The sheer audacity of the criminals who ruined Iceland's economy is impressive, in a perverse manner. The nerve with which they methodically bankrupted their country, while enriching themselves à la Madoff, can only issue from hearts so devoid of morality as to sincerely believe their own lies.

However, the political, business, and banking executives could not have attained the scale of corruption they achieved without the assistance of their lawyers. As Mario Puzo once observed, "A lawyer with a briefcase can steal more than a thousand men with guns."

The lawyers advising the powers-that-be in Iceland surrendered their professional roles and instead served as shameless enablers. They told the villains what they wanted to hear, grabbed their share of the profits, and are now aggressively attacking those seeking to set things aright.

One of the more blatant schemes to defraud the shareholders in Iceland's investment banks involved bank loans to bank officers to buy bank stock with the stock itself serving as collateral for the loan. This had the effect of improving the banks' balance sheets, thereby keeping the regulators at bay, while inducing innocent outsiders to shell out real money for stock.

According to recent news reports, the former (he resigned last week in the light of "the misleading debate about his part" in the bank's decision about the loans) chief counsel at Kaupthing Bank, Helgi Sigurðsson, provided the board of directors with a legal memorandum that concluded that the insiders' personal responsibility for the loans could be written off if things fell apart, though I assume they would reap any financial rewards occurring if the bank's stock continued to rise. I imagine that the memo was as thorough and convincing as John Yoo's torture memo.

Sigurðsson out-Yooed Yoo, however. He himself took out a loan of about ISK 450 million (around $7 million at the time). And guess what? The bank forgave the loan once it became evidence that the bank was about to become insolvent.

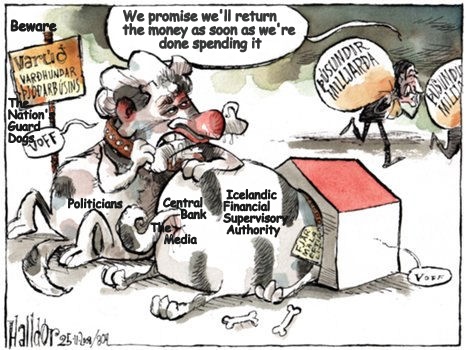

Brilliant cartoonist Halldór Baldursson's take on Iceland's situation. The crooks escape in front of the nation's bloated "guard dogs" (I added the English translation). www.mbl.is/halldor

Brilliant cartoonist Halldór Baldursson's take on Iceland's situation. The crooks escape in front of the nation's bloated "guard dogs" (I added the English translation). www.mbl.is/halldor

Now, Iceland's rules of professional responsibility are not nearly as complete as America's, and don't have any provisions for a lot of the situations that lawyers encounter in today's complicated world. However, even our rules provide that "A lawyer shall not permit extraneous interests, irrespective of whether these be his own or those of others, to influence his advice" (Art. 3).

The obvious course of action would have been, at a minimum, for Sigurðsson to avoid any appearance of conflict of interest, and to insist that the bank's board of directors engage disinterested outside counsel. There would have been no guarantee as to outside counsel's opinion, however, so it was safer for Sigurðsson to have his staff prepare a justification for the board's action.

Iceland's rules also provide that "A lawyer shall perform his work independently and protect the autonomy of the legal profession" (Art. 3) and "shall always provide his Client with an impartial opinion of his affairs" (Art. 10). This obviously requires corporate counsel to make his decisions on the basis of his own legal research, and to resign if faced with the choice of doing as he's told and doing what's right (Art. 12).

The bank's other officers may have gone ahead with their scheme with the lawyer's go-ahead, just as Dick Cheney may have gone ahead with his "enhanced interrogation techniques," but at least they would have been given fair warning and maybe, just maybe, would have proceeded with a little less arrogance.

The mind-set in Iceland's business community before the banks' collapse was, as Bob Dylan once put it, "anything's legal, as long as you don't get caught." It should have been the lawyers' role to "promote justice and prevent injustice," (Art. 1) but Sigurðsson failed miserably, though I daresay he received his 40 pieces of silver.Since the collapse, the lawyers who greased the skids for the crooks have not adopted the stance that, as officers of the court, it is their duty, "in his professional as well as other activities, to protect the honour of the legal profession" (Art. 2). Instead, they've viciously attacked all who try to seek some kind of reckoning from them or their clients.

Attorney Sigurður G. Guðjónsson has taken it upon himself to publicly attack every move and statement made by Norwegian-French magistrate Eva Joly, who was appointed as advisor to Ólafur Þór Hauksson, the special prosecutor investing any financial crimes that may have taken place. Unsurprisingly, Guðjónsson's alleged client list includes Jón Ásgeir Jóhannesson, one of the leading business leaders during the run-up to Iceland's collapse, and Sigurjón Þ. Árnason, the former CEO of Landsbanki, who oversaw the IceSave fiasco. Guðjónsson recently orchestrated a complicated loan scheme for Árnason, enabling the latter to take a low-interest "loan" from a private pension fund in order to avoid paying some ISK 14 million in income tax..

The lack of clear ethical rules and the frontier justice mentality in Iceland continues to cause confusion and raise questions about the legal profession's ability to regulate itself in Iceland. Iceland's largest law firm -- LOGOS -- was appointed official administrator for Jón Ásgeir's company, Baugur, despite having previously represented it. LOGOS was also raided by the police last month in connection with allegations of "share manipulation" linked to Kaupthing Bank. Its offices were also raided by police looking into possibly fraudulent sales and re-sales of the now-bankrupt Sterling Airlines by the Icelandic investment firm, FL Group.

What is especially worrisome is that attorney discipline in Iceland is handled in part by the Icelandic Bar Association. Since the lawyers who had the greatest financial success in Iceland in recent years were the ones most closely tied to the parties responsible for taking the country down, what are the chances that the IBA is going to show the independent judgment necessary to evaluate their compliance with the rules?

The collapse of Iceland's economy had many causes, not all of which were the result of actions taken by Iceland's elite. However, the fingerprints of Iceland's lawyers are all over the most blatant fraud. Their role in enabling the business and banking executives to carry out questionable deals, to obfuscate transactions, to conceal assets, and to attack anyone who questioned their decisions was essential to the formation of the mind-set that rules and regulations were merely obstacles to be overcome, not roadmaps to maintaining a sustainable society.

Just as the physicians of famous people from Elvis Presley to Michael Jackson poisoned their patients by providing an endless supply of illicit drugs, so the lawyers poisoned Iceland's business and regulatory atmosphere by justifying their clients' unjustifiable deeds. Just as some of the drugs may have been needed for the stars' genuine medical conditions, much of the advice may have been accurate. What was so destructive in both cases, though, was the failure of the responsible professionals to look at the overall situation with an impartial eye, to recognize the great harm being inflicted, and to rectify the ongoing evil before it led to disaster.

Restoring faith in the legal profession should be one of the top priorities of the government. As Former Canadian Prime Minister William Lyon Mackenzie King once observed, "Far more has been accomplished for the welfare and progress of mankind by preventing bad actions than by doing good ones."