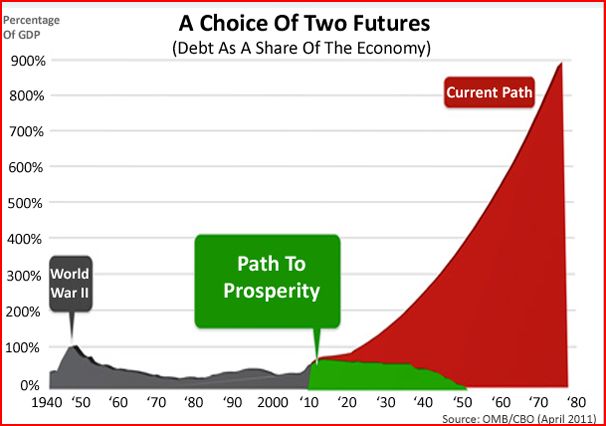

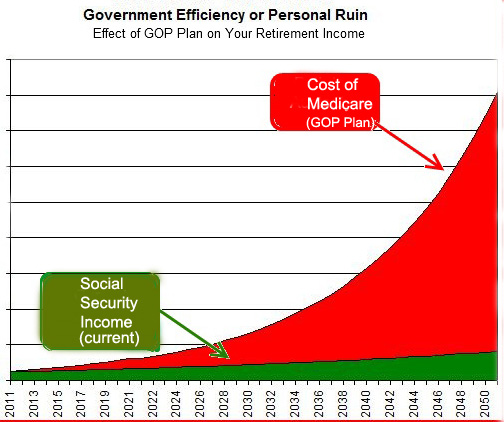

Rep. Paul Ryan's getting a lot of attention for a chart he's using to publicize the new Republican budget:

You know what's funny? I was just projecting the effect of that budget on the average retiree's household budget:

I wish I were kidding, but I'm not. These are the real numbers. The two charts look alike, but they tell very different stories.

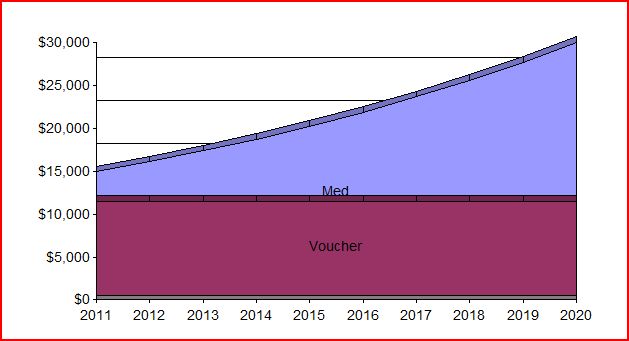

The green ink shows the income you would have after retirement under the current system, which comes with guaranteed Medicare coverage. The red ink shows just how much you'll be in the red if the Republican budget is put into place. Even if you turned your whole Social Security check over to the health insurance company, it wouldn't be enough. If you wanted Medicare-like coverage you'd be forced to give a private insurance company tens of thousands of dollars more in premiums than you'll receive in Social Security and "voucher" benefits.

Together these two numbers paint the picture of a nation where older Americans will either go bankrupt or be forced to go without medical care. For those who say "we can't afford the current system," take Social Security out of that discussion. That system's minor, long-term problems are easily fixed by asking the wealthy to pay their fair share.

And as for Medicare, we could fix our broken health care system and keep the benefits we have now. But that would make some corporate interests very unhappy. Maybe that's why it's not even being discussed in Washington. So rather than fix these runaway costs, the Republicans have decided to drop them all on your shoulders and let you deal with it.

Enjoy your "Path to Prosperity"!

The Point of No Return

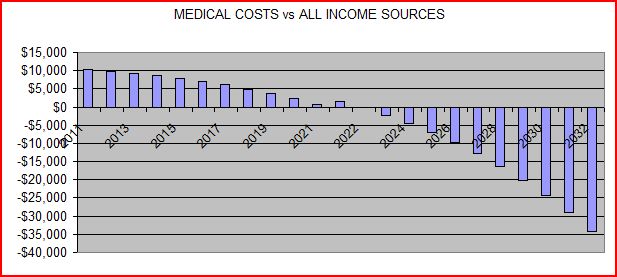

How quickly would that happen? According to the Congressional Budget Office (CBO), seniors entering the program in 2030 can expect to pay $20,000 out of their own pockets for health care. If Social Security payments continue to be adjusted at the same rate they were over the last decade, the average person on Social Security will receive a little over $21,000 that year.

