Let me give you the bad news first -- leaders in the health insurance industry are predicting steep rises in health insurance costs in 2014. The good news, however, is that under the Affordable Care Act (ACA), some consumers will be eligible for a health insurance premium tax subsidy to help ease the burden of having to purchase coverage.

To be eligible for a subsidy, you must:

•Be a United States citizen or legal resident with a family income between 100 and 400 percent of the federal poverty level (FPL).

•Purchase your coverage through a public health insurance marketplace.

•Not have affordable coverage available through your employer.

•Not be eligible for Medicaid.

For most Americans, the federal poverty level is $11,490 for an individual and $23,550 for a family of four. Therefore, individuals that earn $45,960 per year or less and families of four that earn $94,200 or less may be eligible for a government subsidy.

How the subsidy amounts are determined

The ACA calls for the creation of government run online marketplaces where insurance carriers will offer insurance plans that will be categorized according to metallic tiers: bronze, silver, gold, and platinum. Bronze plans will typically have the lowest premiums but the highest deductibles and coinsurance percentages, while the platinum plans will typically have the most comprehensive coverage with the highest premiums but the lowest deductibles and coinsurance percentages.

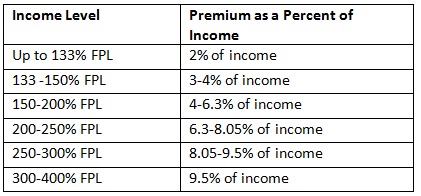

A person or family that meets the requirements listed above may be eligible for a subsidy, and the amount of that subsidy is determined by the cost of the premium for the second cheapest silver plan available in the consumer's area. A consumer will only be expected to contribute a certain percentage of his or her income depending on the consumer's income level relative to the FPL. The table below illustrates how a person or family's subsidy will be determined.

To further illustrate, consider the following example:

In 2014, a man has an annual income of $28,725 (250% of FPL). The cost of affordable health insurance coverage in his area is $5,733. Under the ACA, he is only expected to pay 8.05% of his income on health care, or $2,313. The amount of the tax subsidy he will receive can be calculated by subtracting his expected contribution from the cost of his plan ($5,733 - $2,313 = $3,420).

Other key facts about premium tax subsidies

•Tax credits will be subtracted from an individual's income tax bill after all other deductions and calculations have been made.

•Tax credits are refundable. This means that even people with very little or no tax liability can still benefit from the subsidy.

•Tax credits can be taken as advances. Individuals can use the subsidies toward their health insurance premiums right away without having to wait to file income taxes.

Find out if you are eligible for a premium tax subsidy

The only way to find out your official subsidy eligibility is to complete the form on the government-run marketplace once it is available. Based on information that has been publicly released, the subsidy form will take anywhere from 15 to 30 minutes to complete, and likely will not be ready until closer to October. In the meantime, GoHealth has created a subsidy calculator that provides consumers with quick estimates of how much their tax subsidies and premiums will be in 2014. As opposed to other subsidy calculators, the GoHealth calculator does consider the location of the consumer and does not rely solely on national averages. For more information about subsidies, please visit www.gohealthinsurance.com/subsidy.