Anyone with a non-zero pulse rate should know about the ongoing debate over whether income and wealth inequality has risen in United States and Europe, and the implications if they have. While not a new issue, a best-selling book by French economist Thomas Piketty gave increased impetus to this debate (see my review).

The prominence of the debate is shown in the exchange between Chris Giles of the Financial Times and Piketty over the reliability of the statistics used by the Frenchman. Many have contributed to this debate, but perhaps none so eccentrically as Edmund Phelps, 2006 winner of the "Nobel Prize for Economics" (reality check -- there is no Nobel Prize for Economics; as I explain in my book Economics of the 1% it is awarded by the central bank of Sweden that gratuitously appropriated the name of Alfred Nobel, much to the annoyance of the Nobel Foundation). In the August website of the Financial Times Professor Phelps tells us "no one could argue that historical rises in inequality in the west caused past losses in [economic] dynamism."

To say the least this is a surprising assertion, because quite a few writers have made exactly this argument. Among mainstreamers arguing what "no one could" are a recent working paper of the International Monetary Fund, a chapter in an OECD book on policy reforms in high income countries, and many middle-of-the-road academic economists (briefly summarized on a World Bank web page).

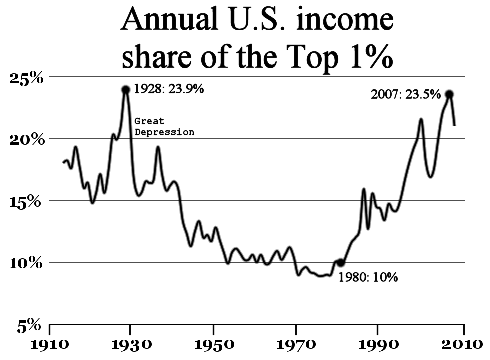

The core of Professor Phelps' argument seems to be that policies attempting to reduce inequality -- he assigns the adjective "corporatist" to them -- stifle innovation, which in his analysis is the driver of economic growth. For empirical evidence he tells us "innovation tailed off between 1940 and about 1970", after which "the top decile's share of wealth and income began rising" (he seems to refer to Western Europe and the United States). From this we can infer that growth was sluggish during 1940-1970 ("innovation tailed off"), then improved after 1970 (when "the top decile's share... began rising").

This is a rather difficult empirical assertion to verify, first because a third of those 30 years included a world war and the subsequent reconstruction and recovery seems to have escaped the attention of Professor Phelps. The decade of the 1940s is hardly a period useful for assessing the interaction of inequality, innovation and growth. Further, there are a consensus that in all the combatant countries the war stimulated a spectacular rate of technical change which spilled over into peaceful uses in the post-war years. While not the most desirable route to "innovation," research into new ways of killing people is a powerful stimulus for technical change.

Setting aside the war-torn 1940s and also the 1950s when many developed countries remained engaged in reconstruction (e.g., the Federal Republic of Germany, West Germany, did not achieve sovereignty until 1955), we can consider Professor Phelps' pre- and post-1970 "innovation and growth" hypothesis. If greater equality resulting from "corporatist" policies reduces growth, we would expect a lower growth rates among countries before 1970 than after.

I divide 1960-2007 (i.e., pre-financial crisis) into five decades for the United States, France, Italy and the United Kingdom, omitting Germany because of lack of comparability before and after 1990. In all four countries the decade of fastest growth was the 1960s, with the difference between the 1960s and the decade with the second-fastest growth greatest for France and Italy (in excess of two percentage points), substantial for the United States (0.8 percentage points), and quite small for the UK (OECD statistics).

These statistics reflect a broader problem with Professor Phelps' "innovation-inequality" hypothesis. He identifies competition as driving innovation, and "corporatist" policies as the bête noir of competition. He fails to inform the reader of considerable disagreement about this issue. His approach seems to derive from an earlier Nobel Prize winner, Friedrich Hayek (also right-wing), rather than Joseph Schumpeter (yet another right-winger). The former stressed competition in the narrow sense of market shares, and the latter cited the advantages of size in generating innovation (see summary in a Forbes blog). In addition, Professor Phelps makes no mention of the contribution of the public sector to innovation, much less how that relates to his stress on market competition and "corporatism."

More than one of the reactionary recipients of largesse from the Sveriges Riksbank (the funder, not the Nobel Foundation) has gone off the rails either in action or words. For example, Myron S. Scholes and Robert C. Merton, who shared the 1997 Prize -- and in an outcome no critic could make up -- used their profound economic knowledge to lose billions of dollars via a hedge fund they created. However, to my knowledge no other faux Nobel'er has denounced "solidarity, security and stability," on grounds that they are "corporatist" motivated killers of innovative behavior.

Opposition to three of the most important human values suggests a vision of capitalism notably appropriate for our reactionary times. During the last several decades an increasing share of the "captains" of industry and finance have adopted Professor Phelps' enthusiasm for a capitalism ruled by alienation, insecurity and instability. Those sharing this free market vision must read on Hobbes' Leviathan with uncontrolled glee. Life for the one percent brings riches and indulgence, while for the rest of us -- you guessed it, "solitary, poor, nasty, brutish, and short."

Camden, New Jersey in real time - "solitary, poor, nasty, brutish and short", fulfilling neoliberal hopes.