I think the CBO has underestimated the cost to seniors. But even if we take their more conservative estimate, the new Republican proposal will use up the average person's entire Social Security benefit within 10 years of its taking effect.

Are you one of the lucky people who has actually managed to set aside some money for retirement? These handy charts and figures will help you calculate how long it will take you to go broke if the new Republican budget is enacted into law.

The "Republican Road to Ruin" Budget

The new budget is being presented by Rep. Paul Ryan, based on a proposal he co-wrote with economist (and long-time "entitlement" opponent) Alice Rivlin. It would dismantle Medicare and Medicaid in 2021, replacing Medicare's system of guaranteed, comprehensive health coverage with "vouchers" for the purchase of private health insurance.

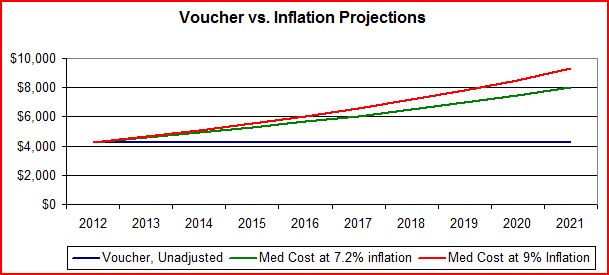

The voucher's value would be adjusted yearly by what the proposed budget calls "a blended rate of the CPI and the medical care component of the CPI." Since the medical component of inflation has always risen much faster than the overall CPI (consumer price index), that means that the voucher is designed to purchase less coverage with every passing year.

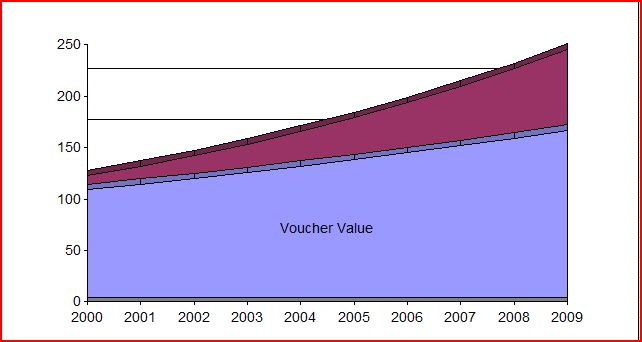

Ryan has already spelled out what he thinks that "blended rate" should be, in a proposal he co-wrote with economist Alice Rivlin. Over the past decade, their formula would have yielded 5% increases per year while medical costs were going up 9%:

The Republican voucher would have lost nearly 30% of its value over the course of the last decade. Medical coverage that cost $100 when the decade began would have cost $228 at its close, while the voucher would only have been worth $163.

It's not clear what the voucher will actually be worth in 2021, since the language is ambiguous. The original proposal (co-written by Ryan and economist Alice Rivlin) says that the voucher will be based on what Medicare was worth in 2012, after which an inflation factor will be added.

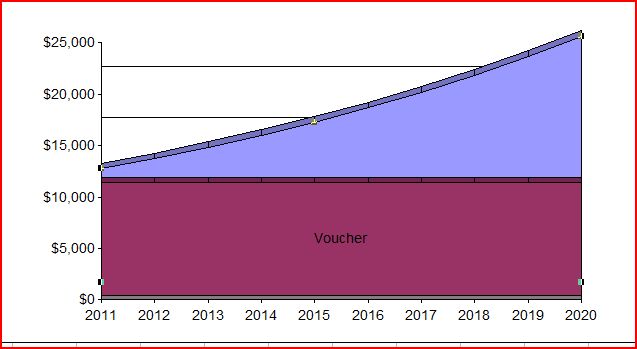

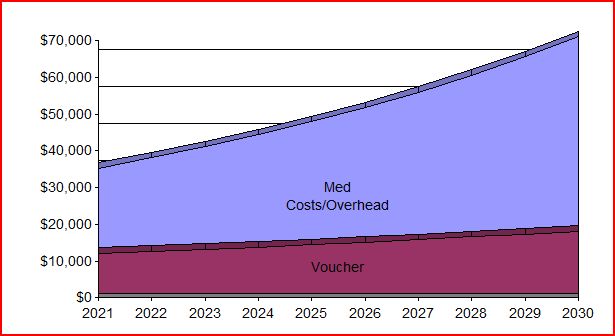

But will the first year's number account for medical cost rises between 2012 and 2021? It's not clear. If not, the voucher's value will look something like this:

What's more, there's an additional overhead cost for using private insurance, which is costlier to administer than Medicare. If that's added in, here's what could happen in 2021:

The voucher would then be worth $11,000, while Medicare coverage would cost more than $30,000. For people aged 65 who enter the program in 2021, here's what the shortfall would look like (depending on which inflation rate is used):

Either way it's bad.

