wave of entrepreneurs -- all part of government efforts to stabilize accelerated growth. After implementing the program in 2011 starting a business has become increasingly attractive, which is vital in a country where at least 97 percent of entrepreneurs are small business owners.

As exciting as the social enterprises presented were, the most interesting and perspective-changing lesson for me was the Vietnamese flat tax. This is what allowed for organizers Trang Nguyen, Thuy Minh, Huong Nguyen, and Duong Lee to put on the event -- and its an incentive to even further growth in this nation.

A flat tax is a simple concept. For instance, our income tax system in the US which progressively taxes income at an increased rate per the total income. So, income of $100 is taxed at a higher rate than income of $10. Meanwhile, a flat tax is a single, stagnant rate that applies to all income above zero.

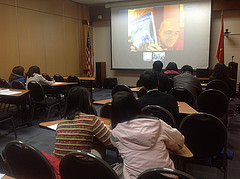

The conference

We know exactly how government regulations and taxes greatly impact the small business owner (see here).

Furthermore, I have seen with my own eyes the energy and excitement in the economies of Cambodia and Vietnam -- despite the very recent history of tragedy in both places (i.e. genocide, civil war, and all the social and economic implications of both (see here, here, and here). In hindsight, we can see the Colonial circumstances that led to this tragedy -- much like taxation without representation led to our own country's independence. Perhaps, with a simpler tax code, this could have been prevented?

In Vietnam last fall

Vietnam's rapid growth over the past several years has only been boosted by the government's tax laws, which help small business people incorporate their companies in just 12 weeks, the profits of which are currently taxed at a flat rate of 22 percent or less -- as low as 10 percent for those operating in the industrial zones.

In Vietnam last fall

Small business owners also have a 50 percent decrease in the personal income tax they owe. So, while some of the business structuring imposed by the government lags (doing business effort and transparency, to name two) -- this environment is one that allows many individuals to pursue their entrepreneurial dreams.

Enterprise Income Tax Law: Article 13.- Tax rate incentives

1. Newly set up enterprises under investment projects in geographical areas with extreme socio-economic difficulties, economic zones or hi-tech parks; newly set up enterprises under investment projects in the domains of high technology, scientific research and technological development, development of the States infrastructure works of special importance, or manufacture of software products are entitled to the tax rate of 10 percent for 15 years.

2. Enterprises operating in education-training, vocational training, health care, cultural, sports and environmental domains are entitled to the tax rate of 10 percent.

3. Newly set up enterprises under investment projects in geographical areas with socio-economic difficulties are entitled to the tax rate of 20 percent for 10 years.

4. Agricultural service cooperatives and people's credit funds are entitled to the tax rate of 20 percent.

5. For large-scale and hi-tech projects in which investment should be particularly attracted, the duration for application of tax rate incentives may be extended but must not exceed the duration specified in Clause 1 of this Article.

6. The duration for application of tax rate incentives specified in this Article is counted from the first year an enterprise has turnover.

I look forward to reporting the latest innovations in entrepreneurship and social enterprise here in the coming weeks.

Special thanks to Lauren Bailey and Maya Horgan for assistance.