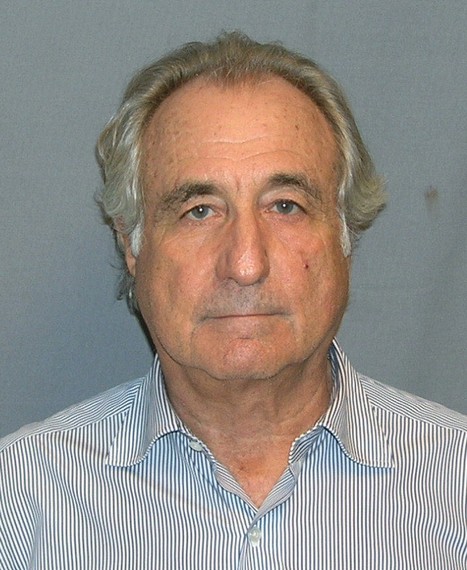

I am writing this piece to fully investigate for myself, whether Higher Education is a Ponzi scheme. For the past year now, after leaving the system, I have had a growing suspicion that it is. Just in case none of the reader's immediately identify with the title picture, it is a mug shot taken of Bernie Madoff. Madoff is often regarded as running the largest Ponzi Scheme in history. Being a well-known and respected financier, Madoff was able to lure in thousands of investors, promising them consistent profits. Before being caught, he conned these people out of $65 billion. Now before continuing, I will say that today, in the US alone, total student debt stands at $1.2 trillion. I don't believe that all of this debt has been used to fund a giant Ponzi scheme, but I believe that a significant amount of it has been. If even 10% of the courses on offer are a total waste of time for the students enrolled in them, then Higher Education puts Bernie Madoff to shame.

Lets begin here by stating what a Ponzi scheme actually is. It is a system whereby Investors are lured in by the promise of high returns. They are run by a central operator who uses the money from new, incoming investors to pay-off the promised returns to old investors, even though no actual profit is being made. Now, I think that for millions of students, the first part of the definition of a Ponzi scheme definitely rings true for tertiary education systems. But the second part of the definition probably doesn't ring true. Personally, I think it would be great if some false returns were paid to me after my many years of being enticed into a corrupt scheme that promised false returns. Unfortunately though, there was nothing waiting for me on the other side. And many recent graduates the world over have found the exact same thing (nothingness) to be waiting for them also. Remember as well that the $1.2 trillion debt figure doesn't include the amount invested in education from students (small) savings accounts, and from their parents savings accounts. The figure invested in Higher Education (worldwide) would then be closer to $20 trillion.

The second part of the definition of a Ponzi scheme can actually be applied to Educational institutions, but not in a purely monetary sense. If we think solely of the Central Operators of the 'Educational Ponzi Scheme' as being a make-up of all the Deans, Professors and Lecturers in Colleges', then a pure Ponzi situation does become apparent. Those people, many of whom go straight from College themselves, to working in a College, are in fact part of a Ponzi scheme. By promoting Higher Education, they are luring new investors into the scheme, some of whom also go on to be Lecturers and such. Fortunately, the scheme lures in young people, so it is unlikely to run out. But considering that the Baby Boomer generation is now moving into retirement age, the population of young people in the western world is going to start massively decreasing. Personally, I don't think that Education is a great Industry to be an employee in long-term.

But what is the central lie of the system? Of course it is that every in-coming student is promised a future of gainful employment once they leave. A recent study in the US however, found that 53% of new graduates are either underemployed or unemployed altogether, In fact, because so many recent graduates can't find a job, or find a menial one, they consequently can't pay back their loans. It has therefore often been discussed that their debt should be forgiven, in the US at least.. But as Ohio University developmental economist Julia Paxton said,

"One of the problems of debt forgiveness is that it sets a precedent that similar loans in the future will also be forgiven. Although the loans are allocated toward education, money is fungible and will have the net impact of increasing the spending ability of students in other areas of their lives. As the expectation of repayment obligation falls, borrowers may enter into a situation where they take on higher levels of debt and take more risks. This will lead to a weakened ability to repay, creating a vicious cycle that hurts the financial sector and the credit ratings of the borrowers".

This situation is what economists call moral hazard, and is what was frequently the criticism of many of the bailed-out financial institutions in 2008. In New Zealand we have interest-free student loans, which actually incentive the borrower (student) to prolong paying them back. By the definition above, I think we can reasonably assume that Universities (Colleges) in NZ have become, or are becoming moral hazards. Where this is not the case, is in those disciplines whereby you are streamlined into a career. This refers to degrees such as those in Medicine and Teaching. For the rest of the recent Graduates, they fall into two groups.

The first group are those lucky enough to be born into the right family. These people will be able to use their family connections to get ahead. When a relative is in a position of influence in a particular organisation, dear little son/nephew Johnny (hypothetical name) will get put above another person, even if that person is smarter and better suited to the job. I have seen this happen with many of my peers from University, and I continue to see it happen in many organisations. In fact, I was in the running for a job last year, and the guy who beat me to it, had lesser Educational qualifications, and also had no experience in Investing and Business. Of course, when I noticed that his Dad was the chairman of the board that ran the company, it became very clear to me to see why he got the job.

The third group of gainfully employed Graduates, who weren't in one of the streamlined career degrees, and who don't have a family connection; are the people who I most admire. These are people who create their own luck, or are so persistent that the employer has no option but to employ them. In fact more than any other group, these are the people to most aspire to. They focus on being so good at what they do, and they are so persistent, that success will come to them no matter what. My favorite example of one of these sorts of people is Michael Burry, who was famous for profiting big money from shorting the US housing bubble. There was a fantastic address he did at the UCLA Economics Commencement in 2012, which I consider to be one of the greatest speeches ever given. He finishes by saying that the world is not fair, and that Graduates would be best-served to keep their eyes always open for opportunities, even unconventional one's. Specifically what he said, was that Graduates should seek exploit the opportunities that the world offers, and do it in as just a manner as possible.

The world currently being dealt to Graduates is certainly an unfair one. Even inside the streamlined career degrees, the competition is intense, and when your grades don't measure up, you'll be cut from the system... swiftly. For those Graduates who don't have the benefit of family connections, or don't choose to use those connections; their options comprise of Unemployment, Underemployment, or the hardest route possible (making their own luck). Concerning what Burry said about exploiting opportunities in a just manner, I no longer consider that many jobs in Higher Education are honorable and just opportunities to exploit. Outside of the streamlined career degrees, it seems to matter far more whether someone has an VIP family connection, than whether they have good grades. Within many disciplines, the system has become a corrupt Moral Hazard. In fact, it is entirely obvious that Higher Education does indeed put Bernie Madoff to shame.