The First Decade

Even if the voucher is given full Medicare value in Year One (which we question), things start to get really bad after that. If medical costs continued to increase at 9% each year, which isn't at all impossible, and the voucher's value continued to increase at 5%, here's what would happen 10 years later using my figures:

By 2031, the cost of Medicare-equivalent coverage would be $73,000, and the voucher would be worth $18,000. By my calculation, the average retiree would be more than $50,000 in the hole.

The CBO says the shortfall would be $20,000 for a person retiring in 2030, which isn't wildly incompatible with my figure (especially when you include our other differences).

Presumably the voucher will include an adjustment for very high-cost patients -- they say it will -- which will offset this total effect somewhat. But the plan places that process in the hands of the patient's health plan, which will be required to request increased premiums for costlier patients.

My guess is that they'll drop them instead.

The Dickensian Retirement Plan

By my calculation, within a year or two of the new plan's inception, the cost of Medicare-style coverage would exceed the combined value of the average recipient's Social Security check and the average recipient's Medicare voucher:

If you think my numbers are too high, pick the CBO's. Even under their somewhat more modest projections, the average recipient's entire Social Security check will be used to pay for health care coverage by 2031. Either way, the typical middle-class retiree won't be able to afford it.

We'll be faced with the choice of either giving up our entire Social Security benefit or doing without health coverage altogether.

Death and Disease

What happens to those retirees who can't afford the care they need? There is excellent evidence that Medicare has significantly increased life expectancy and reduced the amount of time older Americans spend in the hospital. The public health benefits of Medicare will slowly be rolled back as fewer and fewer seniors get the health care they need.

The result, according to at least one well-regarded study, is an increase of 13% in elder mortality each year, and an increase of roughly 13% in the number of days they spend in the hospital.

Of course, when they get critically ill or injured, uninsured older people will do what uninsured people have always done: They'll go to the emergency room. Who will pay for that?

Misery Loves Company

The plan also raises the age for Medicare eligibility, and will soon have a devastating financial impact on even those people who are fortunate enough to have arranged pensions or other forms of income that exceed $80,000 per year.

There will be more out-of-pocket costs, some (but not all) of which are factored into these numbers.

The voucher is supposedly adjusted for regional variations, but how is that practical? When an average Medicare recipient's care costs roughly twice as much in McAllen, Texas, as it does in El Paso, how can a "voucher" system adequately adjust for these costs?

Since health costs vary dramatically based on demographics, insurers are going to be "cherry-picking" healthier customers and trying to drive sicker ones away with terrible service, constant denials of medical authorization, and God know what else.

And, as we've pointed out elsewhere, health care costs skyrocket during the last two years of life. That means insurers will also be burning the midnight oil figuring out how to bounce people from their plans as they lay dying.

The Real Solution

This is why so many people have been been saying that the government doesn't have a long-term "deficit" problem -- it has a long-term health care problem. That means we have two choices as a nation: We can either fix our broken health care system, or let older people go without medical coverage they can't possibly afford.

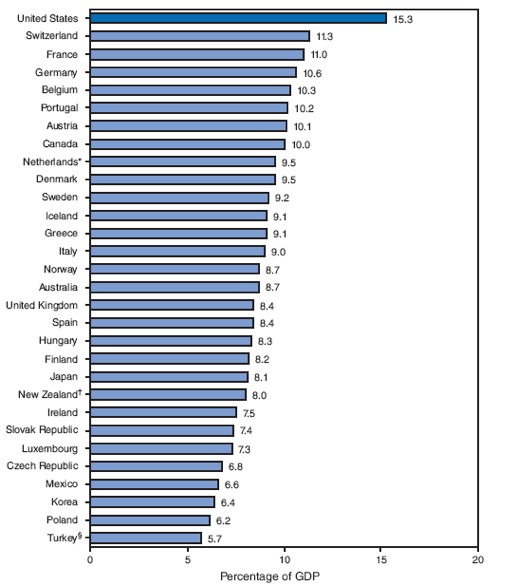

How do we fix our health care system? By doing what other industrialized countries are doing, which is costing them far less (for better results):

- Restrain profits in the hospital industry.

