(Reuters) - The current high rate of unemployment in the United States is primarily due to cyclical factors, not structural changes in the economy, according to researchers at the San Francisco Federal Reserve Bank.

The study runs counter to worries among some top Fed policymakers that undesirable upward pressure on wages, and thus inflation, could kick in even when unemployment remains relatively high -- a situation that could have implications for U.S. monetary policy.

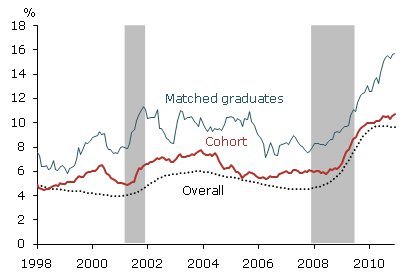

According to the research, recent college graduates are finding it just as hard to get work as other job seekers.

Since college grads are among the best educated and most mobile in the labor force, their difficulty finding jobs suggests that it is labor market weakness as a whole, rather than mismatches between workers' skills and employees' needs, that is keeping would-be workers from getting jobs, the researchers said.

Recent college grads are also unlikely to be motivated by the extension of unemployment insurance, often cited as a reason for the elevated unemployment rate in the labor force as a whole.

"The current unemployment rate trends are reminiscent of the 2001 recession and the subsequent jobless recovery that continued through 2004," research advisor Bart Hobijn and research associates Colin Gardiner and Theodore Wiles said in the bank's latest Economic Letter.

"This holds for both the overall unemployment rate and for those of recent college graduates, suggesting that structural factors are not quantitatively important in driving the overall unemployment rate, just as they were largely irrelevant after the 2001 recession," they wrote.

Some U.S. central bank officials, including Minneapolis Fed President Narayana Kocherlakota, have suggested that structural shifts in the economy since the Great Recession have pushed up the new "normal" for joblessness.

A higher norm for U.S. unemployment means upward pressures on wages could start to build even when the jobless rate is quite high by historical standards.

The San Francisco Fed research suggests that such concerns are remote.

"Given the current weak labor market, we expect the labor market outcomes of the recent college graduate cohort to remain depressed well into the future," the researchers said.

From the San Francisco Federal Reserve report:

(Reporting by Ann Saphir; Editing by Andrew Hay)

Copyright 2011 Thomson Reuters. Click for Restrictions.

Support HuffPost

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

At HuffPost, we believe that everyone needs high-quality journalism, but we understand that not everyone can afford to pay for expensive news subscriptions. That is why we are committed to providing deeply reported, carefully fact-checked news that is freely accessible to everyone.

Whether you come to HuffPost for updates on the 2024 presidential race, hard-hitting investigations into critical issues facing our country today, or trending stories that make you laugh, we appreciate you. The truth is, news costs money to produce, and we are proud that we have never put our stories behind an expensive paywall.

Would you join us to help keep our stories free for all? Your contribution of as little as $2 will go a long way.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you’ll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.