- Lower our pharmaceutical costs, which are 50% higher than those in other developed nations.

- Create a rational system of physician payments and incentives, so doctors don't make a lot more money putting people to sleep for operations than they do keeping entire families healthy (and so cardiac surgeons don't make more money cutting people open than they do preventing surgeries).

- Develop better programs for managing high-cost and chronic conditions.

- Restrain runaway profits and overhead in the insurance industry.

- Expand the role of government in setting rates, establishing which medical procedures work, and performing other vital services in improving the quality of care and slowing the growth of costs. (Instead, the Republican plan would eliminate government's current role. Without it, the rate of medical cost growth would actually speed up -- something neither the CBO nor I have factored into our numbers.)

These steps would be a good start. Of course, most of them call for a little inconvenience on the part of corporations that happen to be big campaign contributors. That can't be part of the problem, can it?

The Bottom Line

The Ryan budget is nothing more than a plan to dismantle Medicare altogether. Once it's implemented they'll go after Social Security. That's in the budget, too, in the form of "triggers" that will require cost-cutting at some future point.

How long will it take you to become indigent in your senior years? For most people, that moment will come sooner or later under this proposal. The alternative is to go without health coverage, which means increased sickness and death.

The Republicans have made their choice. It's up to us to choose a different, better path: fixing our broken health care system while preserving Medicare, Social Security, and the financial security of the American middle class.

-------------------------------------

Disclaimer: Old consultants, of which I am one, never present figures without saying something like this: "These figures are estimates to be used for discussion purposes. They are based on unverified, publicly available data. They are not to be used for rate-setting, actuarial, or accounting purposes without further verification and an opportunity to review source data files."

That may sound nerdy to you, but it makes me feel better.

FOOTNOTES:

The general rate of inflation (CPI) plus 1%. UPDATE: Ryan is actually not adding 1%, according to the CBO. That makes the gap between medical costs and the voucher even greater.

Overhead costs for non-governmental, nonprofit private-sector health plans are 16%, while for-profits are in the 26% range. Medicare's overhead is 4%. (To be fair, some of that overhead is marketing costs, which Medicare doesn't have. But these new plans will have marketing costs, along with everything else, including senior executive salaries.) Assuming that the for-profit/non-profit mix stays the same, private-sector overhead will average 21%, or 17% more than Medicare's current level.

The CBO uses 11% for overhead. That's too low. Even Medicare Advantage plans average 13% in additional costs, and that's without removing the competitive pressure of the Medicare program as the Ryan budget would do.

Overhead costs for non-governmental, nonprofit private-sector health plans are 16%, while for-profits are in the 26% range. Medicare's overhead is 4%. Assuming that the for-profit/non-profit mix stays the same, private-sector overhead will average 21%, or 17% more than Medicare's current level.

My higher rate of inflation (see above), higher overhead factor (see above), and the fact that I start adjusting the voucher for inflation in 2021 instead of 2012.

"The Effects of Medicare on Health Care Utilization and Outcomes." Lichtenberg, F. Frontiers in Health Policy Research, Volume 5, January 2002. For more on the health impact of insurance coverage on older people see, for example, Kassab et al. "The Influence of Insurance Status and Income on Health Care Use Among the Nonmetropolitan Elderly," Journal of Rural Health, 8 Apr 2008.

The plan would raise the age when people become eligible for Medicare from 65 to 67, and would impose a means test on the program, so that anybody who makes $80,000 a year or more ($160,000 for couples) would have their Medicare benefit cut in half. By 2032, according to our estimates, that would be a penalty of nearly $9,000 under the more generous interpretation of the GOP plan.

That presumably means that a "wealthy" recipient earning $81,000,would then be required to spend about $34,000 in medical premium costs if they want benefits at their current levels -- and that's out of a total after-tax income of $60,750 (if they're taxed at current rates). But since they've already been tagged as "wealthy," they're probably also going to see cuts in their Social Security benefits when those "triggers" go off, too.

Here are the figures:

Medicare and Medicaid have been the only part of the U.S. health care "system" that resemble that of these other countries at all. The GOP plan would dismantle that and move our system in the opposite direction.

Richard (RJ) Eskow, a consultant and writer (and former insurance/finance executive), is a Senior Fellow with the Campaign for America's Future. This post was produced as part of the Strengthen Social Security campaign. Richard also blogs at A Night Light.

He can be reached at "rjeskow@ourfuture.org."

Website: Eskow and Associates